Samsung Changes Its View

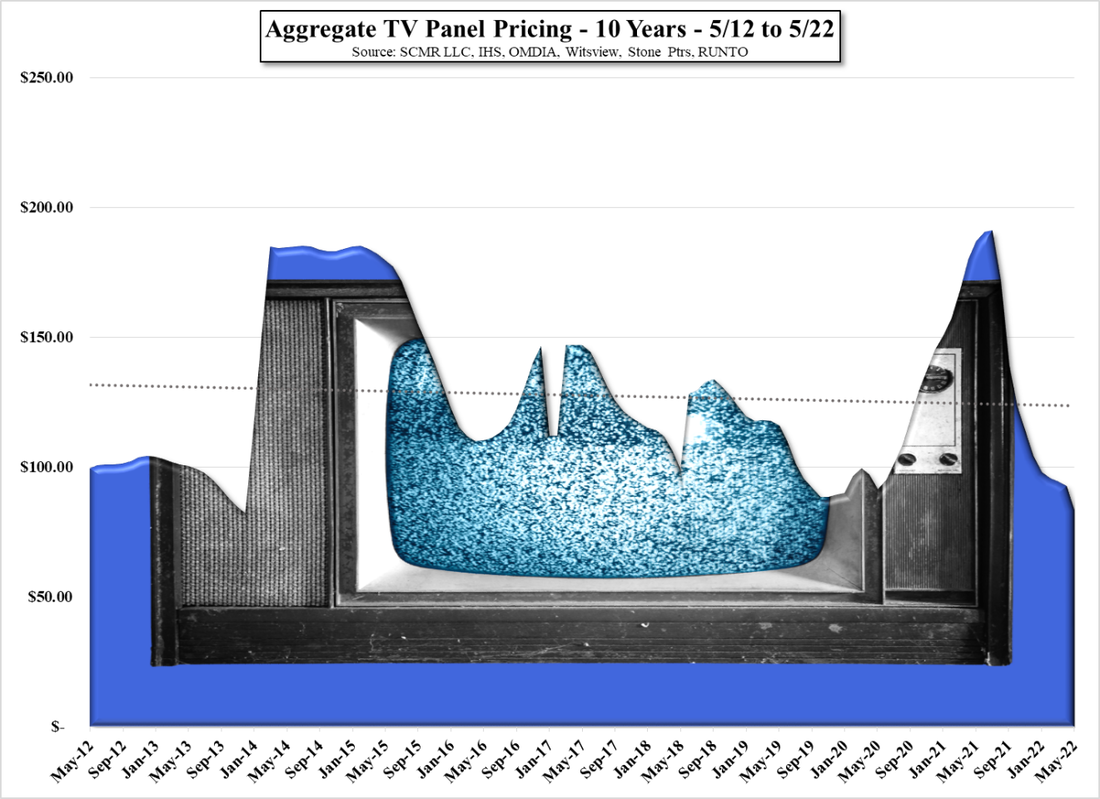

According to Japanese Tech press, Samsung has now halted issuing new purchase orders and asked a number of suppliers to reduce component shipments for the rest of this month and the full month of July. While no product specifics were given, smartphones, TVs, and home appliances were the primary product categories, with semiconductors, packaging, and a number of other components were said to be involved. Samsung is said to have told suppliers that it needs to closely review component and final product inventory, and while suppliers have not stopped shipping to Samsung, some suppliers indicate that shipments to the company have been cut by as much as 50%.

It would seem that with Samsung’s change of heart, much of the public optimism that CE companies had been expressing about a better 2nd half, regardless of whether it was seasonal or otherwise, has begun to evaporate, although there are still many suppliers, particularly those producing more specialized products, that are optimistic and see orders on the books through 3Q or the remainder of the year. Our concern is that the current cuts being made by Samsung and other TV and smartphone brands are coming a bit too late to salvage the remainder of the year, inclusive of the holiday season. Inventory levels in many CE products have been building since the beginning of the year, along with the higher costs associated with rising raw material and transportation costs, making it more onerous to offer the steep discounts needed to get consumers to use what remains of their buying power.

Our hope is that many CE companies will bite the bullet quickly and begin discounting aggressively to burn off excess, high-cost inventory, and the lack of new production allowing some reductions in component pricing, all of which would allow a somewhat more profitable holiday season. That said, given the global macro and geo-political environment, the odds against such a scenario playing out are low, which means we should more likely expect a more ‘wait-and-see’ attitude from CE companies, who will maintain said reduced levels until August when the seasonal build period begins, and hope that even a seasonal increase foretells a better holiday season and likely begin inventory building.

It is hard not to be pessimistic when only a few CE companies were willing to look at markets like smartphones or TVs and project that the effects of COVID-19 on consumers that led to rising prices and component shortages had already become unglued early this year. Rather, many assumed that this was to be the ‘new normal’ and the CE boom-bust pendulum would never swing back again. Yes, it is easy to be a Sunday mooring quarterback, but the data has been pointing to progressively weaker results for at least two quarters, despite record 1Q results for many. Now suddenly the CE space has a dark hue and concern over excessive inventory levels is now a major driver, which to us is the first step toward a better CE space in 2023.

RSS Feed

RSS Feed