Is BOE Planning a 3rd Gen 10.5 LCD Fab?

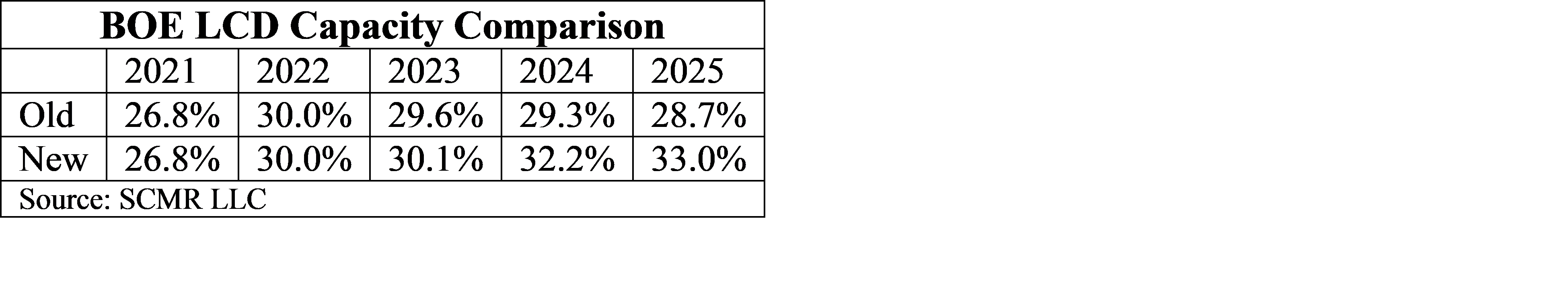

BOE’s last two Gen 10.5 fabs have a stated capacity of 120,000 sheets/month, and while speculation about the new fab is calling for 150,000 sheet/month capacity, we are, at least for now, adding 120k to our fab database, as duplicating an existing fab is always easier and less expensive than changing the configuration. Timing is still a big question, as no announcements have been made, but we plan an announcement, if the project is approved by the board, in September, which would lead us to a phase 1 opening of June 2023 and a phase 2 opening of March 2024, with both ramping to full production over roughly 10 to 12 months. The ramp will begin to increase BOE’s global capacity share in 2023, and more so in 2024 and 2025, although much will depend on the timing and how quickly BOE can find customers to fill the new fab. The table below compares our expectations for BOE’s gross LCD capacity share under current circumstances and with the inclusion of this new Gen 10.5 fb.

