High Flying Politics Resurfaces

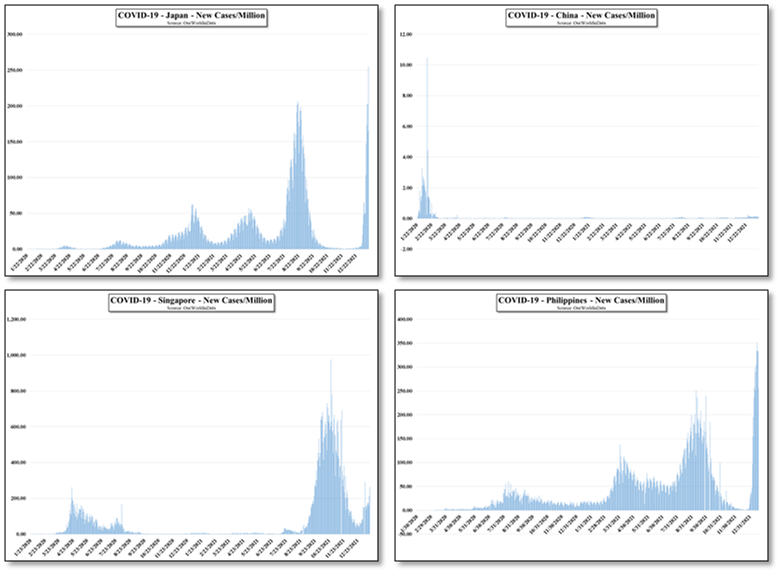

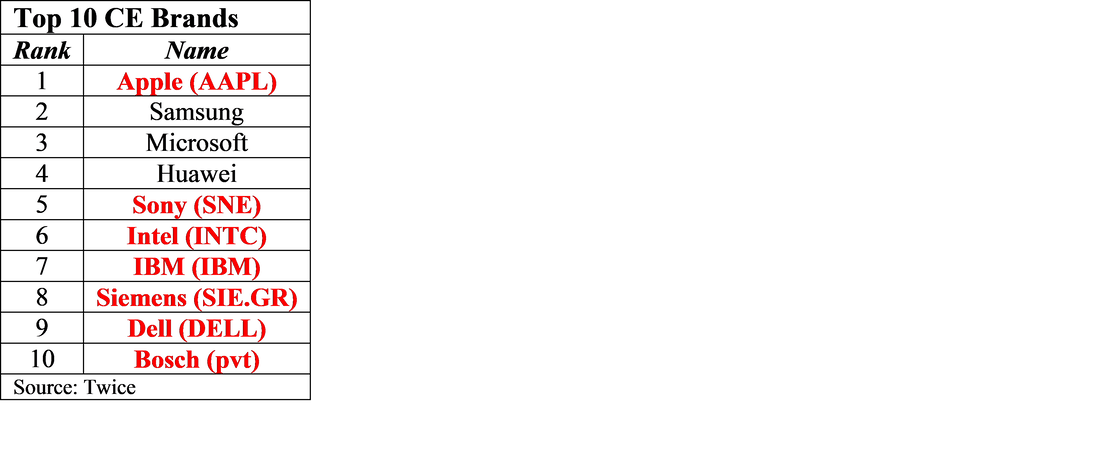

While the US government has intervened (again) to smooth things over between the affected parties, the question remains as to why things have gotten to this point given the fact that for almost two years telecom carriers, airport administrators, airlines, and US regulators were unable to come up with a plan that would satisfy both safety concerns and the use of 5G C-Band. Making it more embarrassing is the fact that the C-Band is being used in ~40 countries for 5G, with no reported altimeter problems, and the FAA, along with altimeter suppliers, have been working to determine which altimeters are reliable under 5G and which need to be retrofitted or replaced for months.

Carriers are not without some blame in this situation, having known that this was a potential issue when they were bidding on C-Band spectrum, and the FAA proposal for a 5G buffer zone (~1 mile) only affects ~50 airports across the US, where over 5,200 public and 14,700 private airports operate. But there are other factors, such as the higher power 5G transmitters used in the US and the larger buffer zones used in other countries (France has a 96 second buffer zone, while the FAA proposal is for a 20 second buffer) that are still being regaled by carriers.

According to statements made by the FAA on January 13 - 16, aircraft that are operating with untested altimeters ort those that are in need of retrofitting or replacement will be unable to perform low-visibility landings where 5G is deployed, although they have cleared ~45% of the US commercial fleet for low-visibility landings at ‘many’ airports. In particular two altimeter models that were installed in a wide variety of Boeing (BA) and Airbus (AIR.FP) aircraft have been approved, which opens runways on up to 48 of the 88 airports most directly affected by the 5G interference question.

All in, now that the controversy has made its way to CNN and other news media and a few foreign airlines were said to be planning to limit flights to the US if the 2nd 5G deferment was not extended, traveler interviews and aviation specialists will get their day in the sun until carriers figure they have waited long enough for the FAA to finish its evaluation and for the industry to adapt its equipment to the ever-changing technology environment and press for an end to the moratorium or final regulations, including upgrading or replacing altimeters that are affected..

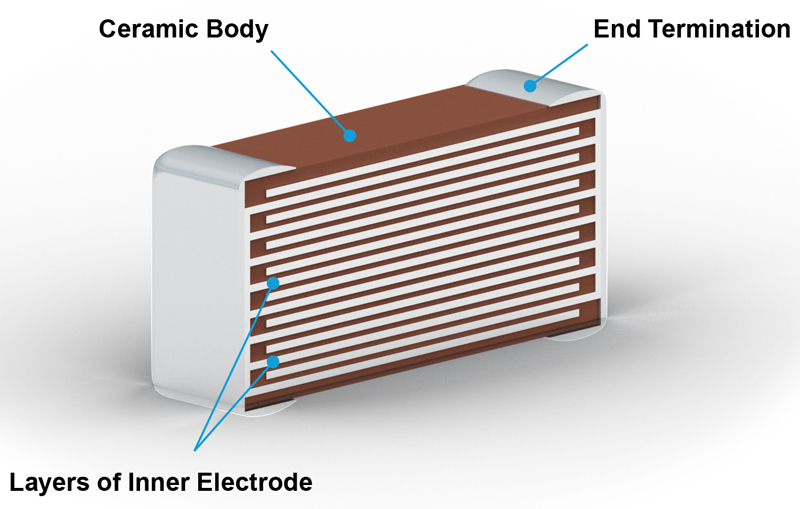

Altimeters come in 4 types. The first is based on barometric pressure and temperature. These would not be affected by 5G. The second are radio altimeters that measures the time it takes for a pulsed signal to be reflected from the surface. As the pulse time is very short, separate transmit and receive antennas are needed. We believe these could be affected by 5G signals. The third type are GNSS (Global Navigation Satellite Systems) that use radio waves that are bounced off of satellites rather than the ground. We believe these types could also be affected by 5G signals. He fourth type are laser altimeters that use laser light instead of radio waves to measure distance similar to the way TOF works for short distances. The most common of the 4 types is a barometric altimeter.

RSS Feed

RSS Feed