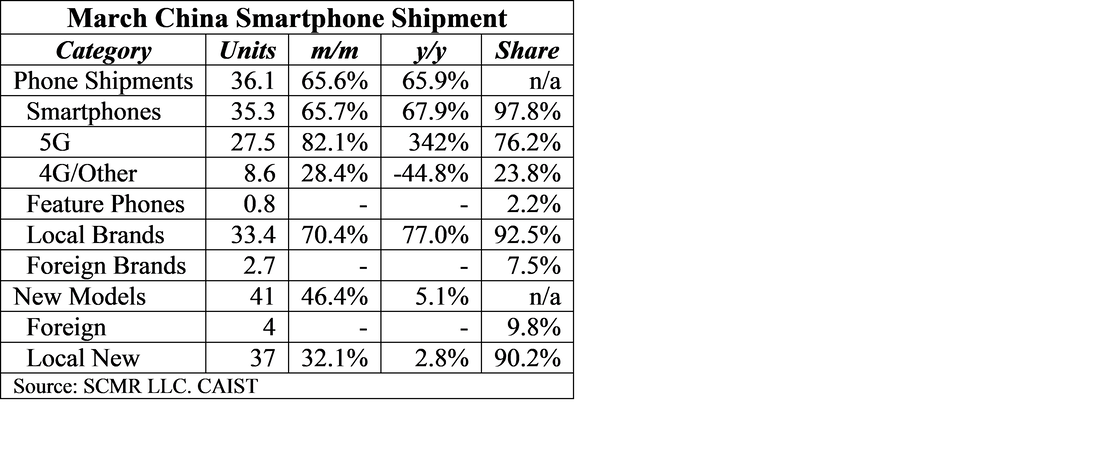

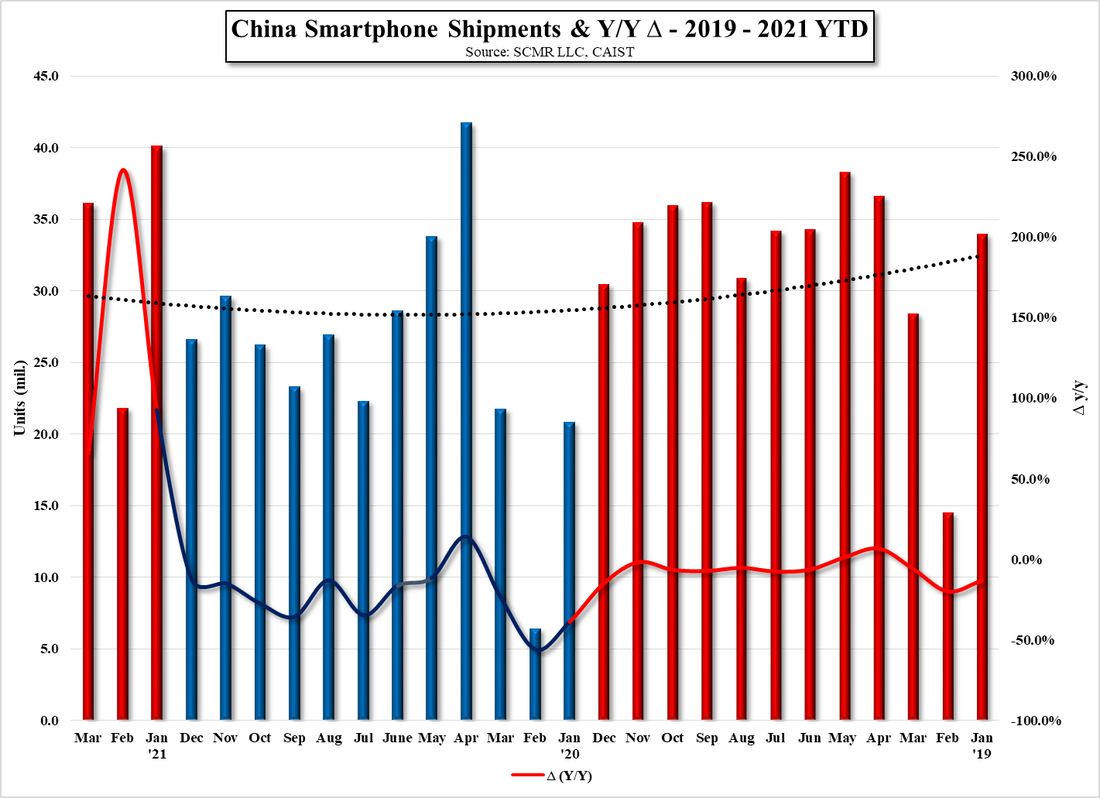

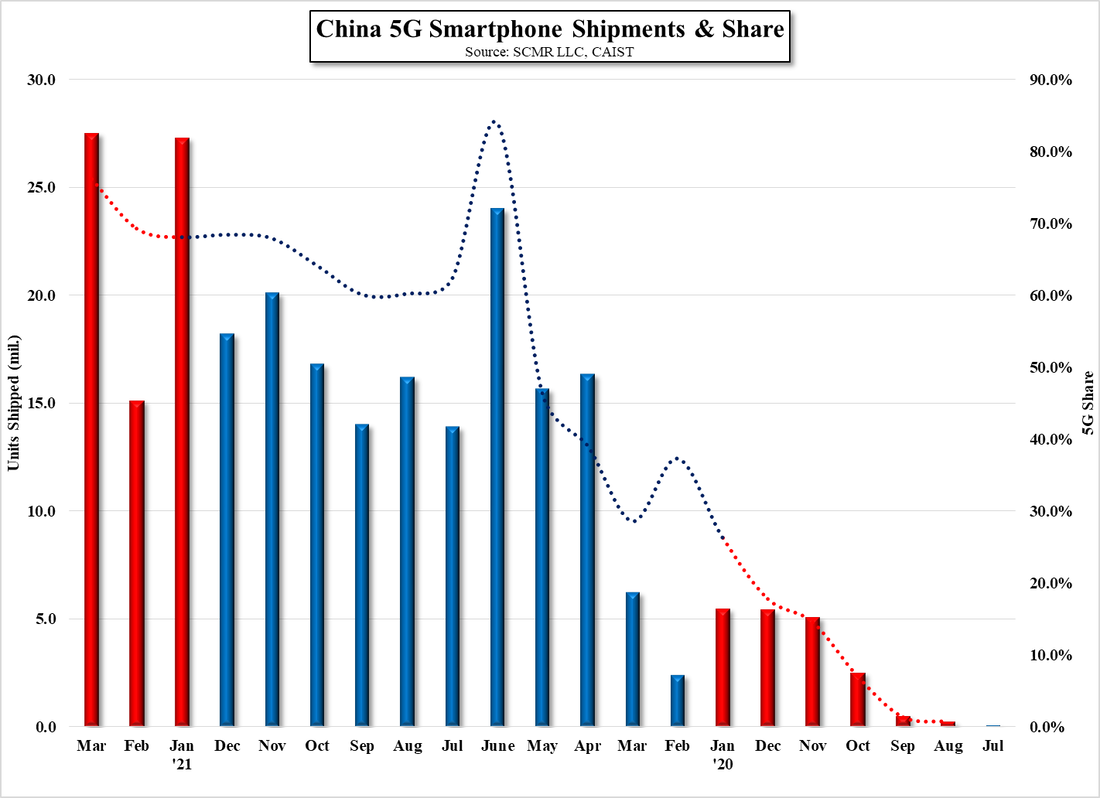

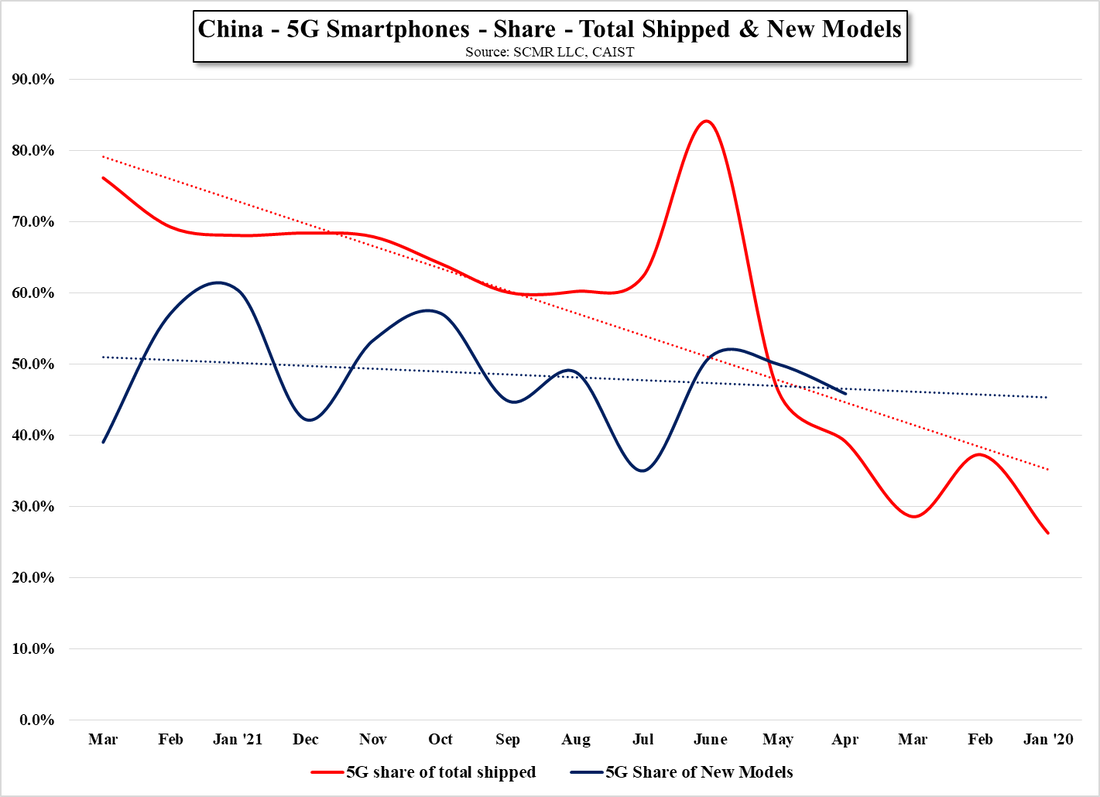

China March Smartphone ShipmentsSmartphone shipments in China saw a large jump from a weak February, ↑65.6% m/, and while this is below the March 5 m/m average of 109.8%, the more telling metric is the March y/y shipment increase of 65.9%, far exceeding the 5 year average of ↓8.5%. Thus far, all three months this year have seen very strong y/y increases, although we temper that given that the COVID-19 pandemic had its greatest effect on smartphone shipments in China in 1Q of last year. That said, absolute shipment numbers are also higher by 17.9%, 50.3%, and 27.1% when compared against 2019 shipments, so the trend of negative smartphone growth in China seems to have ended for at least the 1st quarter of this year. 5G Smartphone shipments in China were 27.5m units in March, back to January levels and at the highest share of total phone shipments sine 5G shipments began in China, which was in mid-year 2019., and the share of 5G smartphones relative to all types shipped continues to increase. While the 5G share of new models remains in a slow but steady uptrend. In all 1Q trends in the Chinese smartphone market have been positive on both a relative basis (against last year’s COVID-19 impact) and on an absolute basis, which makes the data that much more positive. This differs somewhat from inventory building we have seen with a number of other CE products, but as this data represents product shipped and not sold through, we can only surmise that brands and dealers are not building appreciable inventory and that the demand increase is real and will continue into 2Q.

0 Comments

Apple Mini-LED Hints |

AuthorWe publish daily notes to clients. We archive selected notes here, please contact us at: [email protected] for detail or subscription information. Archives

May 2025

|

RSS Feed

RSS Feed