More on March Panel Results…These times are a changin'

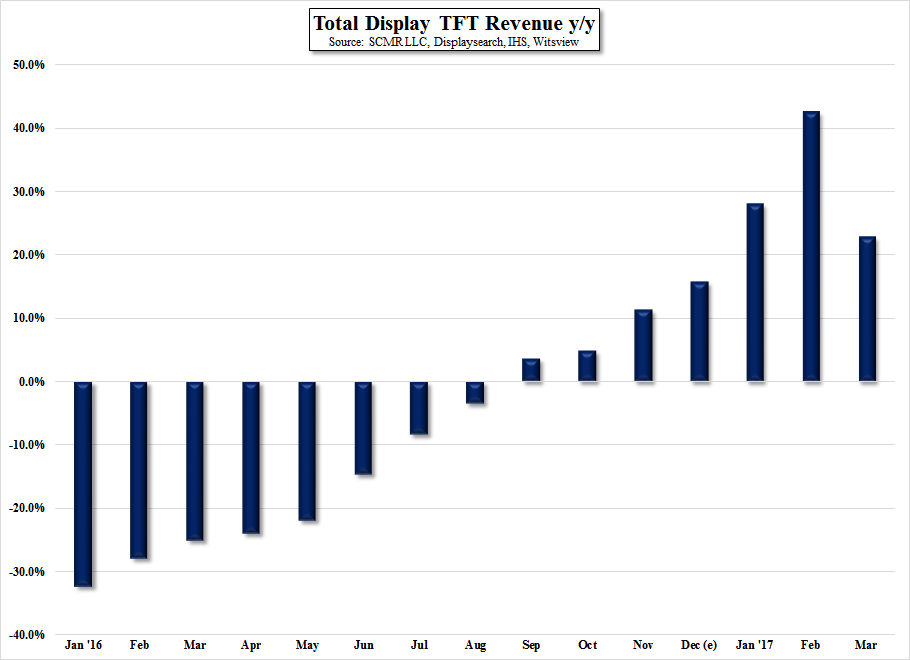

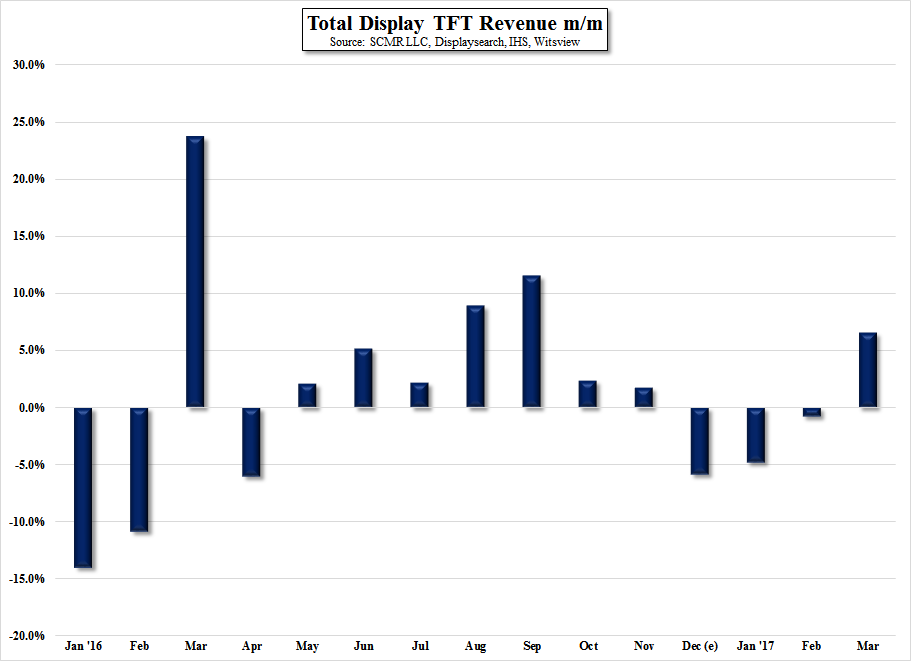

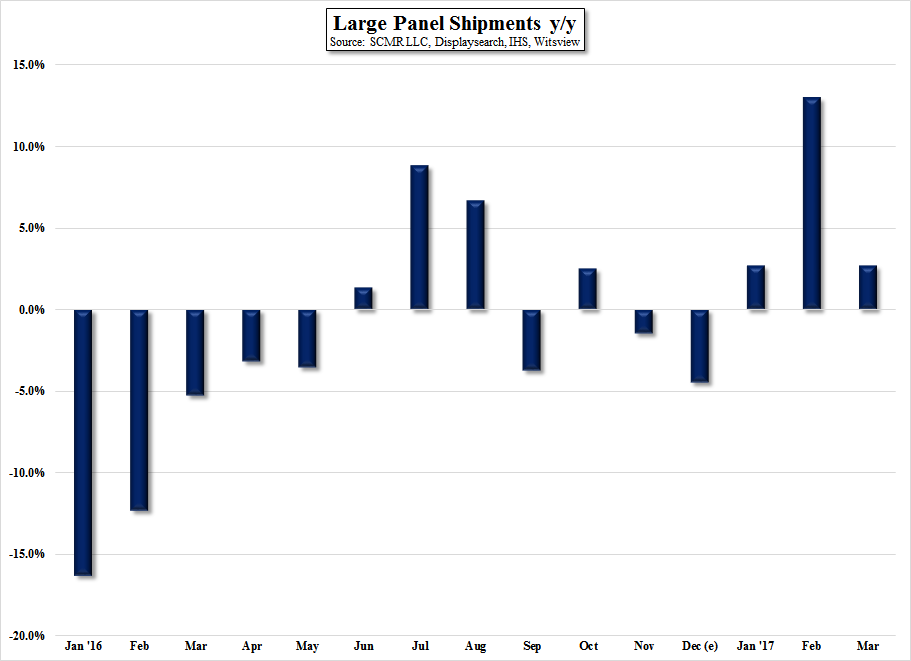

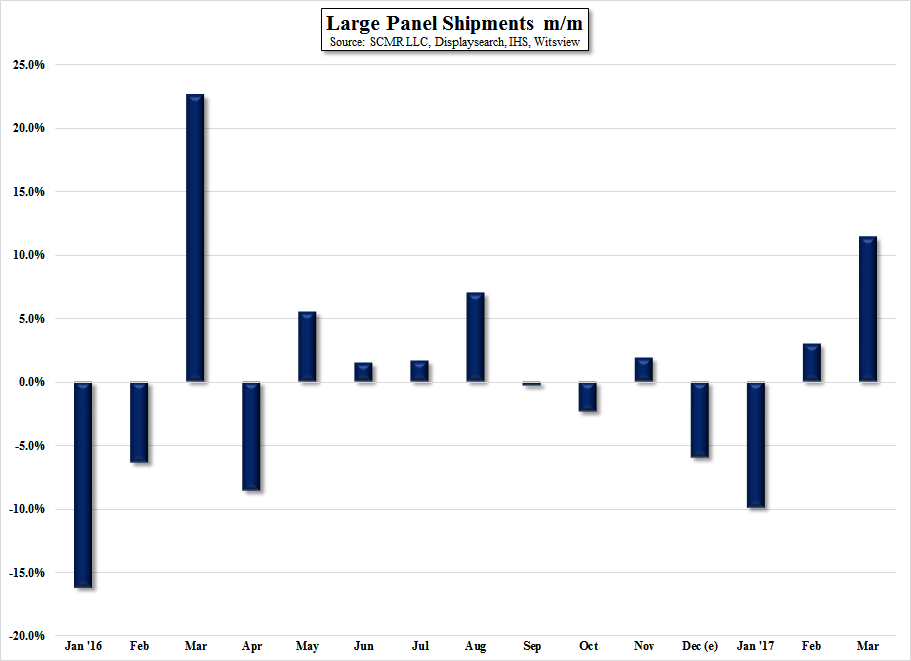

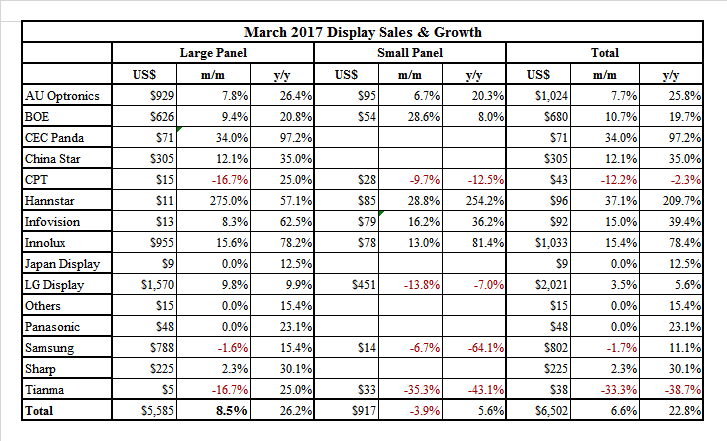

On a m/m basis, things look a bit different, with comparisons following a more seasonal pattern with January and February being weak comparisons, and March being a typical ‘bounce-back’ month. However, we note that during the previous months, panel pricing has been on the rise, while shipment growth (large panel) has been erratic. Panel pricing in April has been flat to down in all categories, so shipment growth become more important, and would be necessary to sustain positive m/m revenue gains across the industry. This leads us to expect weaker results in April from panel producers. At the brand levels, although it is a bit early to expect margin improvement, CE brands will begin to see less pressure on costs and will begin to have the ability to start being more aggressive toward retail discounting, at least in theory. That said, more likely CE brands will not start discounting to any large degree at the onset of 2Q, as they now have the chance to increase profits. If panel prices remain flat or decline going forward, the CE industry’s profitability will move from the panel producers (supply) to the CE brands (demand), a more typical scenario. This has significant implications for the industry, but given that May could be more of a defining month, we wait a bit before making assumptions for the rest of the year.

RSS Feed

RSS Feed