What is holding back OLED lighting?

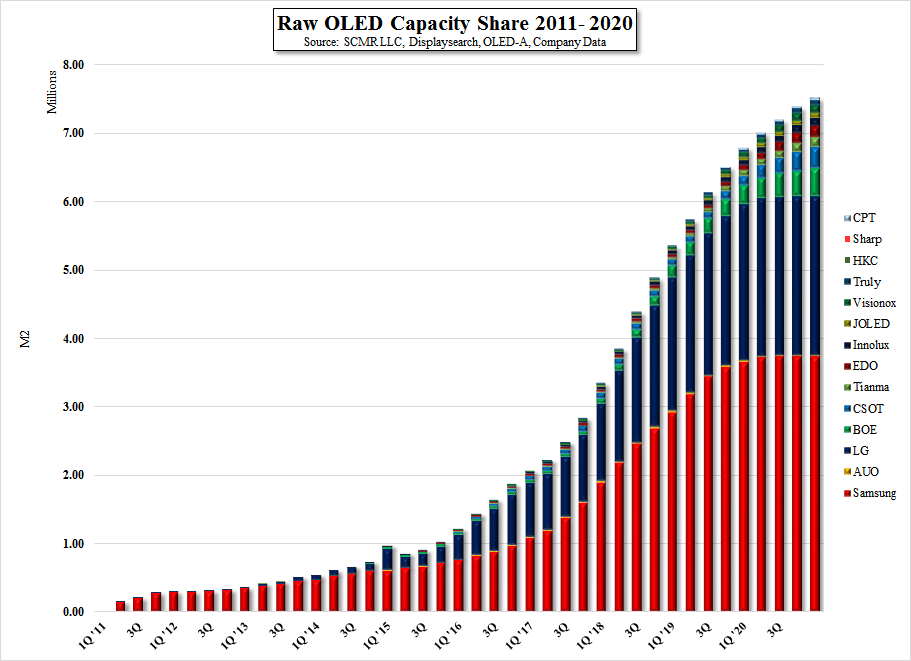

Much of our optimism comes from the potential that LG Display’s (LPL) OLED lighting G5 fab and equipment will bring to the industry, but at the same time, we caution investors that in the case of OLED lighting, capacity could grow more quickly than demand, an unusual circumstance for a new technology. LGD, as part of its G5 lighting fab project, is building a high capacity production tool and line that can produce 15,000 sheets/month. When the line is in full production, the math would look like this:

15,000 Sheets/month

1.2 m2/sheet = 18,000 m2/month

60 panels/m2 = 1,080,000 panels/month

80% yield = 864,000 panels/month * 12 months = 1,036,800 panels/year

While this is highly commendable and better capacity than seen previously, it was pointed out by another OLED lighting producer that this is more than 100 times current demand, and while it seems to solve the ‘chicken and egg’ problem, it means the industry has to significantly grow demand in order to justify such new capacity. As OLED lighting has the ability to be shaped into a wide variety of forms, many of which were impossible with other lighting modalities, the ability of the industry to create new demand has possibilities. That said, the lighting industry is not one known for rapid adoption of new technologies and formats, leading us to temper our optimism a bit in regard to timeframe, but the major step taken by LG Display, first in consolidating OLED lighting into LG Display, and taking the initiative to develop the first real OLED lighting mass production tool is very encouraging, hopefully similar to the risk Samsung Display (pvt) took when it opened its first small panel OLED production line years ago.

RSS Feed

RSS Feed