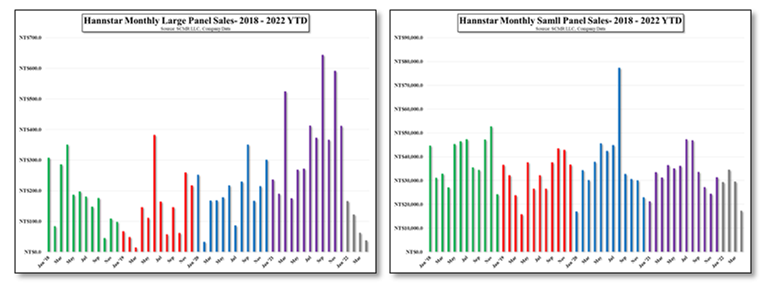

April Taiwan Panel Debacle

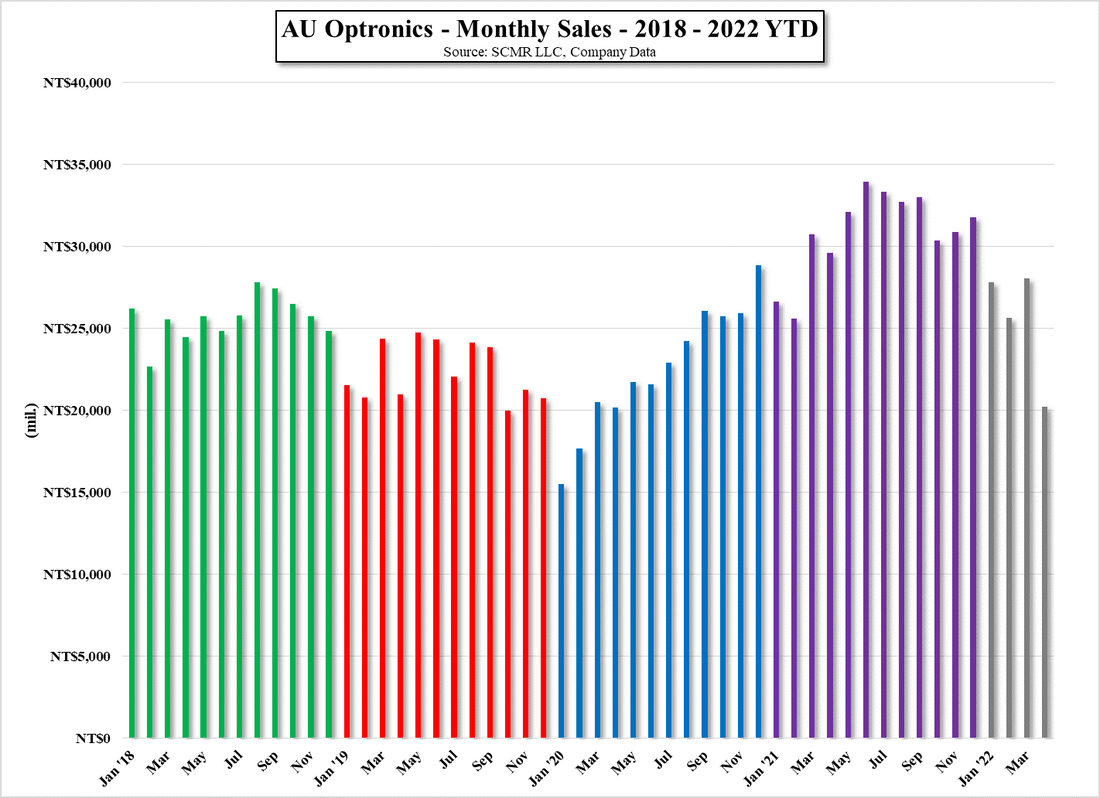

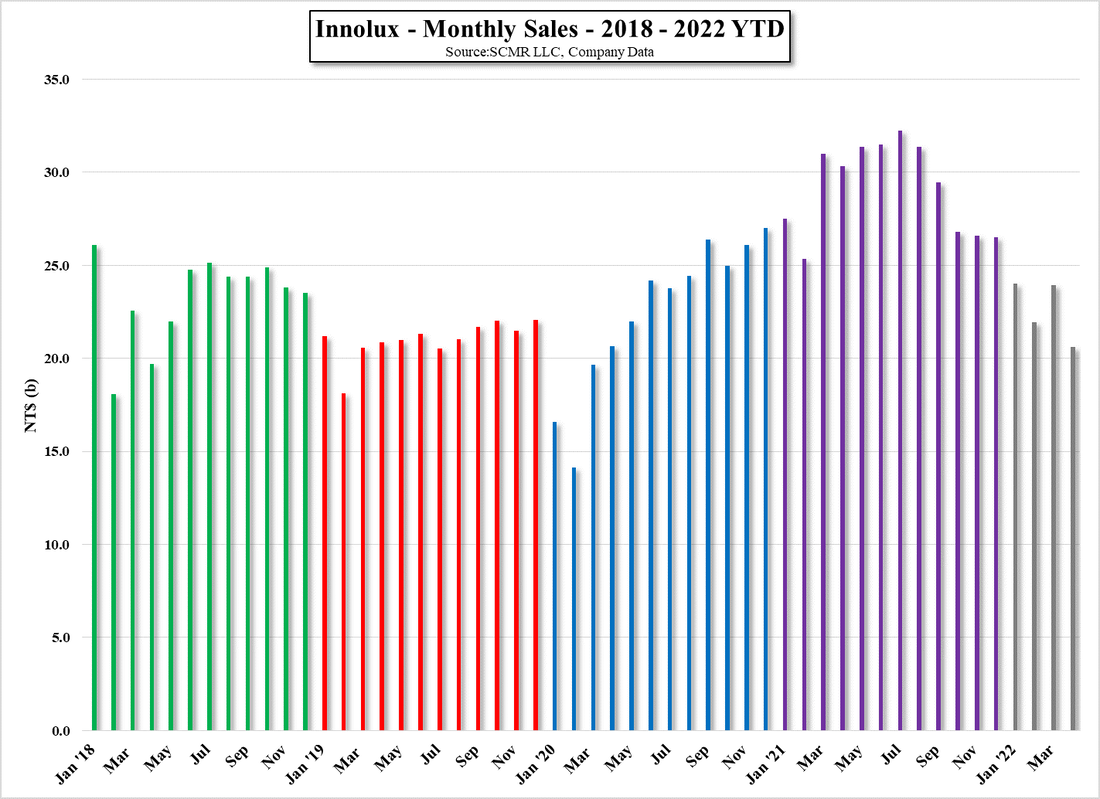

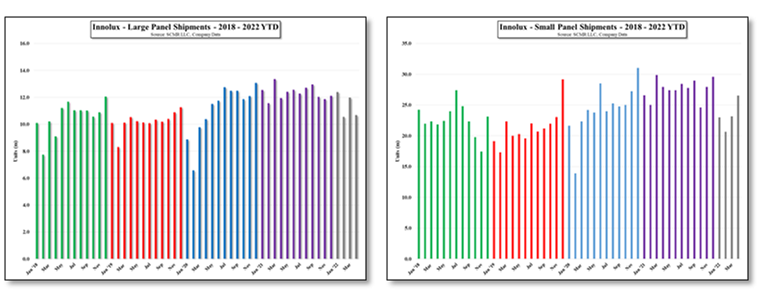

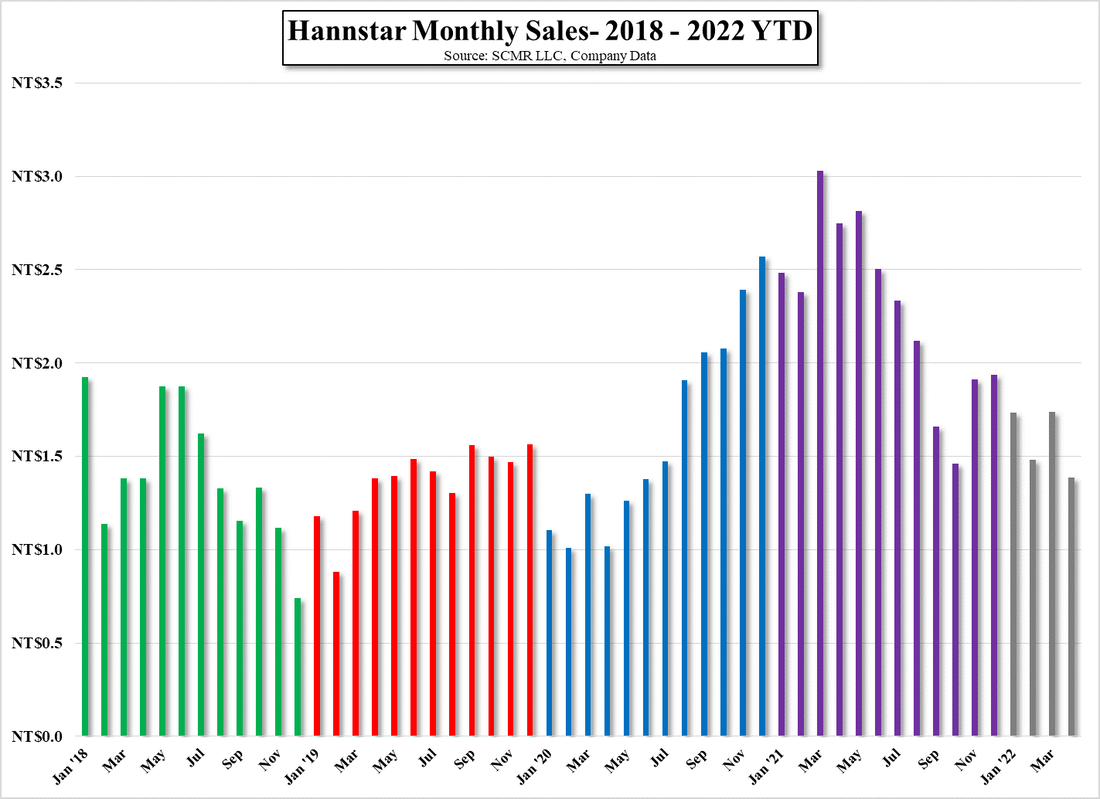

“Revenues dropped sharply in April, largely due to weaker demand amid macroeconomic uncertainties caused by war and inflation, together with higher channel inventory resulted from previous port congestions and container shortage. In addition, eastern China has introduced strict Covid-19 related lockdowns since April. Given the challenges of lack of workers, combined with supply chain disruptions under these lockdown measures, the Company has lowered utilization rates at its production sites in Kunshan and Suzhou. Meanwhile, shipments to customers were also impacted by these lockdown restrictions. Currently, lockdown measures were lifted in certain areas while the pandemic gradually eased. However, it may still take some time for market to return to normal.”

RSS Feed

RSS Feed