Chromebooks Slowing?

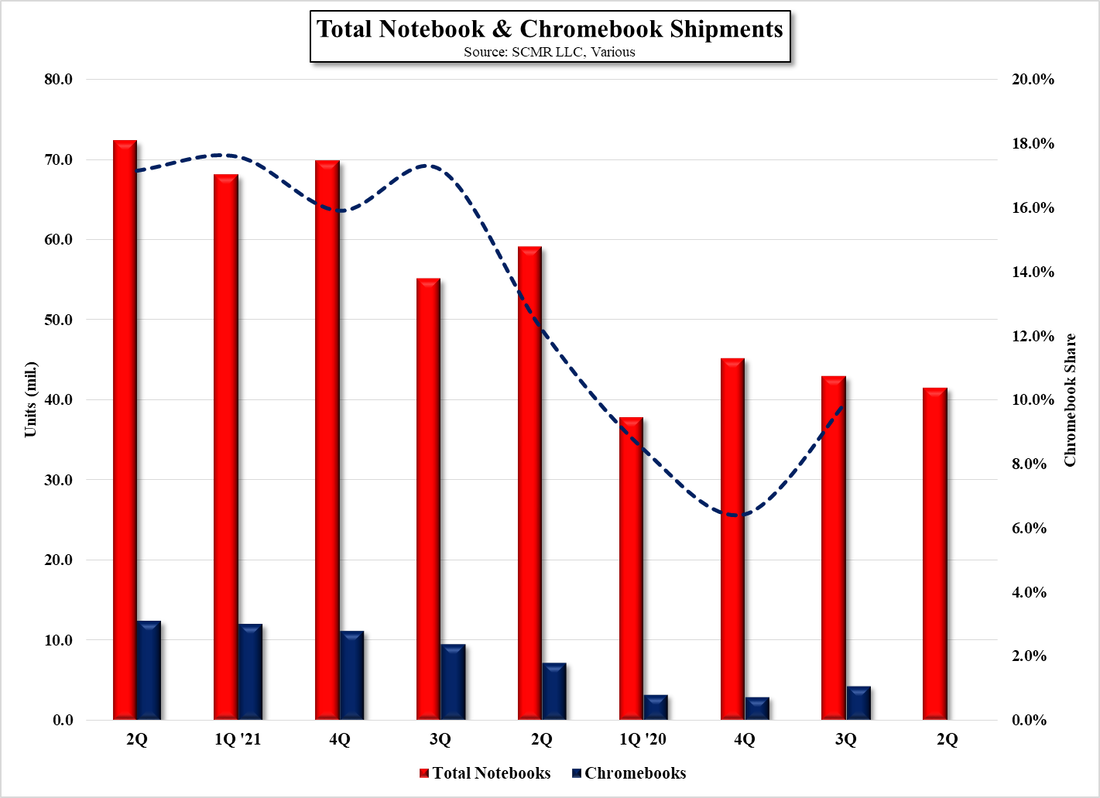

On a more general basis, while revenue could still see some improvement in 3Q for notebook OEMs in general, those gains will come from mix and pricing, despite the typically seasonally strong 3Q as some of the global notebook acquisition programs in the education space come to an end or begin to tail off. As we noted in our 7/14/21 note, global notebook shipments were up almost 20% last year, against a more typical 3% to 4%, with expectations for another 15% shipment growth again this year, which would imply 2H shipments of 115m, down ~18% from 1H, which seems a bit aggressive to us given the weakening shipment expectations for Chromebooks, which represented ~17.2% of total notebook shipments in 2Q ’21, up from 12.1% in 2Q ’20.

Based on what seems to be the tone of a number of notebook OEMs and brands, we would expect the 2nd half shipment growth to be revised downward as demand weakens. The one positive factor that could come into play is that as demand weakens it could put less pressure on component manufacturers, particularly semiconductor foundries, where capacity contention with other application segments has led to shortages or extended lead times. As demand from Chromebook or notebook producers slows, the shortages relating to those products could lessen or abate, allowing lead times to be pulled in. Whether that is a good thing against slower notebook/Chromebook demand remains to be seen, but it could lead to some shipment timelines being pulled in. Unfortunately that also begs the question of whether those orders will remain as originally given as notebook and Chromebook brand targets could be in jeopardy of being lowered as3Q develops.

Looking a bit further down the supply chain, the last thing panel producers want to see in 2H is weakening demand for IT products (notebooks, Chromebooks, Monitors, Tablets) as they have shifted production capacity away from TV panel production toward what have been more profitable IT products. Lower utilization would be the result if IT product targets are reduced, and while we expect a more optimistic view will be carried by most panel producers, we worry that there is little alternative to slowing production in such a case. Those same utilization reductions will also signal considerably more difficulty for panel producers when it comes to panel prices, and while IT panel pricing increases have slowed a bit, they are still in positive territory. TV panel prices, which have turned negative, have flattened panel producer revenue expectations, but with the additional leverage associated with IT products at most panel producers, the impact could be greater on the industry.

