April Panel Shipments & Pricing

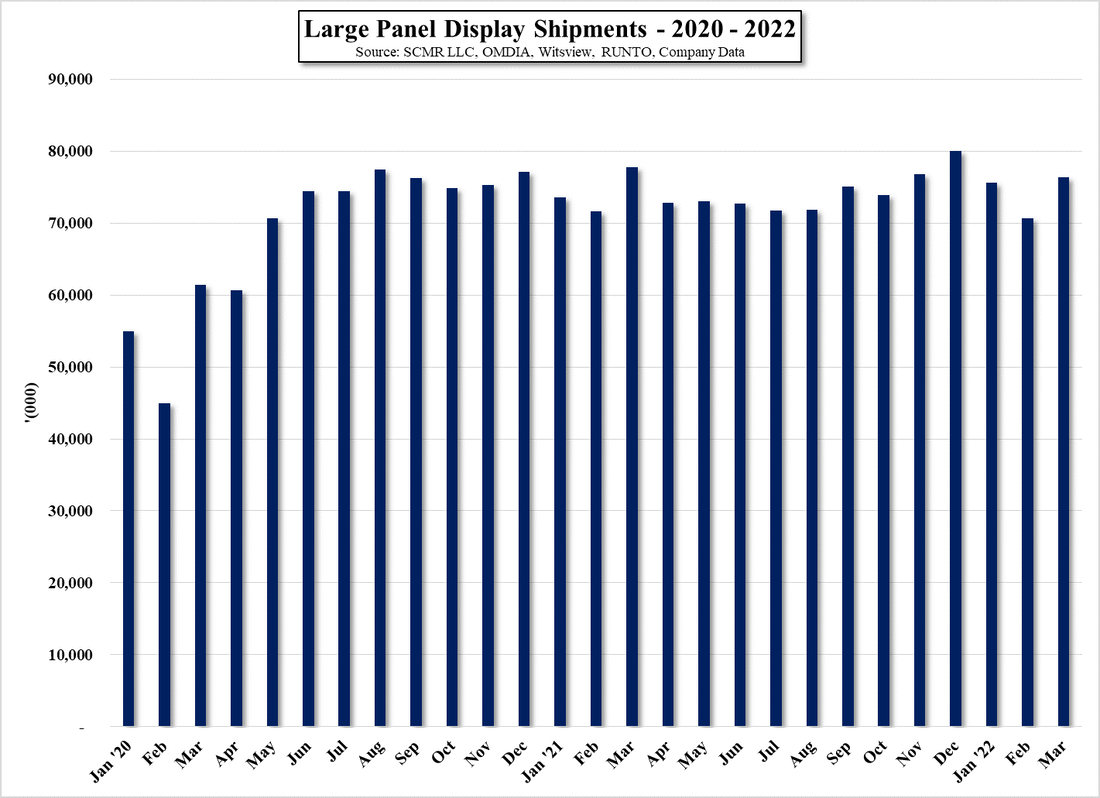

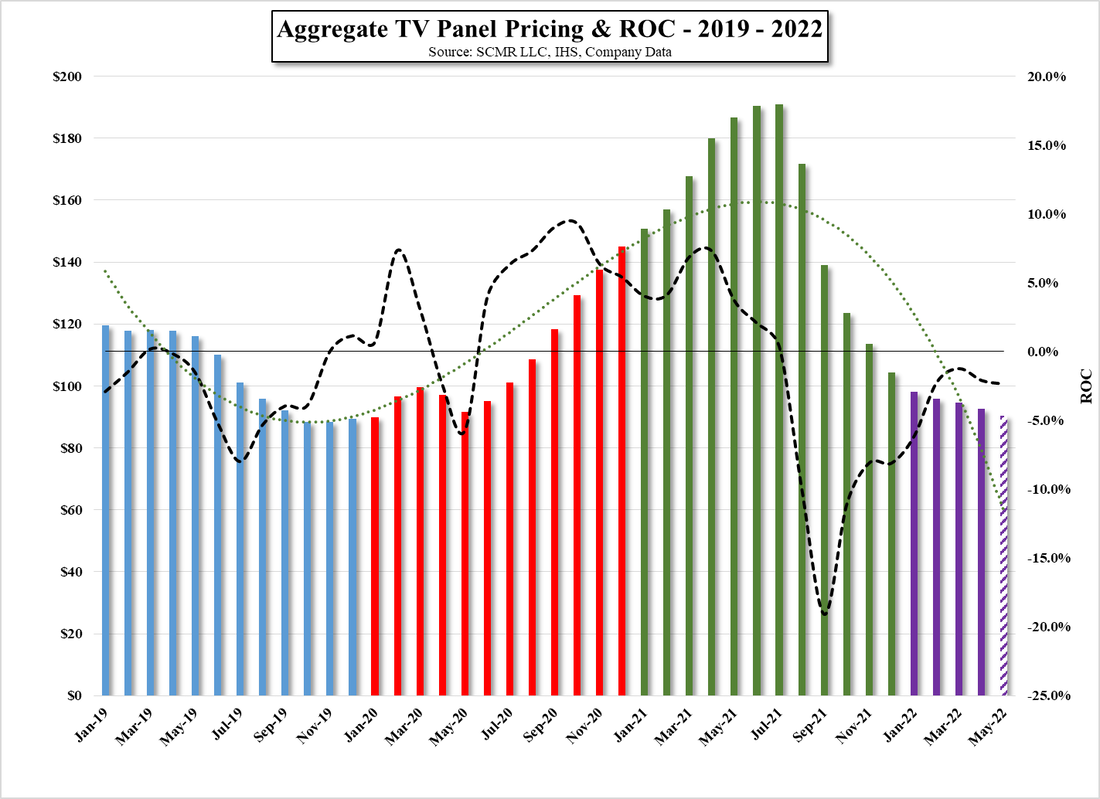

As we noted in our 04/06/22 note, TV brands had set very aggressive goals for the 2022 year under the assumption that lower TV panel prices would stimulate TV set sales, however a number of TV set brands cut back orders in 1Q and are likely to do the same in 2Q, although not all brands are have reacted the same way. TV set shipments declined by ~20% in 1Q, despite TV panel shipments being up 2.9% y/y, which has prompted expectations for TV set shipments for the 2022 year to be reduced to flat to up 1%. Reasons cited have been the Russian/Ukraine war, China’s zero-tolerance COVID-19 lockdowns, FIFA World Cup postponement, and component shortages, much of which had already been part of higher estimates.

