China PCB Suppliers Holding Back

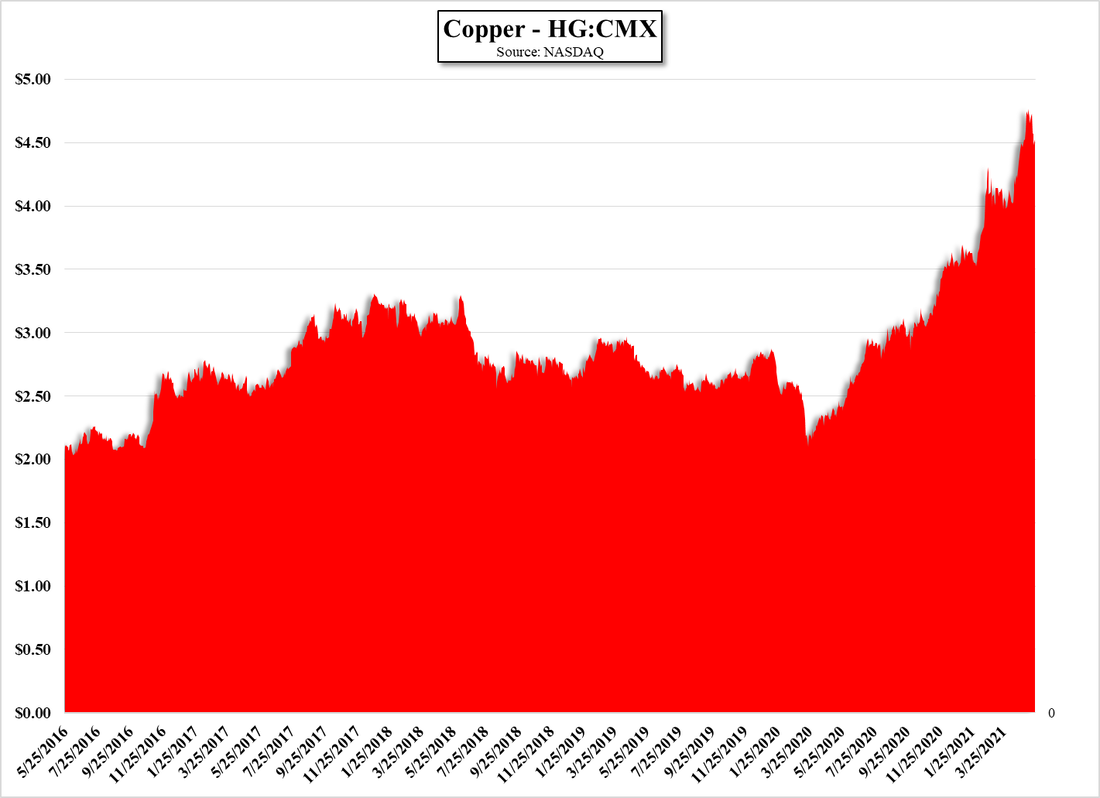

While the highest share of PCB cost is in the design and layout of the board before it is produced, PCB manufacturers are seeing these material price increases eat away at margins. In most cases the price increases instituted by PCB producers lag the raw material price increases which leaves board manufacturers questioning whether they will see positive margins on orders, with some smaller producers in China refusing to take orders based on their evaluation of that particular order’s price structure, particularly at the low end of the market. Some of the larger producers are better able to negotiate with material suppliers, but we expect considerable consolidation in the industry among smaller players this year if material prices continue to rise. We do expect PCB material prices to continue to rise on a long-term basis, due to demand from some of the newer applications mentioned above, but the recent momentum is putting considerable strain on an industry that rarely has to compete with others for what are basic materials on which it functions.

RSS Feed

RSS Feed