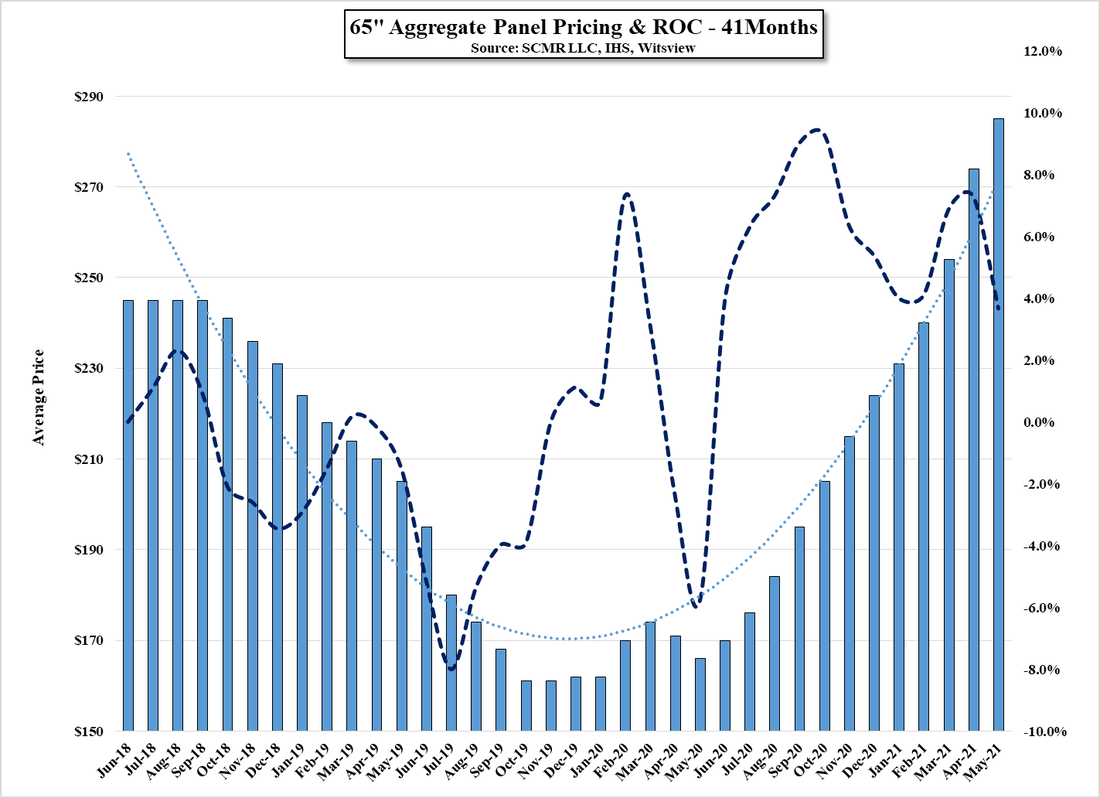

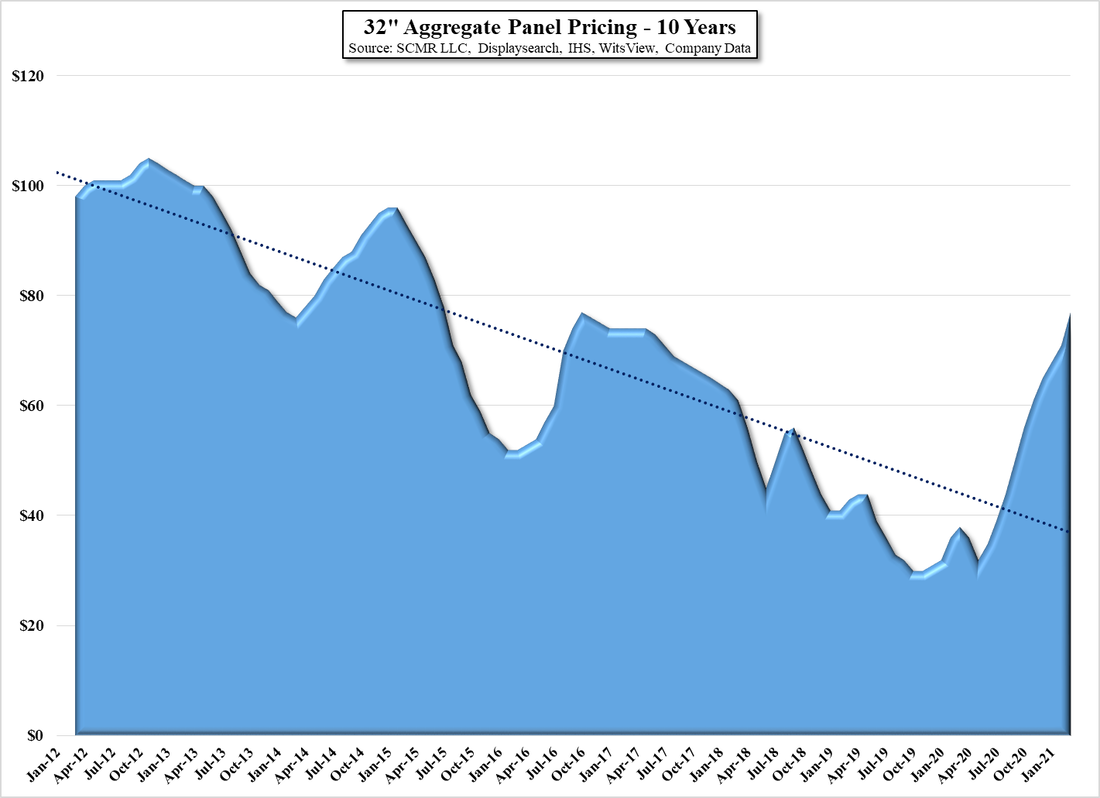

While we agree with the fact that the LCD display space is maturing, we are not convinced that cyclicality is being washed out of the industry. LCD displays will still have to compete with OLED and other potential display technologies, and while mini-LED backlighting and quantum dot enhancement can help to bring LCD specs closer to other display technologies, consumers want bigger and better TVs at lower prices and that means continued competition. Unless the world has permanently changed due to COVID-19, there will always be periods of supply/demand imbalance, during which the profitability of LCD fabs will be marginal. Building a Gen 10.5 fab does give BOE and others an efficiency advantage over older Gen 8.5 LCD fabs, especially with larger LCD panels (65” and over), but assuming that everything will remain the same as it is now years into the future is a dangerous game.

RSS Feed

RSS Feed