Handset Shipments – Playing with the Numbers

As we have stated in the past, there are many ways in which statistics and numbers can be used to paint a picture, with the selective use of data the easiest way to paint that picture in a way that presents such a positive viewpoint, or a negative one, but there are times when such numerical ‘paintings’ are merely hopes and desires and do not represent facts but emotions. An unnamed source in Taiwan has such a bias, and we rail against it every time we see it being used to view a situation through rose-colored glasses. A recent note from this source indicated that a number of upstream and downstream hand set suppliers in Taiwan have remained optimistic about their prospects for 3Q, despite some less rosy issues.

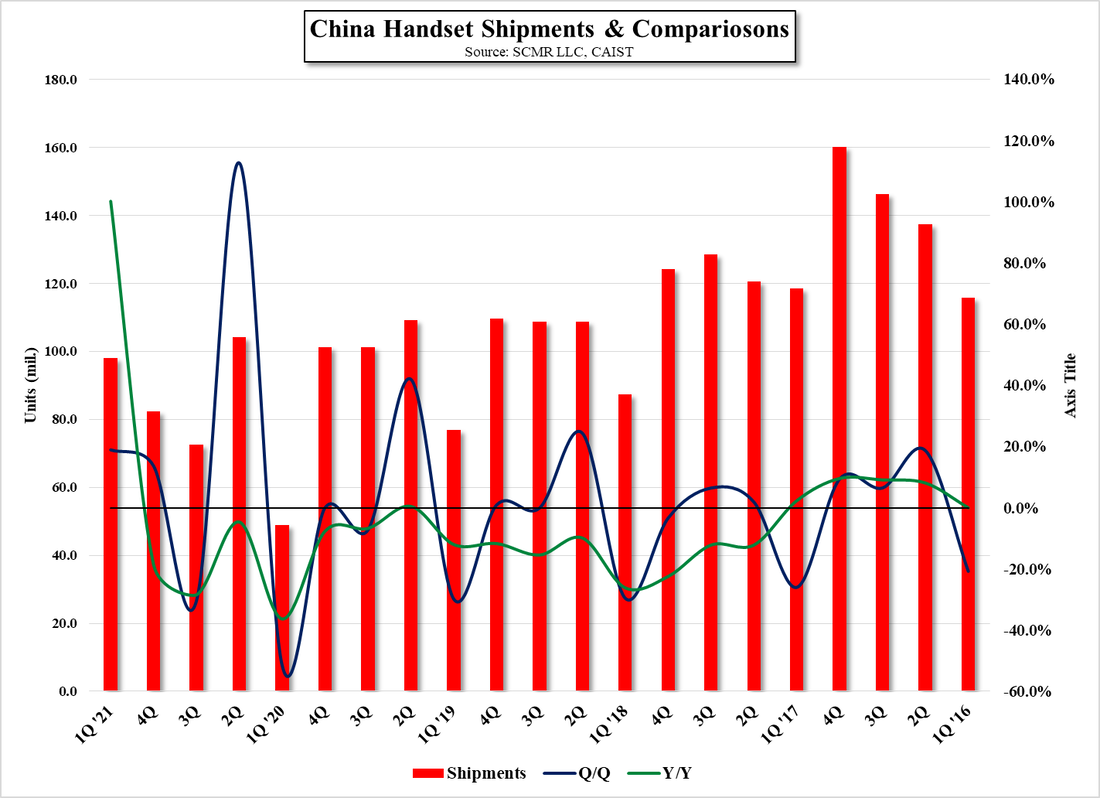

In this case the source cited the fact that even after weak sales of handsets in China in April, Chinese handset shipments were still up ~40% y/y, which makes one shrug off the weak April shipments., but the number quoted misses a few key points that might change one’s perspective a bit. 1Q handset shipments in China were strong at ~98m units, which was up 18.9% q/q and 100.2% y/y, but when April’s weak results are added in, which was a 23.8% decline m/m and a 34.1% decline y/y, total YTD handset shipment went from up 100.2% y/y YTD at the end of March to up 38.4% y/y/ at the end of April. In itself the data still suggests a strong quarter and 2021 in terms of Chinese handsets shipments, but it must be looked at in context of last year’s 1Q, which was down 51.6% q/q and down 36.3% y/y against 5 year averages of -31.6% q/q and -18.1% y/y, indicating that last year’s 1Q was quite a bit worse than average and the lowest in many years.

This was obviously due to the COVID-19 outbreak, but the numbers from the source do not reflect that the y/y comparison is so distorted as to be meaningless, and even after citing the fact that many handset brands have already lowered their yearly expectations and target shipment levels, the source takes the optimistic view that those reductions may help to keep component and raw material prices from rising as quickly as they have been, due to shortages and double ordering. We do note that 2Q typically sees a big improvement over the typically weak 1Q, but there are still a number of issues that should be reflected a bit more clearly in the rosy view offered by some of the supply chain, including the impact of the massive COVID-19 outbreak in India, the biggest market for Chinese handset brands outside of the mainland, the display driver shortage, rising handset prices, and a host of other smaller issues. Maybe April was an anomaly and a ‘real’ recovery in the Chinese handset market is afoot, but we would rather look at the averages rather than compare what was a very unusual year last year.

RSS Feed

RSS Feed