Welcome Back Lava

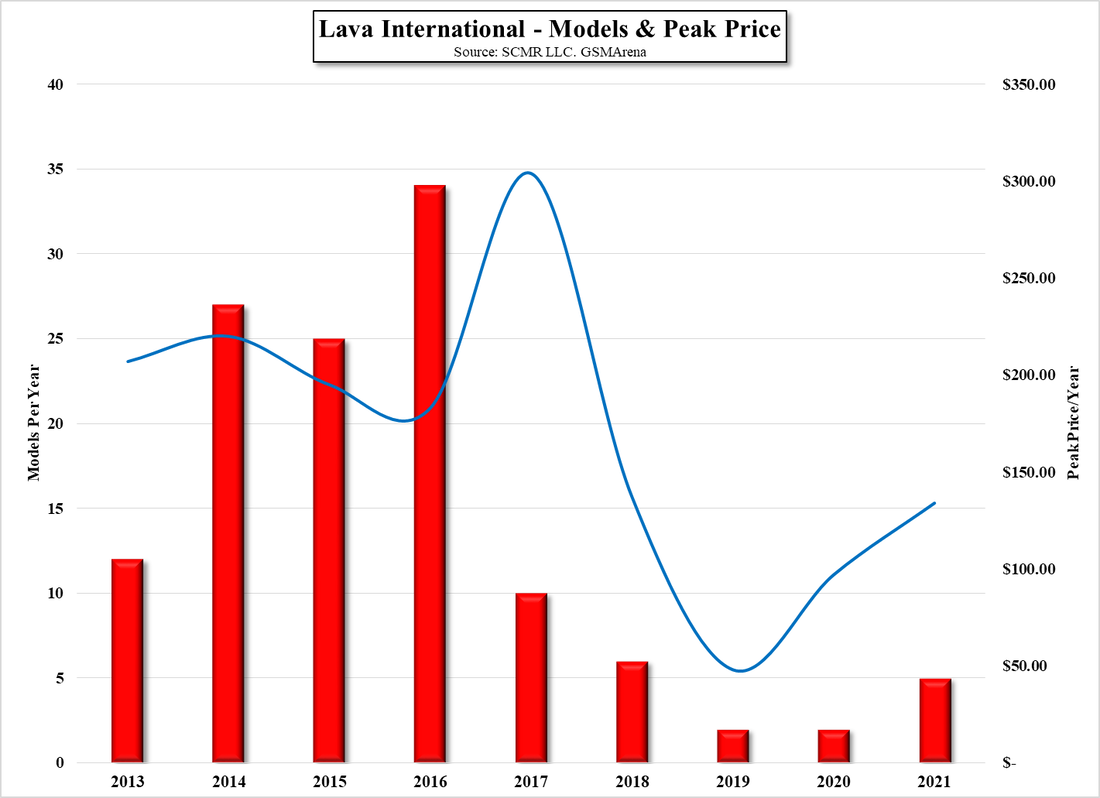

Lava is now reviving its smartphone business and in January released its “MyZ” series of smartphones, which according to the company, is the world’s first fully customizable smartphone line, allowing the user to choose the front camera rear camera, RAM, ROM, and color, and have the phone produced ‘just for you’.. That said, on an overall basis, the new line sports LCD displays from 7” down to 5”, running Mediatek’s (2454.TT) Helios G35 or A20 OS, and costing between $135 and $75 US, which is a bit below the 2020 average smartphone price in India of $156.

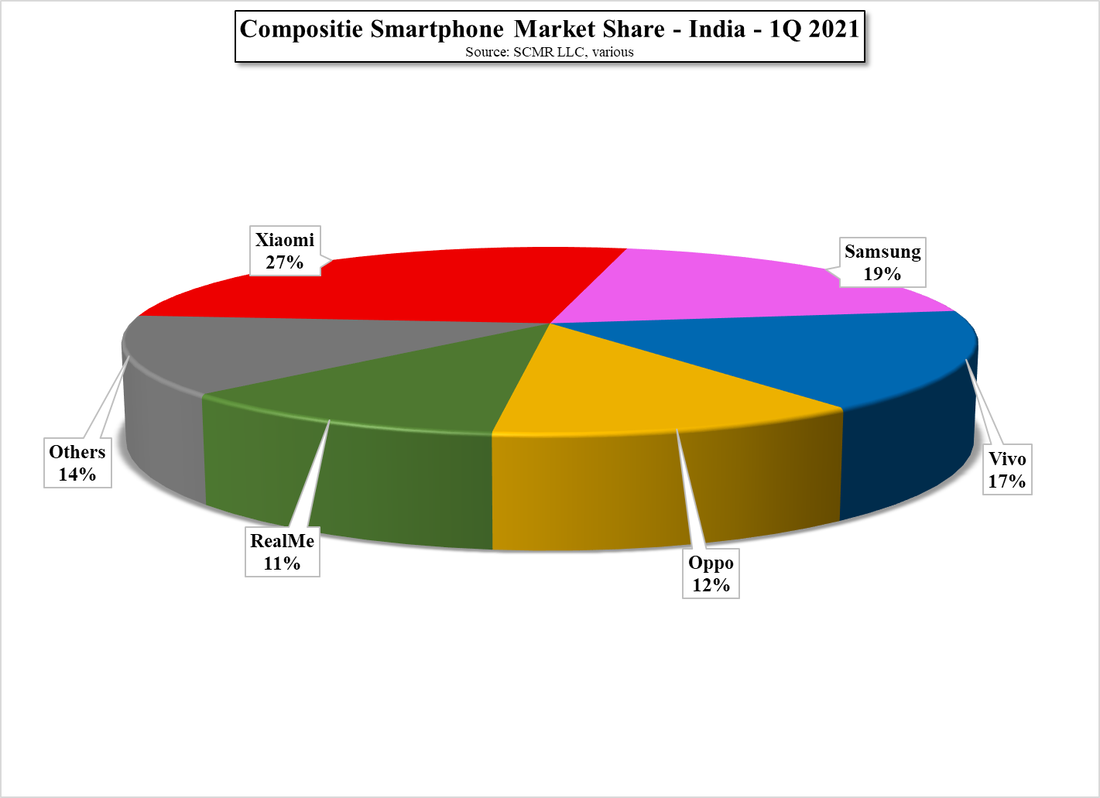

While Lava has not seen its share of the Indian smartphone market above 1% over the last few years, the company expects to see a 5% share by the end of this year, likely more realistically possible after the IPO, which is expected to raise between $1.9b and $2b US. The Indian government is also pushing to help local smartphone brands regain status, with government funding, and the bad border blood between India and China has helped Indian brands regain some relevance in the market over the last few quarters. That said Fig. 2 shows 1Q composite brand share, which includes only Chinese brands and Samsung and qualifying for government subsidies (Production Linked Incentives) means Lava must meet certain requirements to receive the benefits (3% to 6% of sales incentive for 5 years), which was the likely stimulus for the filing.

While the shares in Lava are unlisted, with the IPO filing set for June, there is a small unlisted share market for Lava which has seen the share price rise from ~₹200 (~$2.75) to ~₹400 ($5.50) since the company’s plans for the IPO began to be known. Net profit margin for Lava (March year) has ranged from 3.68% to 1.43% (2019), but increased to 2.03% last year, although not surprisingly the promoters of the unlisted market consider the share undervalued on a market cap to revenue basis.

RSS Feed

RSS Feed