More Fun with Data – Ultra-thin Glass

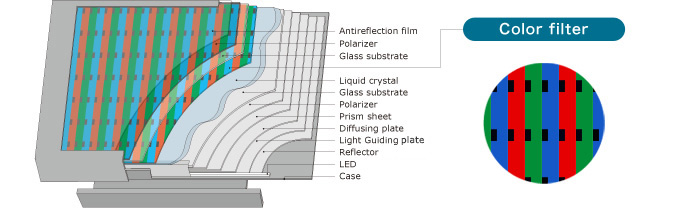

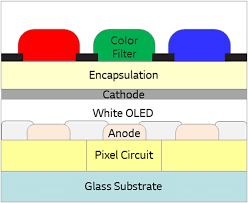

Foldables are certainly attractive to consumers, who gain size without the inconvenience of having to tote a large device, but at a cost. Whether this ultimately becomes a more standard display format depends on the progress that is made in producing foldable displays that remain viable as long as a more typical smartphone, and much of that depends on the hinge system and the materials the display is made of. While some components can be separated inside the device, such as the battery and some PCBs, the display and its associated components have to be able to withstand at least 100,000 folds without showing signs of wear.

To this end, early foldable devices used a clear polyimide film as a cover to protect the display from dirt, scratches, and other potential abrasions, but the film itself was found to retain multiple folding creases which did not sit well with consumers. Further, while the polyimide is said to be clear, it is not as optically clear as glass, the traditional cover glass used in many smartphones. Polyimide certainly had some advantages, particularly its ability to withstand cracking and scratching, the nemeses of cover glass, but continuing developments in chemically strengthened glass have narrowed that advantage.

Until recently, cover glass could not be made thin enough to act as a substitute for polyimide, especially when an essential requirement of foldable devices is for them to remain exceedingly thin, meaning the glass would have a tight fold ratio when the device was closed, however much R&D has been applied to the problem and the development of commercial UTG (Ultra-thin glass) has been the result.

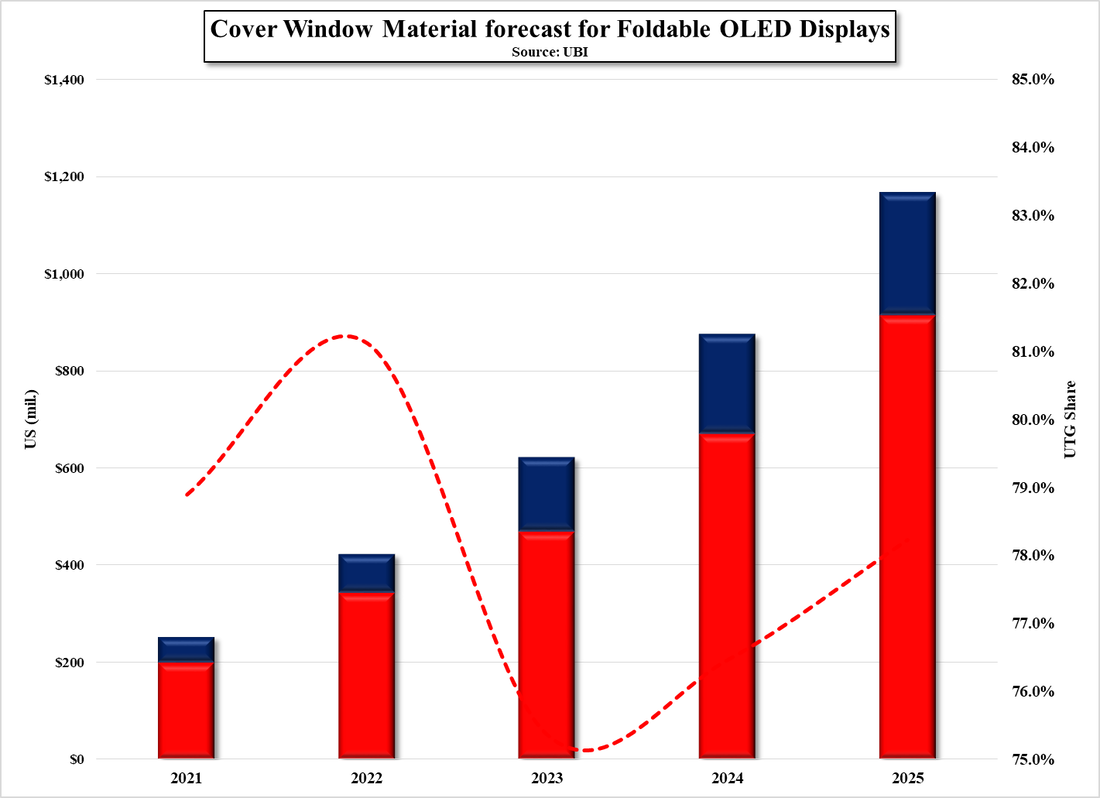

A recent study in South Korea predicts that UTG will remain the choice for foldable device cover glass through 2025 and will have a share exceeding 75% through the period. Polyimide will still be used, as it is ultimately less expensive than UTG, but will likely remain the choice in low-tier priced foldable devices. All in, whether you believe that foldables are the wave of the future or not, UTG seems to have solved one of the early problems associated with foldable devices and as volumes improve, should see overall pricing decline, particularly given Samsung’s dominance in the foldable space and their early focus on UTG. Should Apple (AAPL) adopt UTG when it revels its first foldable iPhone, the relegation of polyimide as a cover material to low-end phones would be sealed, and with Samsung a likely supplier, the odds are even greater.

RSS Feed

RSS Feed