April Panel Prices – Final

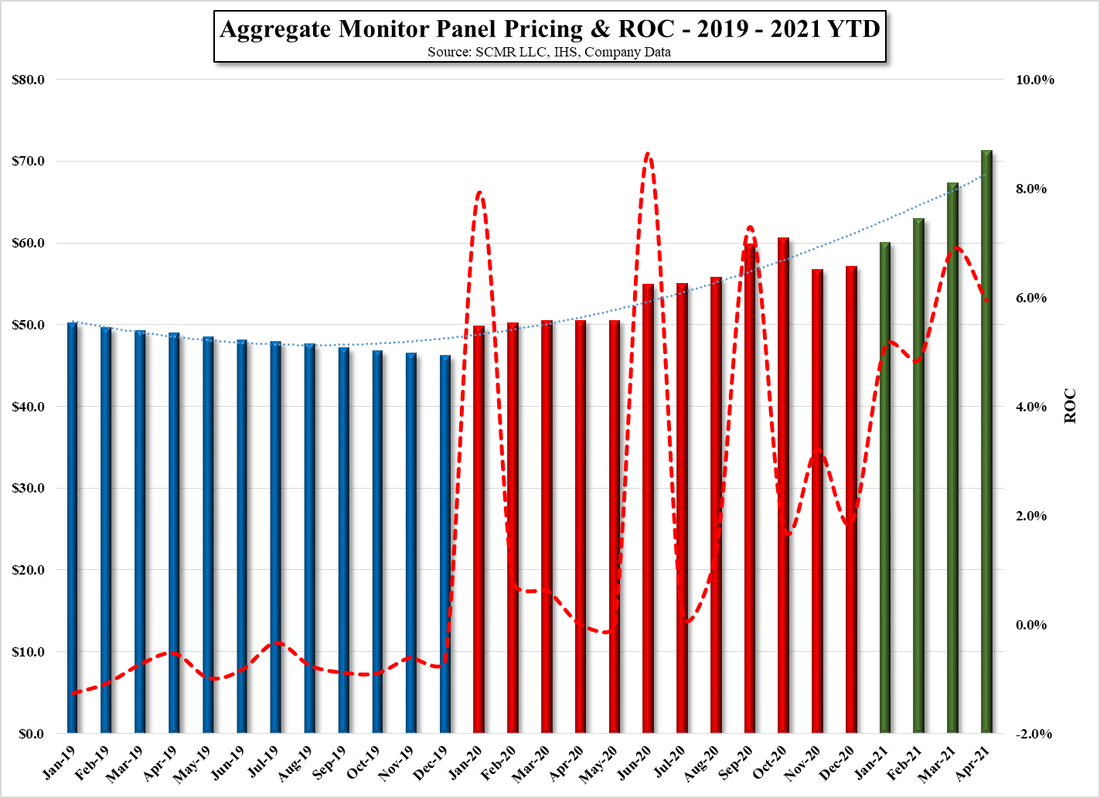

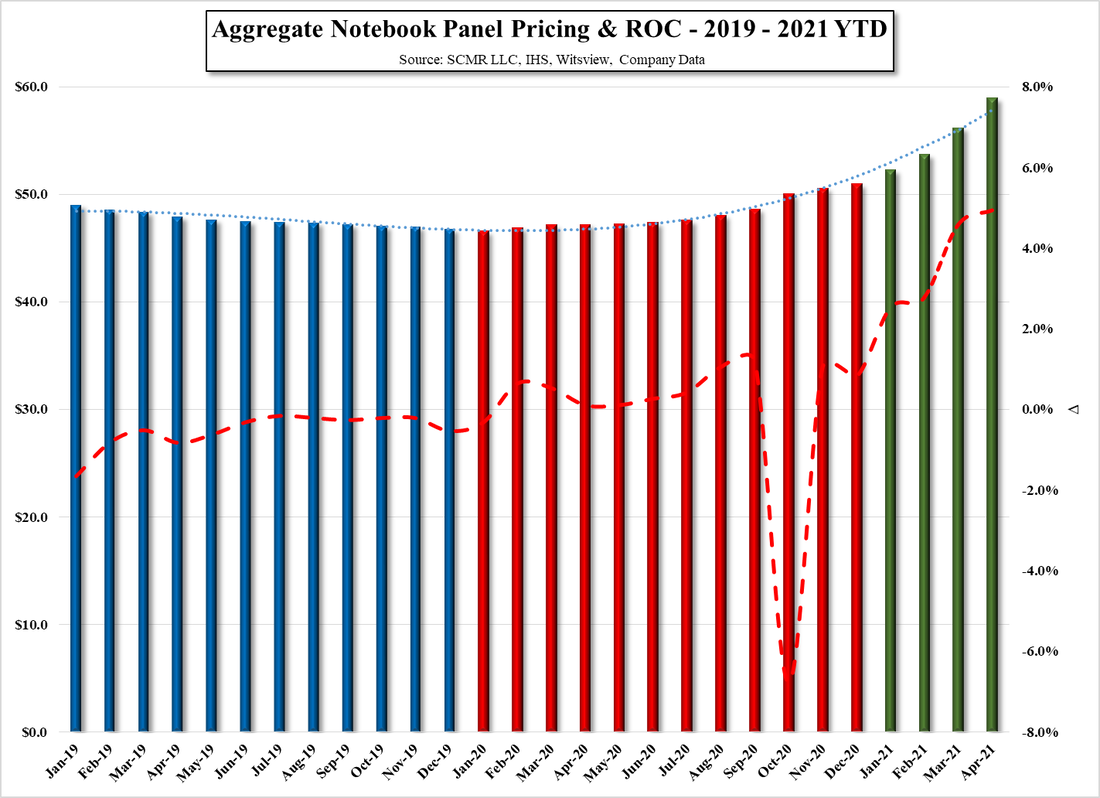

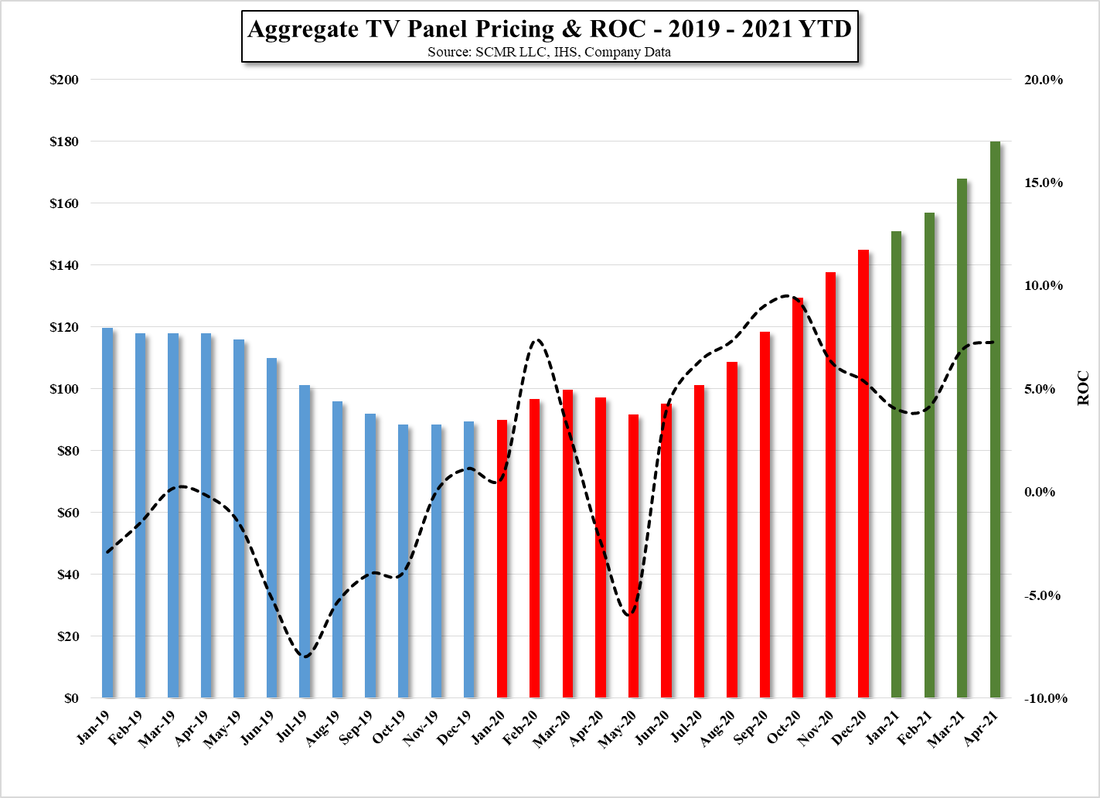

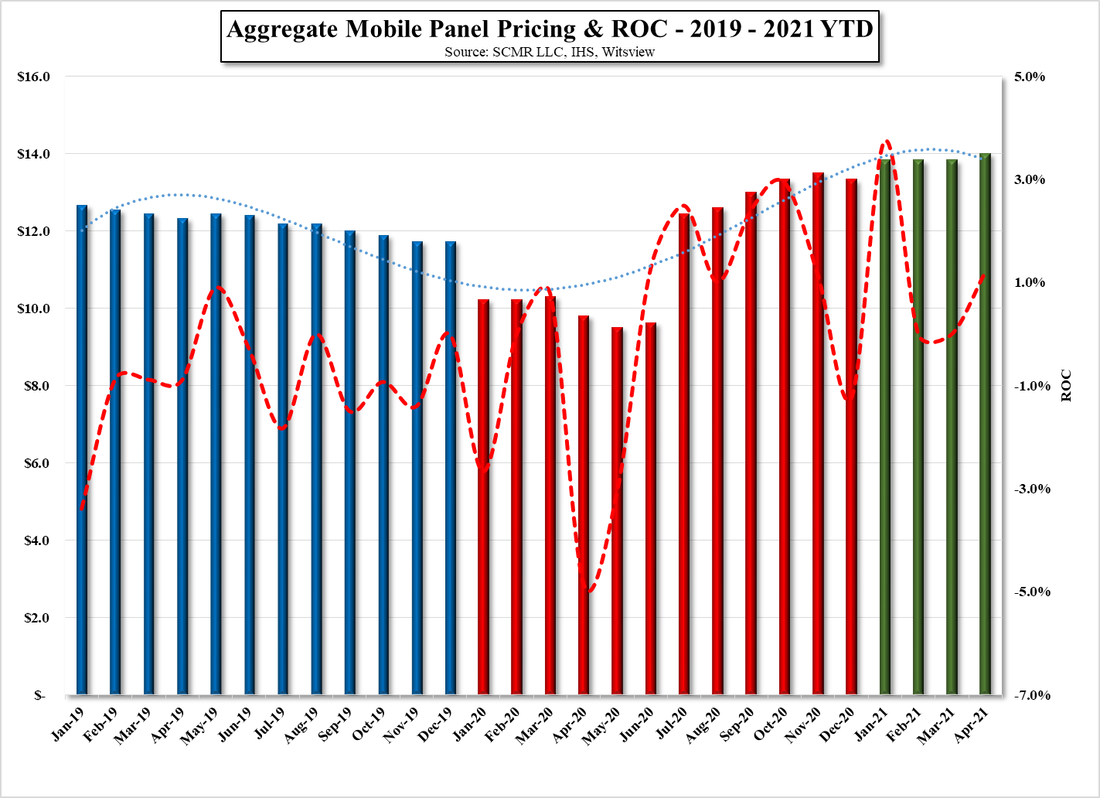

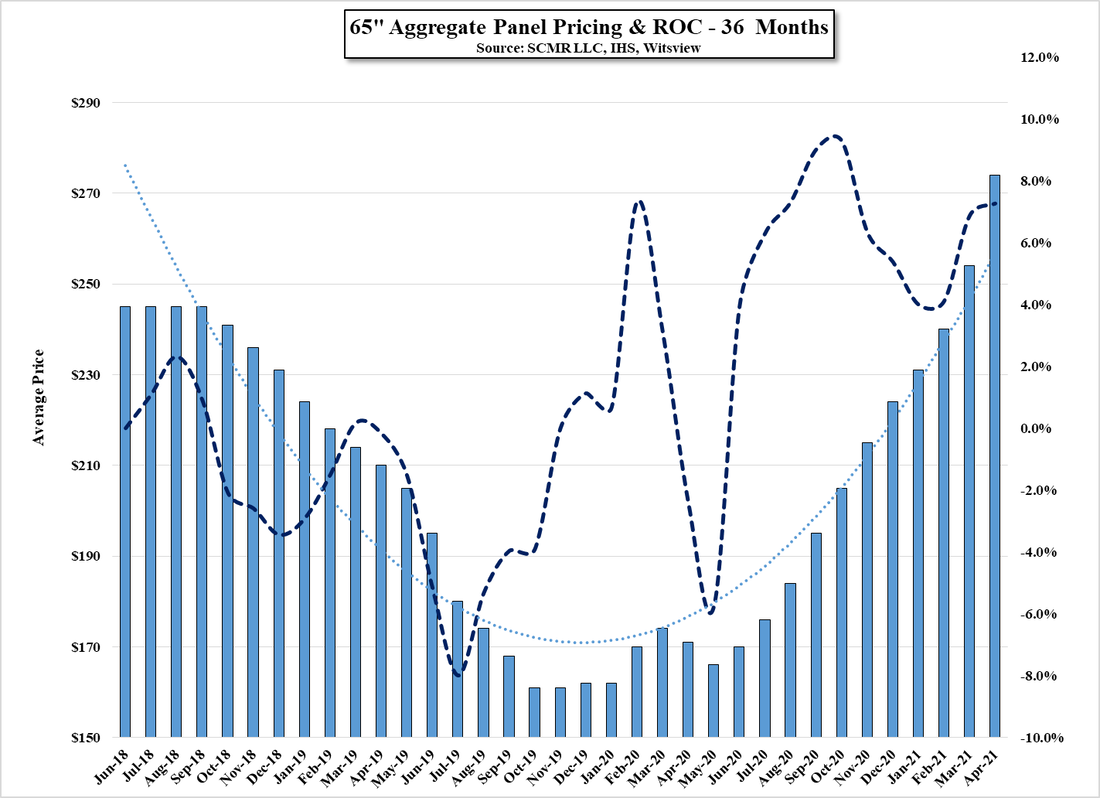

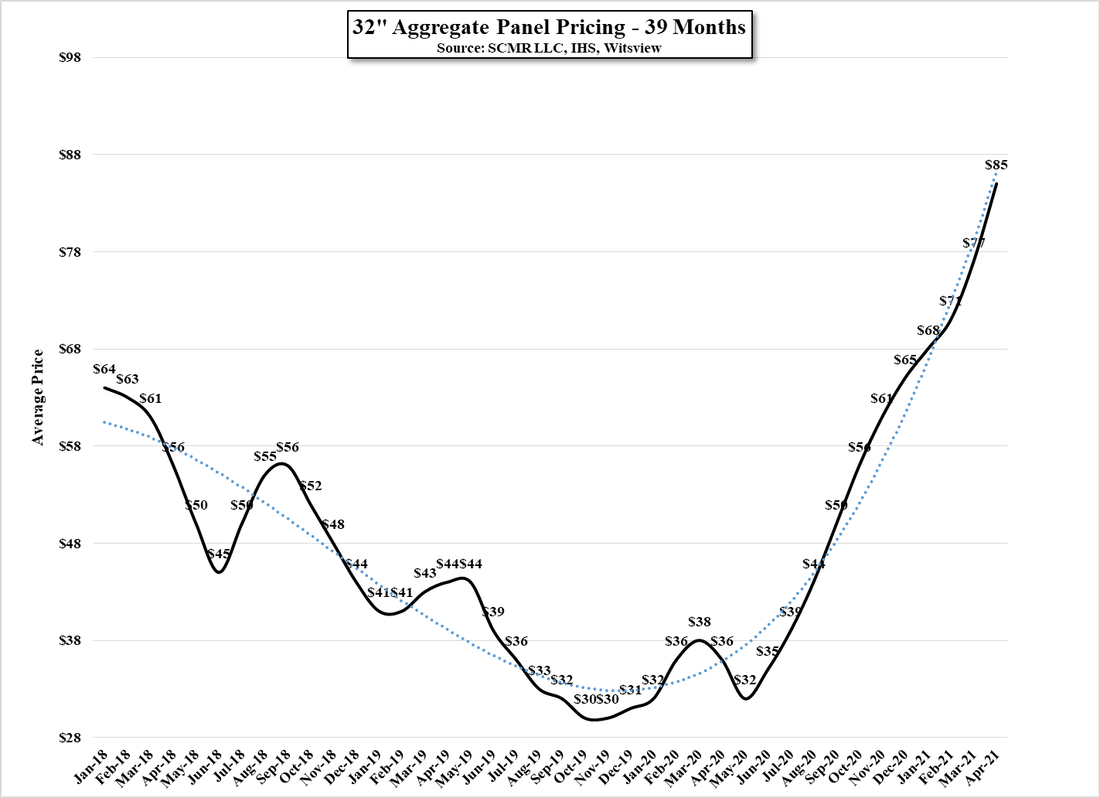

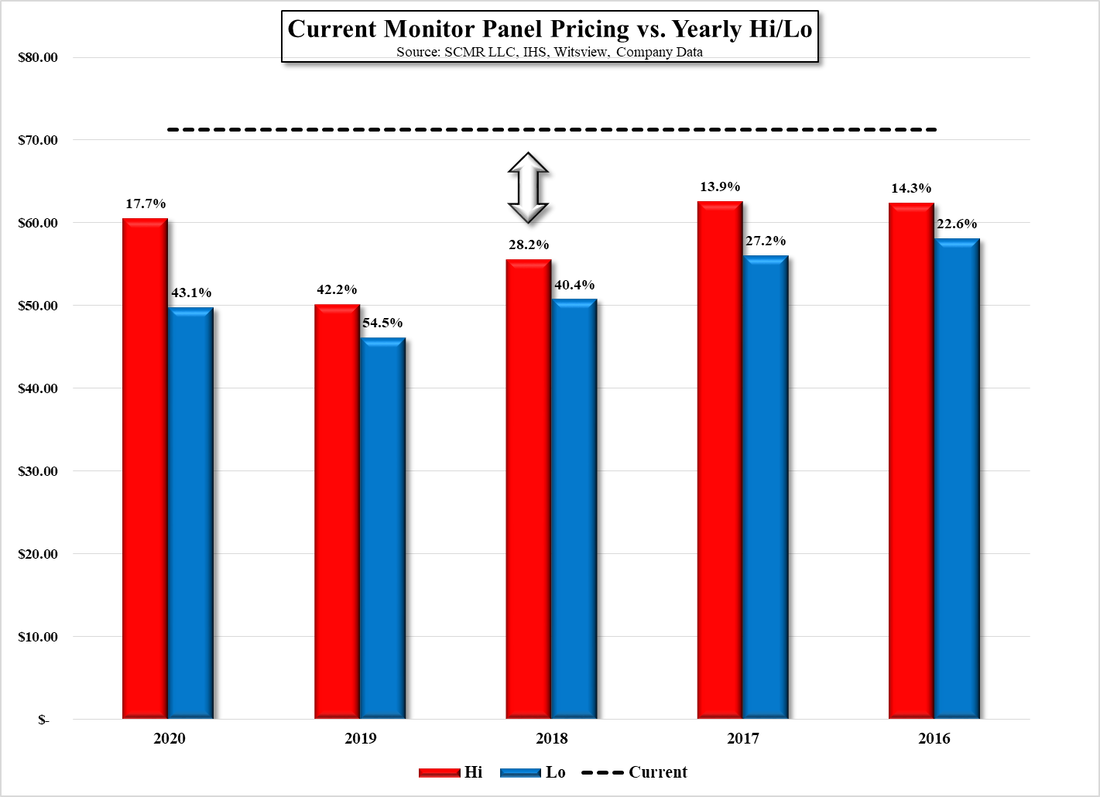

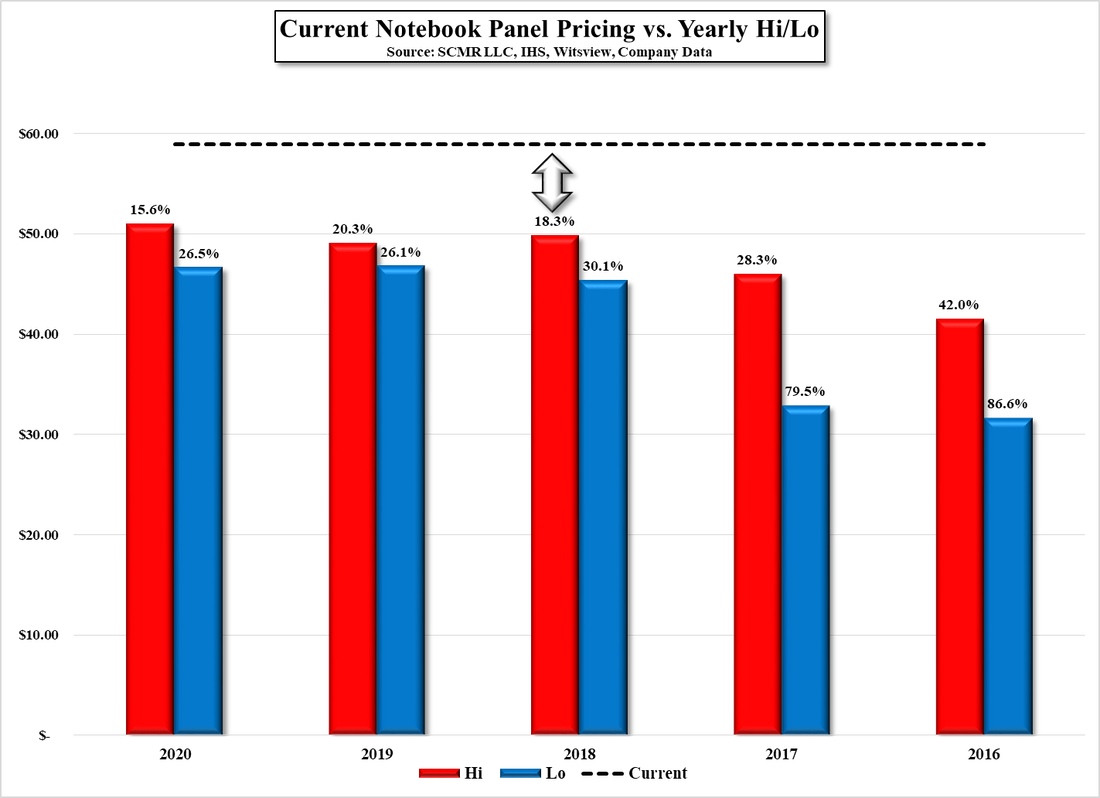

While broad-based semiconductor shortages have plagued almost the entire CE supply chain, there have been some specific silicon issues that have continued to push panel production prices higher. Timing controllers (TCON), which control which pixel is receiving data and when, are basic necessities for displays, and remain in short supply. While there are a number of suppliers of TCONs and drivers for the display space, most are fabless, which means they are competing for foundry capacity with many other products and face the same supply issues as other semi products, which pushes foundries to both raise prices and give priority to their largest customers and products where they derive the most profit.

Glass substrate prices, which historically decline, have been relatively stable, and most recently, after a few mishaps and glass facilities, glass prices are rising, adding to the price of panel production. That said, brands continue to hold onto aggressive CE targets, which gives panel producers, usually in the lesser bargaining position, almost free reign to raise prices faster than costs increase. Chinese suppliers, who have become the dominant suppliers of LCD displays, are seeing this situation as a chance to justify their aggressive LCD capacity expansion over the last few years, and will continue to raise panel prices given their leading status. This gives them much ammunition when negotiating with provincial and local governments for capital to continue that expansion into OLED and LED based displays, albeit in a potentially cyclical space.

The result of panel price increases of the magnitude seen here are higher prices at the brand level, and as COVID-19 still seems to be a lifestyle changing factor on a global basis, the raid vaccination process in the US is beginning to have an impact on demand. In fact, demand continues strong for CE products on a global basis, but we expect a bit less demand from the US later this year if the rest of the population accepts the vaccine as readily as the first 20% of the population. We expect there will be a demand surge for certain iCE items as the US population begins to step out of what amounts to quasi-quarantine, but higher CE prices and a lesser focus on filling time in front of a display will have some effect on demand.

The global CE space however will likely stabilize less quickly and demand for educational CE (notebooks, monitors) will likely continue until new case levels on a global basis, or at least in developed countries, begin to decline in earnest, and some kind of supply/demand balance returns to the space, but the rapidly rising prices do represent a deterrent to a return to normality for CE products, as high-priced inventory will built into CE prices as 2021 progresses, leaving CE brands with margins that might not support the aggressive volume estimates they have now. While we would not expect panel producers to keep in mind such factors when deciding to raise prices, some restraint might help to sustain the length of their positive results. Just a thought…

RSS Feed

RSS Feed