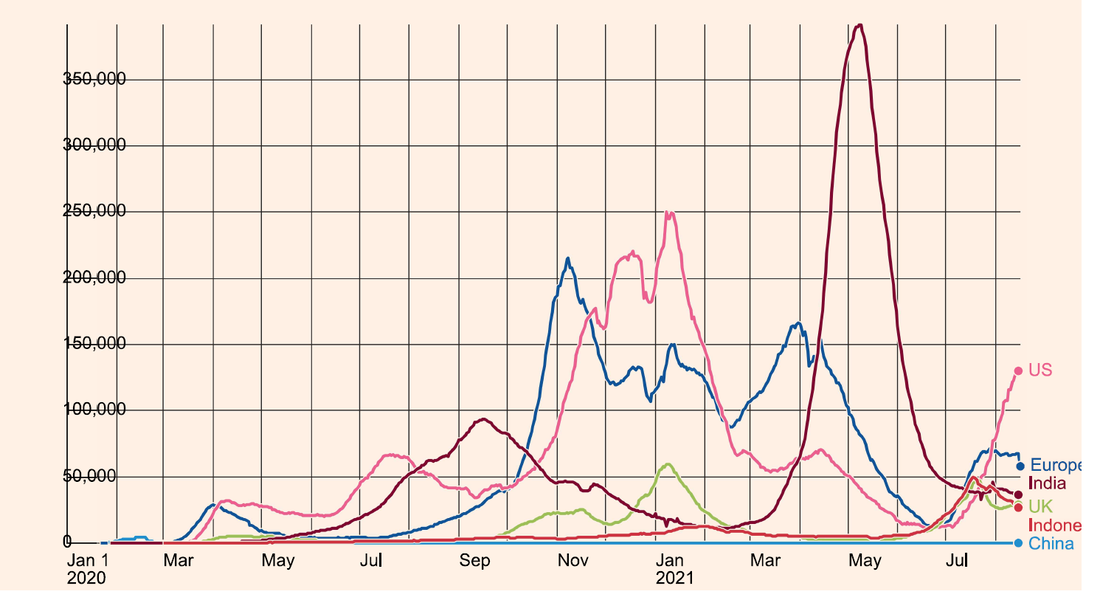

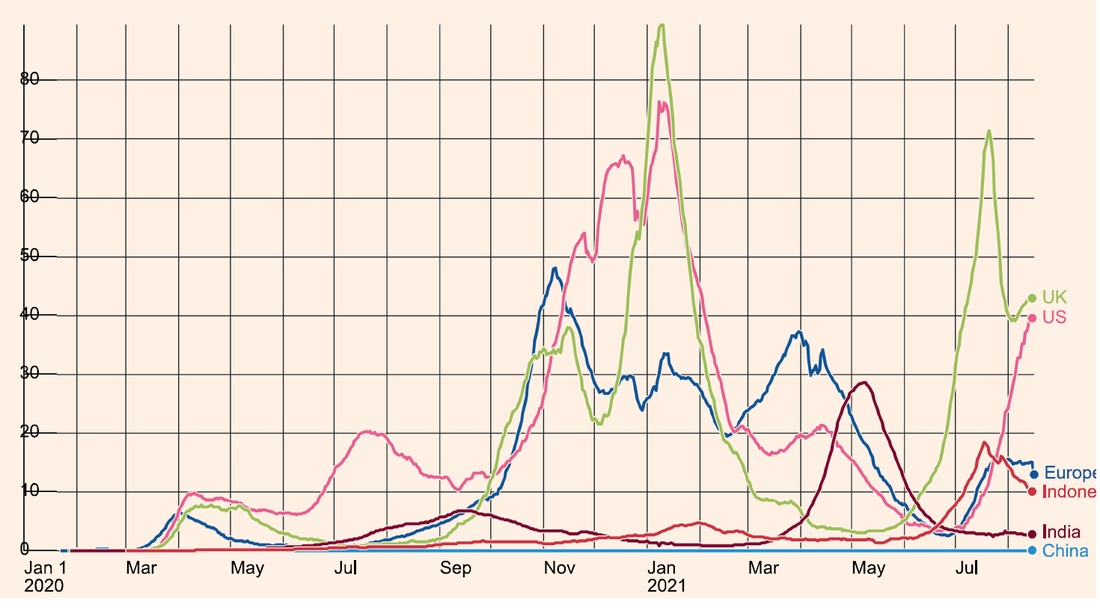

These are still suppositions on our part, but changes have been occurring in CE product demand on an application by application basis as the pandemic (new cases) slows in much of the world. Unfortunately that is not the case in the US both on a raw number and ‘per 100k’ basis (see Figs 5 & 6), but that does not seem to have made much of an impact on CE demand, as the educational market has siphoned off much of the stay-at-home demand last year or earlier this year, and with Federal, state, and local governments all pushing for students to return to classrooms, we expect relatively little incremental demand for notebooks and Chromebooks going forward.

RSS Feed

RSS Feed