Universal Display

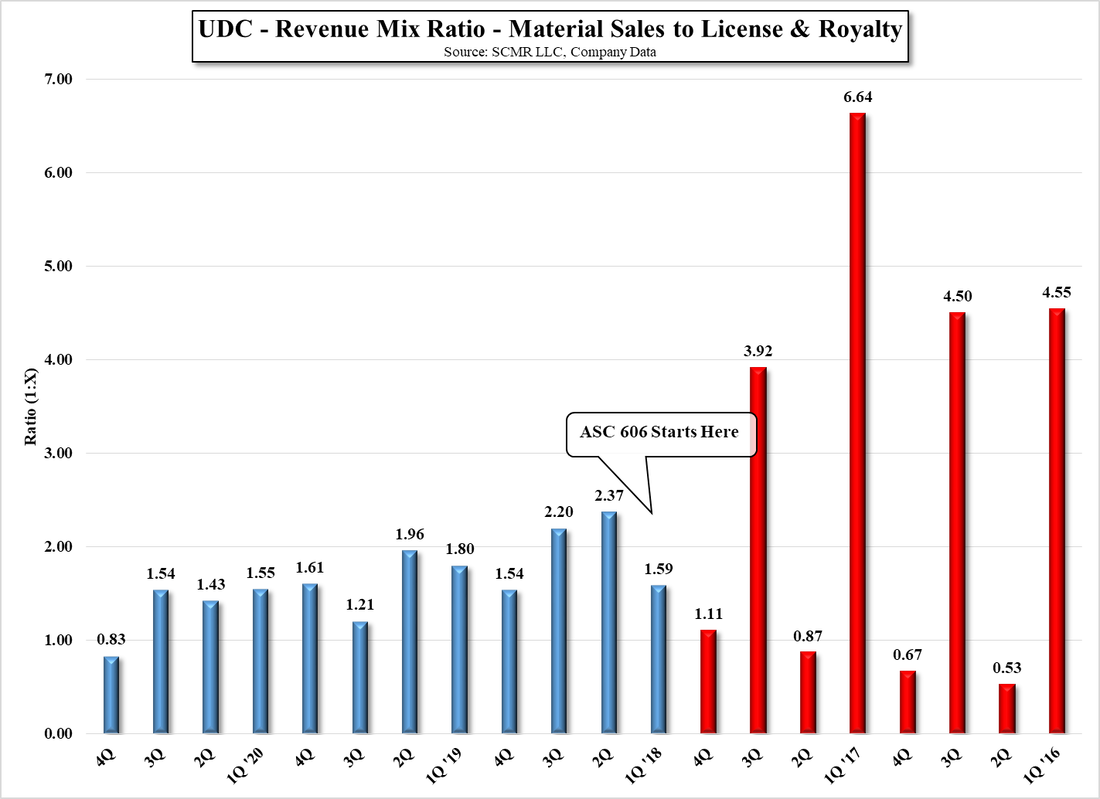

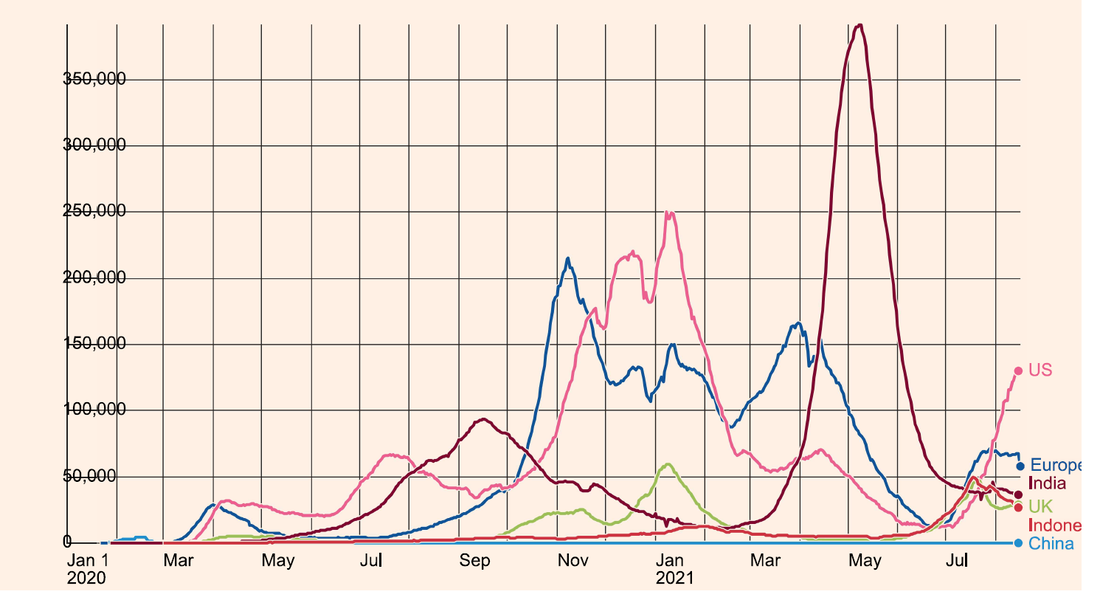

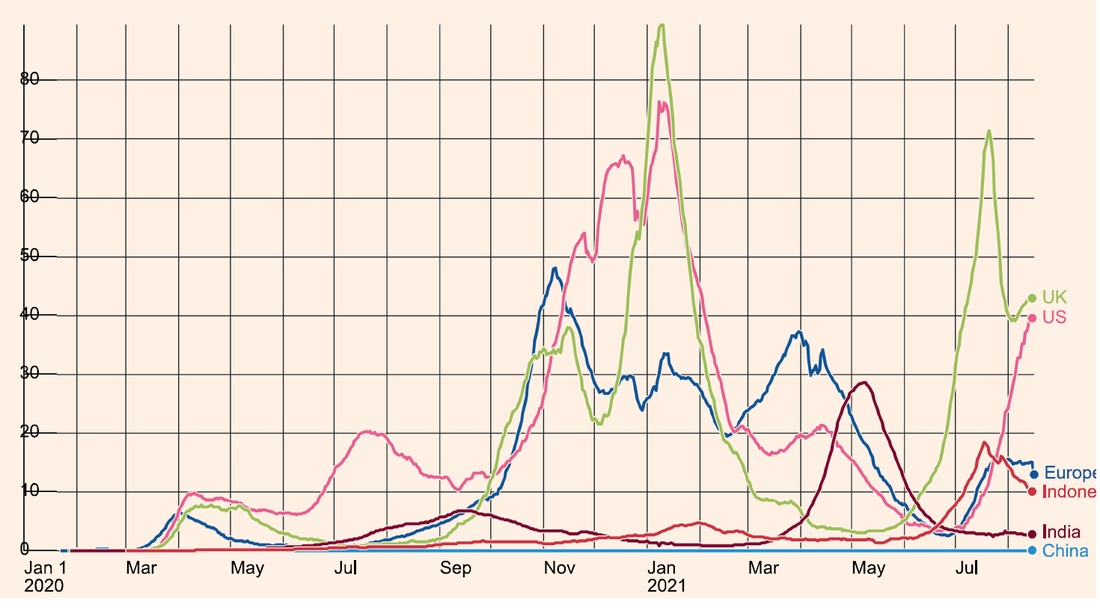

While this was a relatively uneventful quarter for UDC, primarily reflecting continued adoption of OLED across a wide variety of CE display based products, the company indicated that while they have not seen the effects of Chinese COVID lockdowns, continuing inflation, or similar economic headwinds from their customer base, they do acknowledge that such issues are affecting the CE space and could change customer plans. That said, they reiterated previous full-year guidance of $625m to $650m. One point of note in recent quarters has been the decline in emitter material gross margins, which while relative stable in 1Q, have declined from 72.8% in 2019 to 67.2% last year. Contributing to that decline has been a need to carry higher inventory levels and increasing raw material costs, a portion of which is iridium a key part of phosphorescent emitters, which saw a five-fold price increase last year. While iridium has come off its peak in 3Q last year ($6,100+) and reached as low as $3,850 in 4Q ’21, it is now back up to ~$5,000/oz., indicating that volatility in UDC’s material margins will likely continue. While this seems to be a concern to others, we believe the general stability of material margins (63% - 67%) is more important than returning to levels seen in pre-pandemic days until global inflation is brought under control, especially as material sales continue to grow, which will give UDC more leverage toward iridium purchases as the material returns to less lofty levels over time.

