March Panel Sales – Taiwan

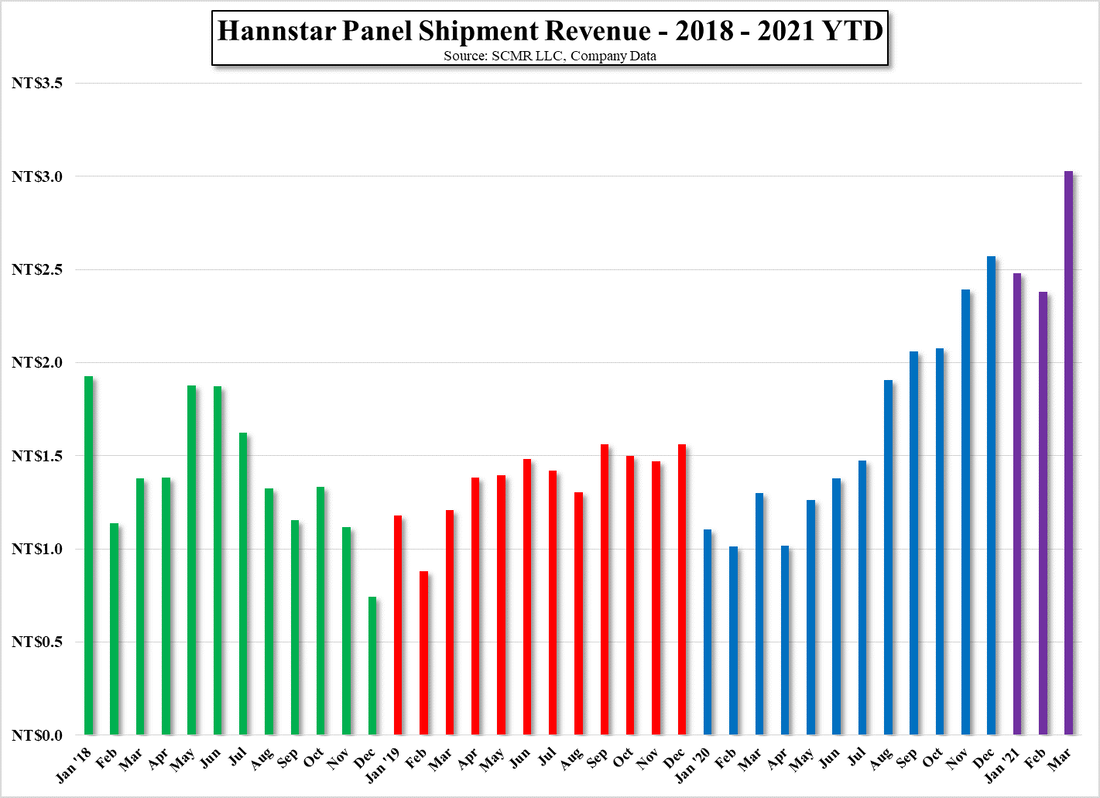

Hannstar (6116.TT), who specializes in small panel production, saw sales of NT$ 3.03b ($106.4m US), ↑27.3% m/m and ↑132.7% y/y. with small panel shipments of 31.3m units,↓6.7% m/m and ↑3.5% y/y. Hannstar shipped 525,000 large panel units in March, ↑176.3% m/m and ↑212.5% y/y, which was the largest number in the company’s history and more than it shipped during the entire 4th quarter last year. Given the rapid increase in large panel prices, we expect Hannstar pushed out as many large panel units as capacity would allow, which added to March profitability despite the decrease in small panel sales.

