BOE caps Chengdu OLED fab

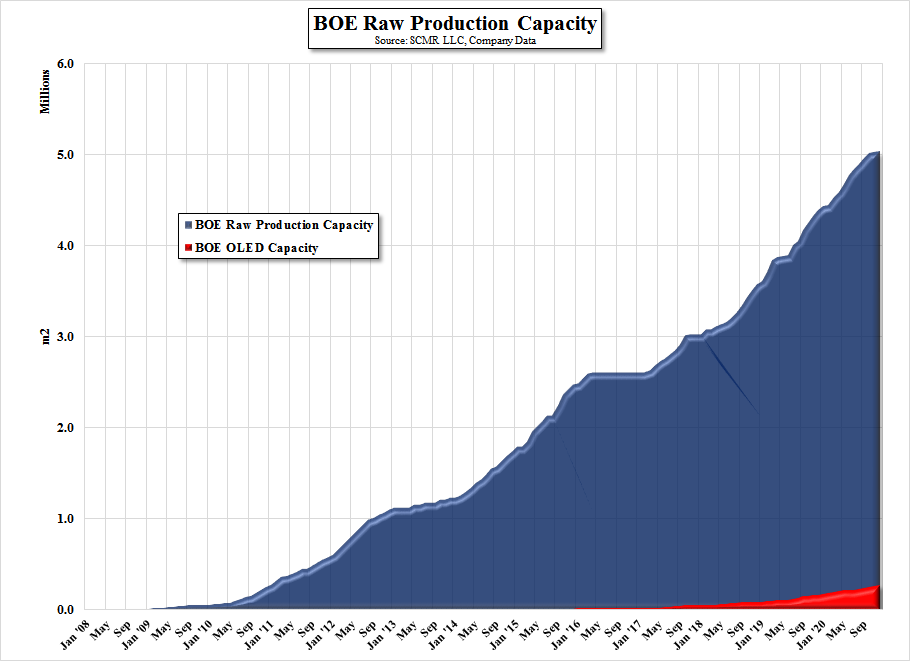

While we expect the fully built-out capacity of the Chengdu G6 fab will be ~45,000 sheets/month, we expect that will be oriented toward both the production of LTPS backplanes and OLED panels, with the LTPS capacity being closer to 45,000 sheets/month and the OLED capacity being roughly half, as LTPS backplanes can be used for LCD displays as well as OLED. We expect phase 2 OLED capacity to be completed by 2Q/3Q 2018, and fully ramped by late 2018, however BOE, while they are the largest and most aggressive Chinese display producer, has only modest experience in small panel OLED mass production and has only a few OLED offerings, which we believe are being sampled currently.

We do expect BOE to become a player in the OLED space, and likely an aggressive one, but its South Korean rivals have very significant combined OLED manufacturing experience, and building fabs is only part of the success equation. BOE has had problems understanding why their OLED deposition yields are low, and has sent emissaries to other OLED panel producers to try to understand the issues, a mindset not usually seen in the highly competitive display space. Of course, unless there is a significant financial motivation ( and even then most unlikely), other panel producers will not reveal the detail necessary for BOE to gain significant insight, so we expect BOE to be a bit slower to ramp small panel OLED production than its South Korean rivals. That said, we would also expect them to be extremely aggressive once they have gained the OLED manufacturing experience needed to compete against Samsung Display and LG Display.

RSS Feed

RSS Feed