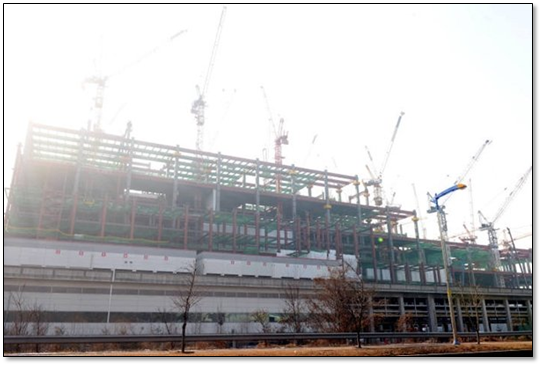

Is the Chairman of Foxconn building a big summer house or a new LCD plant?

We note that Mr. Gou, aside from his Chairmanship of Foxconn and Hon Hai (2317.TT) (he started the company in 1974), the world’s largest contract manufacturer, is also a personal investor in the Sharp Gen 10 Sakai LCD plant, and through a recent acquisition, is the de facto head of Sharp (6753.JP). As is well known, foreign companies that sell their products in the US are under intense pressure to shift manufacturing back to the US. President Trump has stated that various import taxes would be imposed on companies that don’t make such changes, pushing a variety of foreign companies to make noise about shifting manufacturing operations to the US. Mr. Gou has pledged support for such a concept, but has also committed to the same in China, the biggest CE market worldwide.

We doubt this transaction signals the commitment of Mr. Gou’s resources to a particular location at this time, particularly as the Trump administration has yet to detail actual specifics about a tariff, and is facing opposition from a variety of US companies that have substantial operations overseas, but it does put at least some wheels in motion toward a decision by Gou held companies. We believe it would be difficult to remain competitive should Foxconn decide to build an LCD fab in the US, despite the relatively high level of automation, with a more likely solution being some sort of highly automated assembly operation, but regardless of the near-term, Mr. Gou has not built a $6b empire by giving in to threats or coercion, and will likely make the final decision based on the absolute financial benefits of both locations and the concessions made by each government. In either case we would expect both sides to claim victory…

RSS Feed

RSS Feed