Sounds Like the Fat Lady is Singing…

As part of the deal two Coherent executives will be added to the board and one executive from Bain Capital (pvt) will also be added, as they are providing at least $1.5b in equity financing (additional equity financing available), with JP Morgan (JPM) providing $5.4b in debt financing. Coherent shareholders will own ~18% of the merged company stock when the $6.9b deal closes.

According to II-VI, the deal will generate $250m in run-rate synergies within 3 years, with $150m coming from supply chain management and $100m from OPEX efficiencies, with the company citing its September 2019 deal for Finisar (pvt) and a reduction in net leverage from almost 4x to less than 1x in roughly a year, with the $150m in synergies expected from that deal now expected in 24 months instead of 36 months, and the total Finisar synergy estimate now at $200m over 3 years. II-VI indicates that it has already achieved $110m in Finisar run-rate savings as of the end of last year.

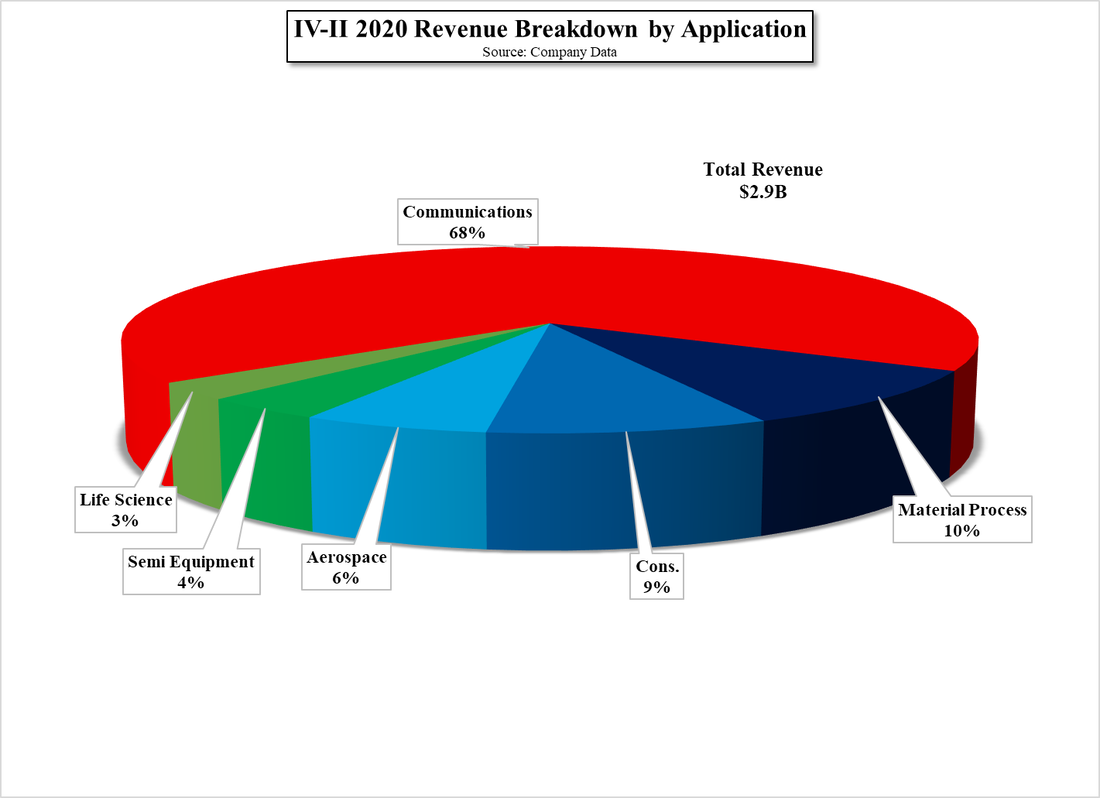

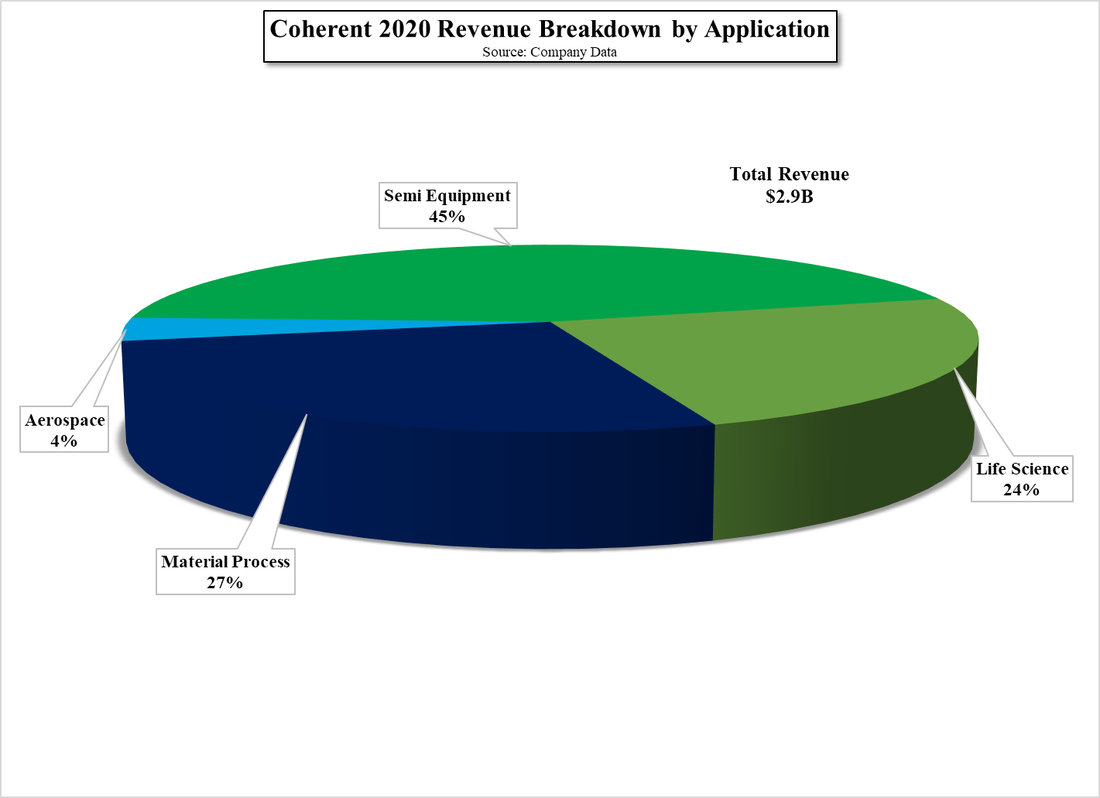

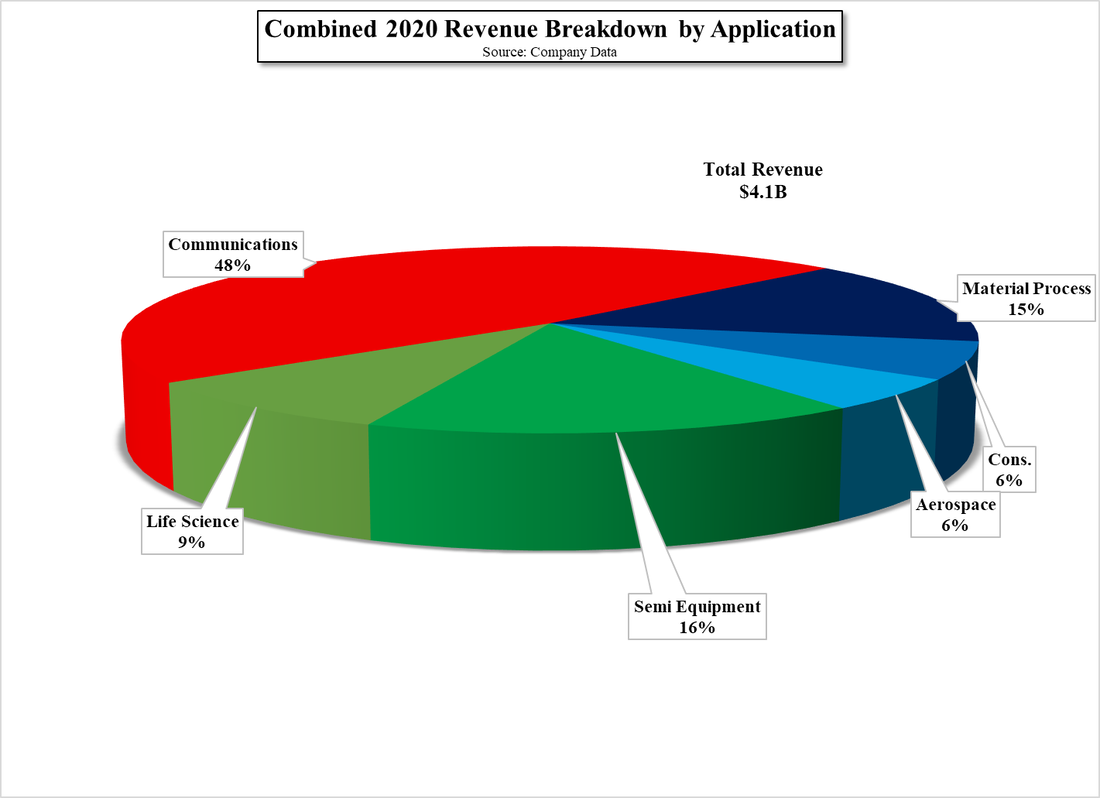

Further, according to II-VI, the combined company will have a $25b combined available market, and will see its revenue climb from 2.9b (12/31/2020) to $4.1b with the combined company having a more diversified revenue base, albeit in some highly cyclical businesses. Lumentum shareholders seemed relieved with the stock climbing 8.5% after the announcement of the accepted II-VI offer.

RSS Feed

RSS Feed