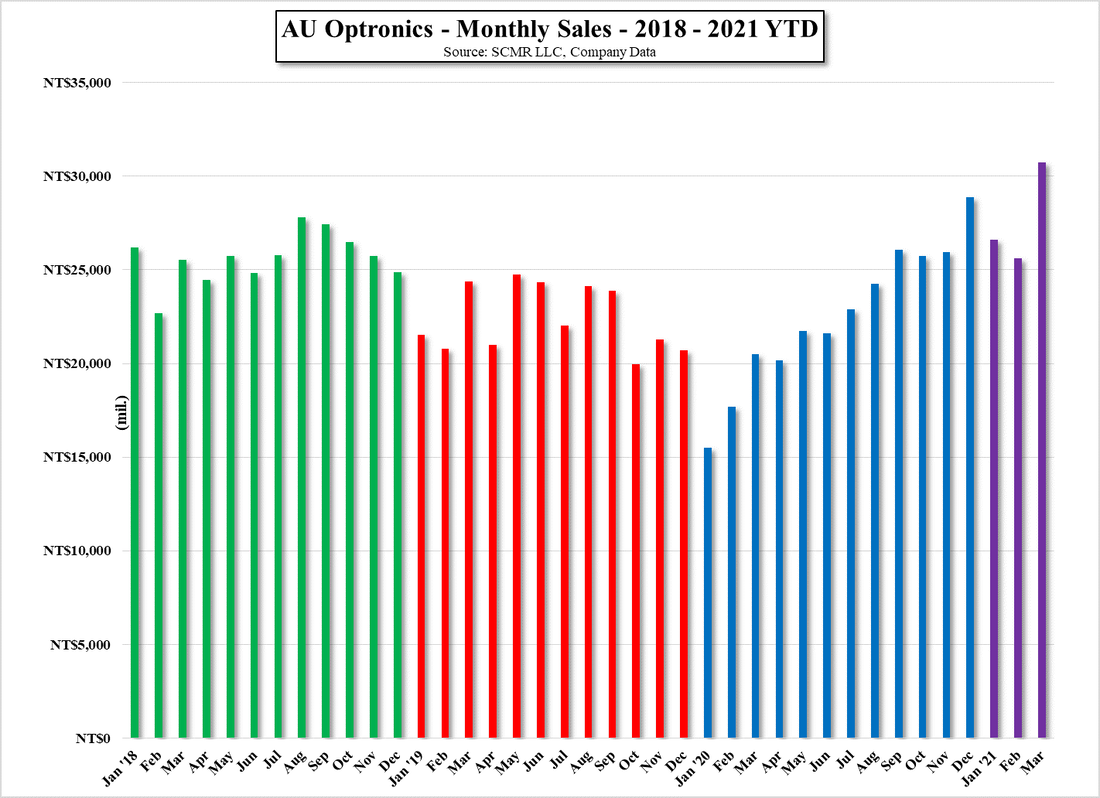

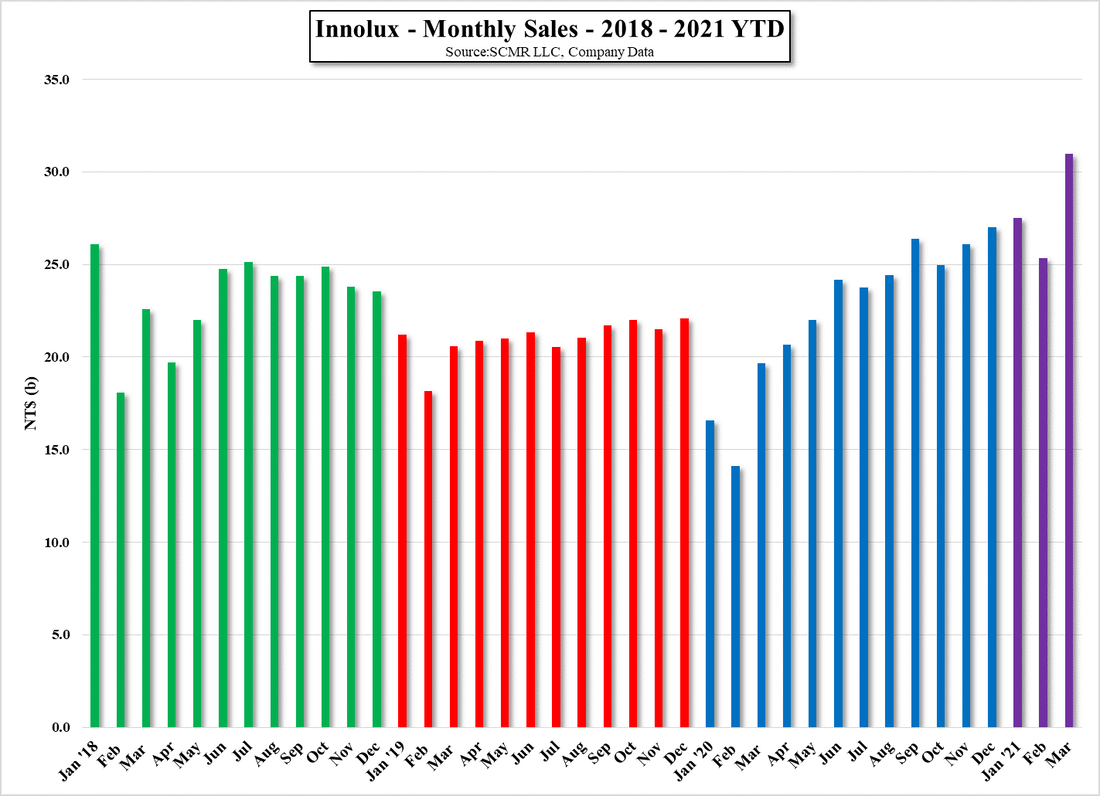

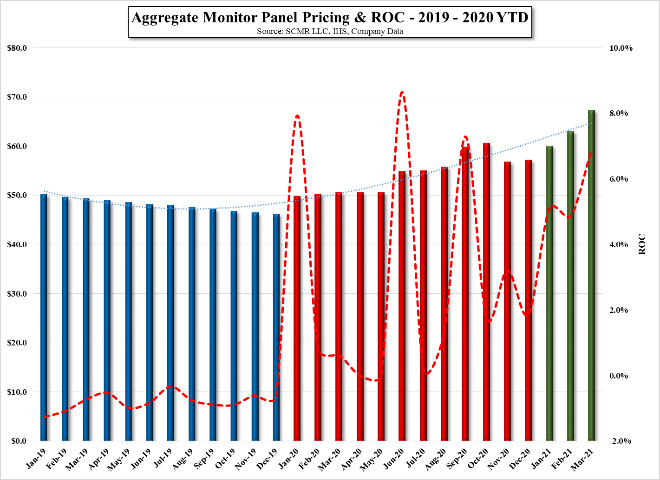

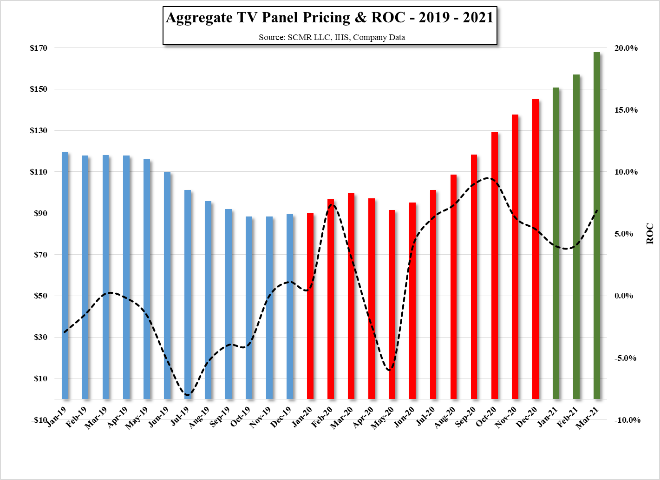

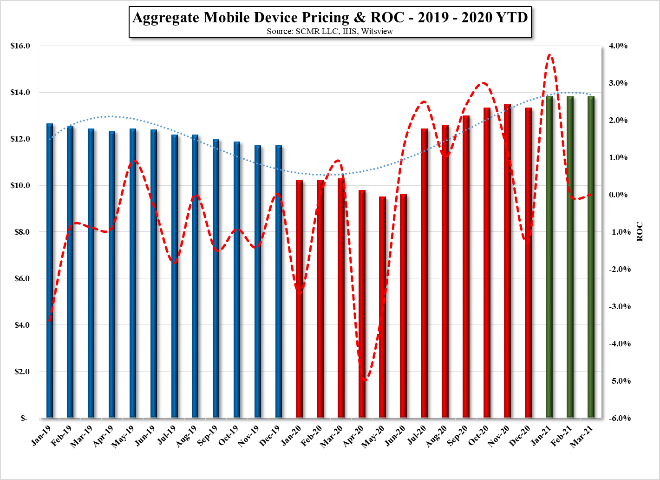

While product and panel type mix would certainly have an influence on panel revenue, we expect that panel pricing and demand were both responsible for the March sales increases. Panel pricing has been finite in that we can get a good read on panel price movement in a wide variety of sizes, but demand is far more difficult to quantify, and the continuing litany of stories we hear about double and triple ordering and exclusive deals being made in both the semiconductor and the display space add to that lack of transparency.

That said, we expect external (meaning what it would be without double or triple ordering) demand was sequentially better than February, as the Chinese New Year celebration ended and an aggressive vaccine roll-out and an additional monetary stimulus in the US gave consumers in these, the two largest CE markets, a chance to get out and spend. That new-found optimism as to the world’s ability to maintain some control over the COVID-19 pandemic seem to encourage brands to hold their shipment and share expectations steady for the 2021 year, while the fear of shortages pushed brand buyers to keep an aggressive stance with suppliers as low-cost inventories diminished. In the mind of CE buyers, price is less important than supply, which continues to feed panel price and semiconductor price increases.

We have just begun to see the results of those aggressive panel price increases, with a recent round of CE end product price increases, which we expect will continue as long as semiconductor foundry and panel production utilization remains high. The problem we see however, is not whether consumers will rebel against higher CE device prices now, but rather when price increases continue after demand slows and component price increases flatten. As the CE space builds inventory to ‘protect’ itself from shortages, that high cost inventory will take months to work down, keeping end-user prices high while component prices are flat or declining. We see the next few quarters as a motorcycle jump over the Grand Canyon. It's looking good from the jump point, but just a few inches short and it’s a long way down…

RSS Feed

RSS Feed