China sees TV unit volume down and sales volume up in 1Q

While the ‘it’s not our fault’ explanation is quite common in the display space, there is a bit of truth there, but more so the lemming-like nature of panel buyers who stampeded to the edge of the cliff last year and are now facing the question of, “is it better to miss unit volume targets or to meet targets and not make any money?” Chinese TV brands have reduced the number of new models being released this year by ~25% (even on-line models were reduced by 15%), and it would seem Chinese consumers have begun to make that decision themselves, but there is hope on the horizon, as Chinese LCD producers continue to add capacity, despite the unusual capacity drop this year, which should begin to reduce supply constraints, real or otherwise.

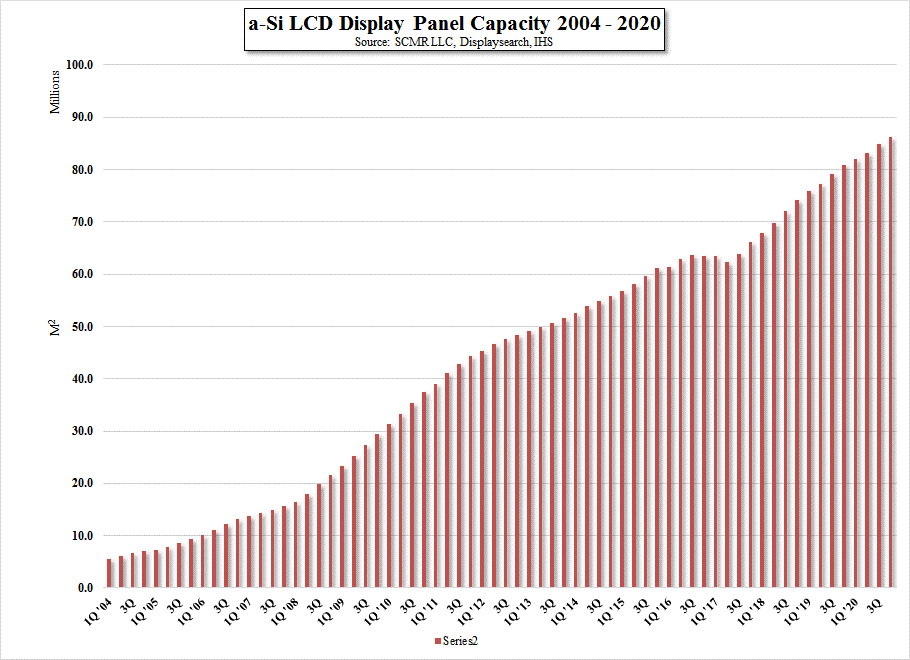

We track over 130 a-Si display production lines, 47 LTPS and 22 Oxide lines, along with over 80 OLED lines, and we expect a-Si capacity to resume expansion toward the end of this year, as a number of new lines begin ramp procedures and production. Does this mean we go back to historic panel price reductions and increasing TV set margins? Likely not in such a smooth pattern, but consumers will only accept higher prices if they think they are getting something worth the premium, and there has been little to incentivize those buyers in recent quarters. If prices do not decline enough to grab consumer attention this holiday season, we would expect to see 2018 as one where panel prices return to historic reductions, attracting consumers back into the TV market.

But, even the Chinese display industry has worries in the back of its mind as, despite the government’s aggressive support and funding of the display industry, there is a fear that adding too much capacity might also be a problem, as it was in previous cycles for the rest of the industry. There are a number of ultra-large format fabs being constructed, planned or considered by a number of panel producers that are capitalized well enough to make them a reality, and while the pressure to gain share in the TV panel space, especially at large screen sizes, is enormous, at what point does it become self-defeating? We only bring it up because it has happened before, and it rarely gets mentioned until it is already affecting the industry, but it is something to think about for 2018 and beyond.

RSS Feed

RSS Feed