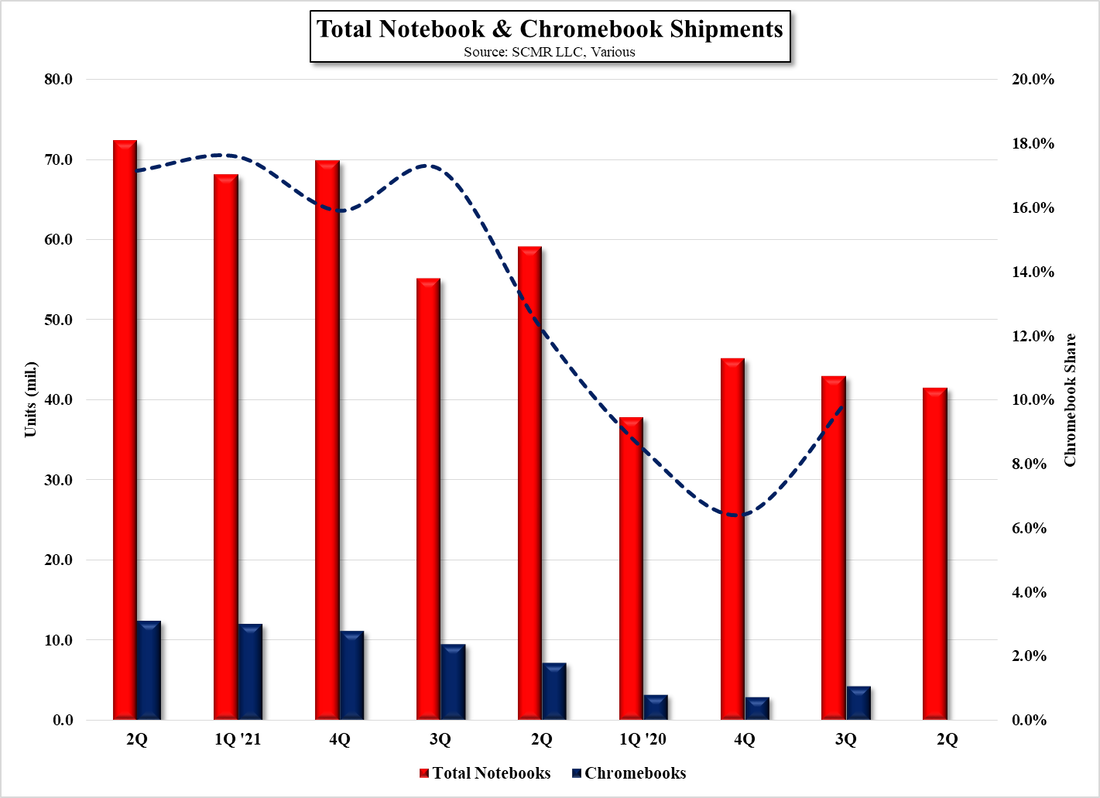

There are a number of potential OLED fab projects under consideration that will likely have an impact on UDC’s long-term material sales should they become actual production lines. Samsung Display, LG Display, and BOE are also considering building Gen 8.5 OLED fabs to better serve the newest OLED application, IT products, and while these will likely not be in production until late 2023 at the earliest, even in their phase one states they will represent a significant boost to overall OLED capacity, and given UDC’s lock on phosphorescent OLED emitter materials and its existing relationships with all OLED producers, we expect there will be another leg to the OLED growth story as OLED IT product demand begins to grow over the next few years.. There will be competition from other display technologies but OLED has established itself as a viable display prpduction process and with the infrastructure already in production will likely have the same staying power as LCD has had over the last twenty+ years.

[1] Samsung’s QD/OLED display does not use yellow/green emitter.

As we would expect there is considerable interest in the development of a phosphorescent blue emitter as it would improve OLED stack characteristics and increase power efficiency, but more toward UDC’s interests would be the addition of a 3rd material revenue stream for RGB displays. We note also that the license agreement and material supply contract UDC has with its first and sometimes largest customer, Samsung Display (pvt), does not include blue emitter material, which would imply an additional or supplemental agreement between the parties when blue emitter material becomes commercially available. As UDC is working directly with its customers on the development of a blue phosphorescent emitter, since they will ultimately decide whether it is ready for commercial use, we expect early revenue would likely be in the form of ‘developmental’ emitter sales, as management noted might show in 2023, with full scale commercial product in 2024.

UDC’s Organic Vapor Jet Deposition development project is also progressing with 23 employees at the end of 1Q working toward putting together the key subsystems necessary for an alpha system that will serve to verify the technology’s ability to scale. An actual commercial product is still a few years away (we would expect a pilot system in 2024 and a gen 6 commercial product in late 2025 or early 2026) although competition from a number of different deposition technologies continues to pressure the development of such a tool. In the interim we would expect a cost burden between $1.2m and $1.6m per year.

All in, 1Q 2022 was a good quarter for Universal Display, both from a financial standpoint and an emotional one. There was little to explain on the conference call, as the issues facing UDC’s customers are well known to investors. More to the point is whether the growth in OLED display penetration can offset the weakness that is expected to continue in CE product demand. While the LCD display business has been on the positive side of the scale during the COVID-19 pandemic, we are slowly moving back to a more normalized demand cycle in the CE space, where competition for consumer dollars will no longer be related to how fast a producer can get a product on shelves, but more does it provide enough incentive for the consumer to shell out dollars with less buying power than two years ago. While LCD manufacturers extol the progress made in their space over the last few years, OLED displays are still considered the best technically, and while there will be issues with every display technology, OLED has become embraced by CE brands as a way to raise the quality of CE products. Given that UDC is in the unusual position of being a ‘window’ into the OLED space, the company should be a focus for any technology investor. Of course, valuation is absolutely up to the individual…

[1] Typically those targets are material efficiency, color point, and lifetime. While UDC likely has a good idea what minimums are necessary for a commercial blue emitter/host system, each customer has its own targets, which makes the adoption timeline particular to each customer.

RSS Feed

RSS Feed