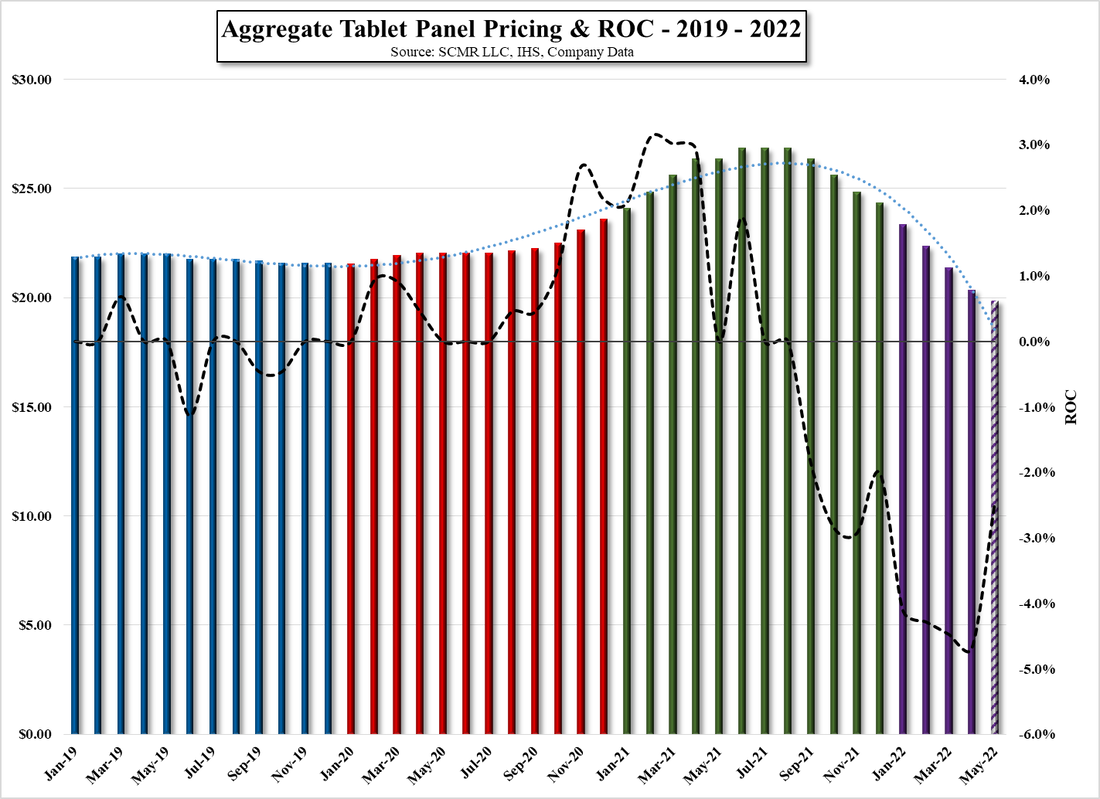

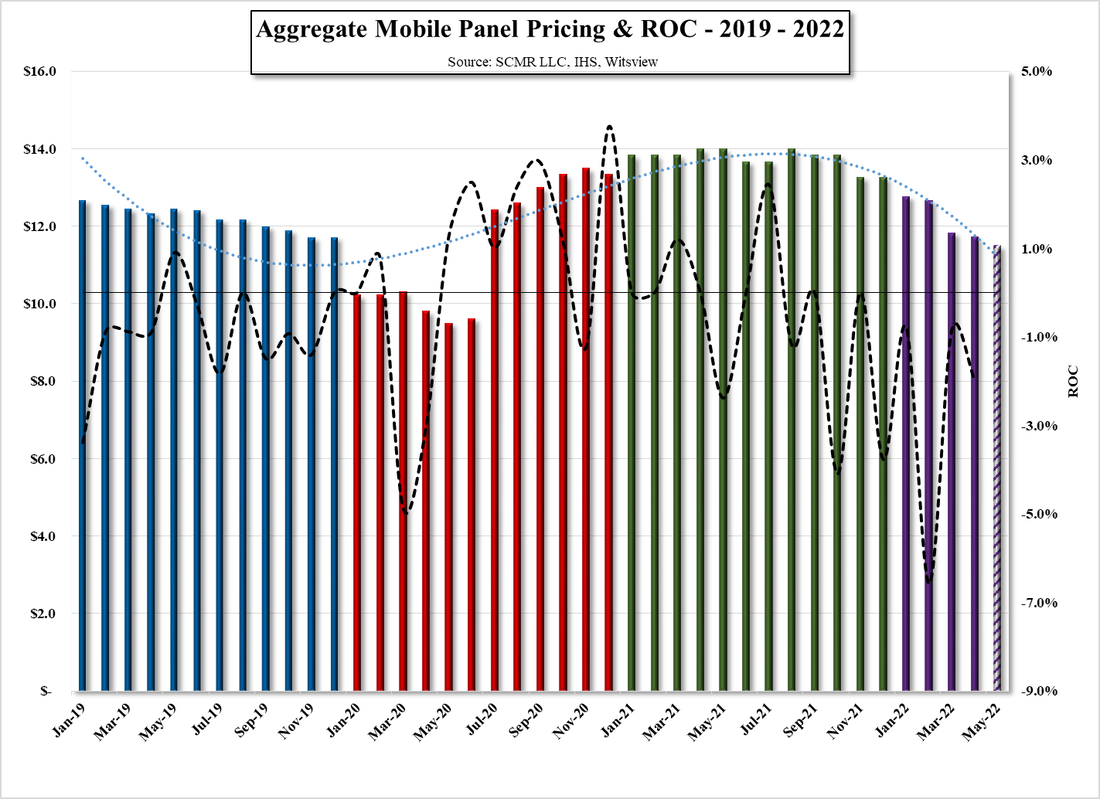

Samsung Electronics (005930.KS) reduced TV panel purchase plans in 1Q by ~7.5% and is expected to do the same in 2Q, while LG Electronics (066570.KS), has lowered its TV panel purchase plans for 2022 by ~20%. Some Chinese TV brands have also made TV panel purchase order adjustments, but others are waiting to see how the 618 shopping holiday plays out before making adjustments to their TV panel purchase plans, which has allowed some Chinese panel producers to continue to see high utilization rates. Other than that there has been little for panel producers to be excited about as we head into 2Q, and few of the negatives seem to be changing quickly to the positive. Large panel pricing is expected to decline again in May (~4.0%), broken out as shown in the table below.

RSS Feed

RSS Feed