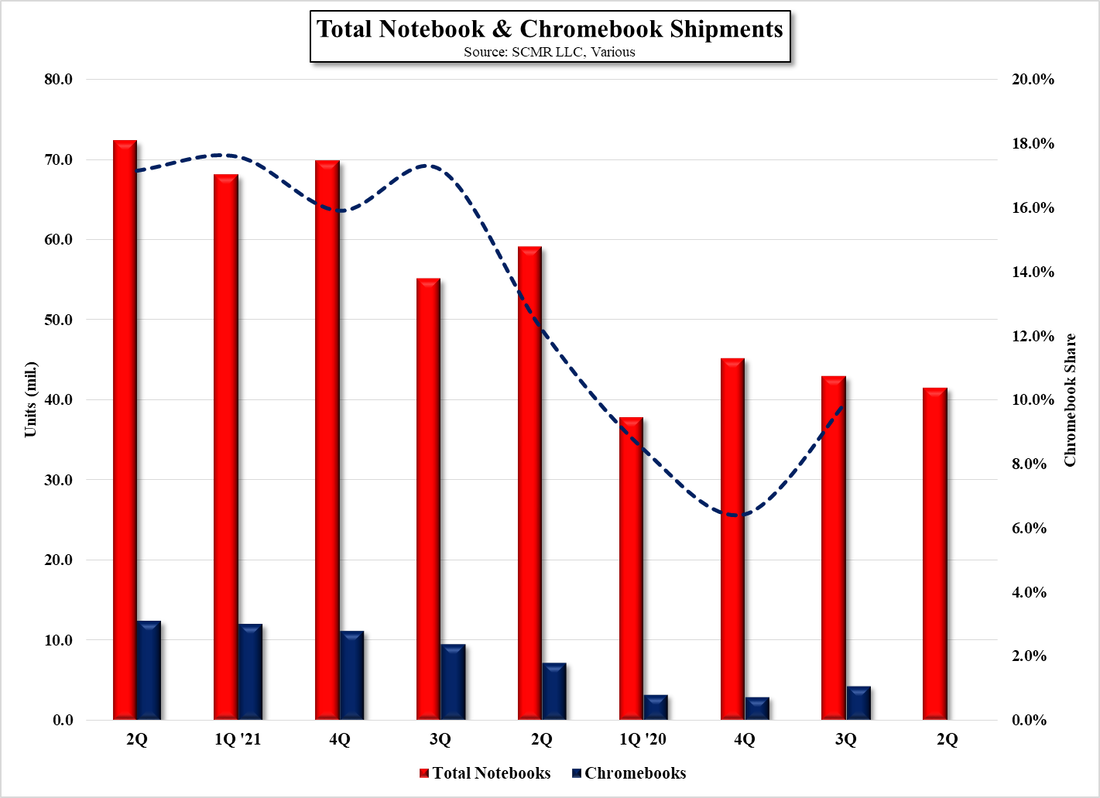

Fun With Data – NotebooksNotebook panel pricing, while certainly down from its peak in September of last year (↓14.6%), has held up better than other panel categories, with aggregate notebook panel prices still up 14.5% from the lows seen in January 2020. Notebook shipments have only recently begun to slow as both demand from remote education programs wanes and the effect of component shortages, COVID lockdowns in China, and inflationary malaise take their toll. While notebook shipments themselves have been a bit lumpy it is easier to see a pattern when looking at notebook panel shipments, which peaked in 4Q last year and have begun to decline after fairly steady increases since the pandemic began. We do note that over the last two years many notebook brands maintained higher than normal inventory levels of components in order to guarantee their ability to fill demand during shortages, and while demand was certain present, this added a bit of ‘anticipatory’ ordering to secure sufficient safety stock. In the panel space it has been most recognizable, as shown in Figure 2, but is now showing signs of weakness, with 2Q notebook pricing already down 9.2% from the end of 1Q if our forecast for May holds true, and while panel production reductions might not follow immediately, panel prices are a direct reflection of demand, which would already be foreshadowing a reduction in demand. It can be seen in Figure 1 that the mismatch between panel production and notebook sales narrowed considerably in 1Q ’22 as notebook brands began to lighten inventory levels, but given the component shortages and lockdowns seen recently, it would be hard for notebook brands to return to pre-COVID component and finished product levels. All in, we do not expect notebook panel demand or pricing to see the same rapid downward spiral that occurred with TV panels, but we do expect the price declines to continue and could be sustained into the holiday build period in 3Q, which leads us to expect it will be difficult for both notebook brands and notebook panel suppliers to show anything but lower y/y returns this year. 1Q shipments for the top brands already reflect a 4.9% y/y decline in notebook shipments, with only Asus (2357.TT) and Apple (AAPL) up y/y, although combined they garner only a 16.1% share of the market, which is less than each of the top three brands, all of whom were down y/y.

0 Comments

Leave a Reply. |

AuthorWe publish daily proprietary market research focusing om consumer electronics and the global supply chain. The archieved notes represent a selection of our proprietary analysis and forecasts. please contact us at: [email protected] for detail or subscription information. Archives

January 2026

|

RSS Feed

RSS Feed