Singing the Blues

It seems that the average investor believes that when blue phosphorescent emitter material is commercialized, the winner of the race, whoever that might be, is due to see a windfall in terms of OLED material sales, but while we believe that is the case over time, we are less sanguine about an immediate and significant jump in revenue from blue phosphorescent sales, as both physics and marketing must be figured into such equations.

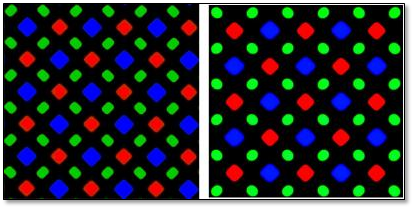

There are two factors that come into play when planning OLED pixels. First is the efficiency of the materials, or their ability to convert electrical energy into light, and the 2nd is the eye’s sensitivity to each color. If we assume the efficiency of both red and green phosphorescent emitter materials is the same (its not), for both colors to look equally bright to the huma eye, the pixel would contain two times the amount of red material to green material, but in practice that ratio is closer to 2 (red) to 3 (green), and again assuming the same efficiency for blue phosphorescent material, the theoretical ratio for blue would be only 16.3% of red, or 33% of green. So if red emitter cost $1,000 per kilogram (arbitrary price), the theoretical cost of a display that used 1 gram of red emitter would be $1.67, consisting of $1.00 of red, $0.50 of green, and $0.17 of blue, remembering that these are theoretical not practical ratios.

Back to reality, just by looking at a common pentile pixel layout, those ratios are not even close, especially as the efficiency of fluorescent blue (currently used) is considerably lower than that of (hopefully) phosphorescent blue, so ‘more’ fluorescent blue is needed currently to make up for that inefficiency, which leads to the idea that if fluorescent blue is replaced by a more efficient phosphorescent blue emitter, wouldn’t that mean that less blue is needed? If all were of equal efficiency, yes, but that is certainly not the case with OLED materials.

OLED material developers must find a balance between three major factors. Color point (such as deep blue, not sky blue), efficiency, the ability to convert energy applied to light, and lifetime, or how long it takes for the material to degrade to a set point. Finding a true deep blue phosphorescent material is not an impossible task, but finding one that has a reasonable efficiency is much harder, and finding one that is deep blue, with a high efficiency, but does not degrade in a few hours is very difficult, so material scientists continue to wrestle with materials until the right combination is found. Even at that point however, we don’t know what the efficiency of this new blue phosphorescent material will be, and that will be a determinant in how much blue phosphorescent emitter material is needed to balance existing red and green phosphorescent emitter materials, which will also determine how much blue phosphorescent emitter material an OLED panel producer must buy when incorporating it in a new OLED display, so the variables are truly ‘variable’.

With all of those physical issues, there is another one as important, and that is the manufacturing cost of this new blue material. Again, in theory, the amount of heavy metal, in this case iridium, needed to produce the increasingly higher energy levels of green and blue emitters, would make a phosphorescent blue emitter more expensive to produce than green or red, and under the assumption that the cost of raw materials for emitters is ~40%, this does represent a bit of an incremental cost, along with a relatively immature manufacturing process and considerable R&D that needs to be amortized, so the price/kg of a blue phosphorescent emitter is going to have to be higher than red or green.

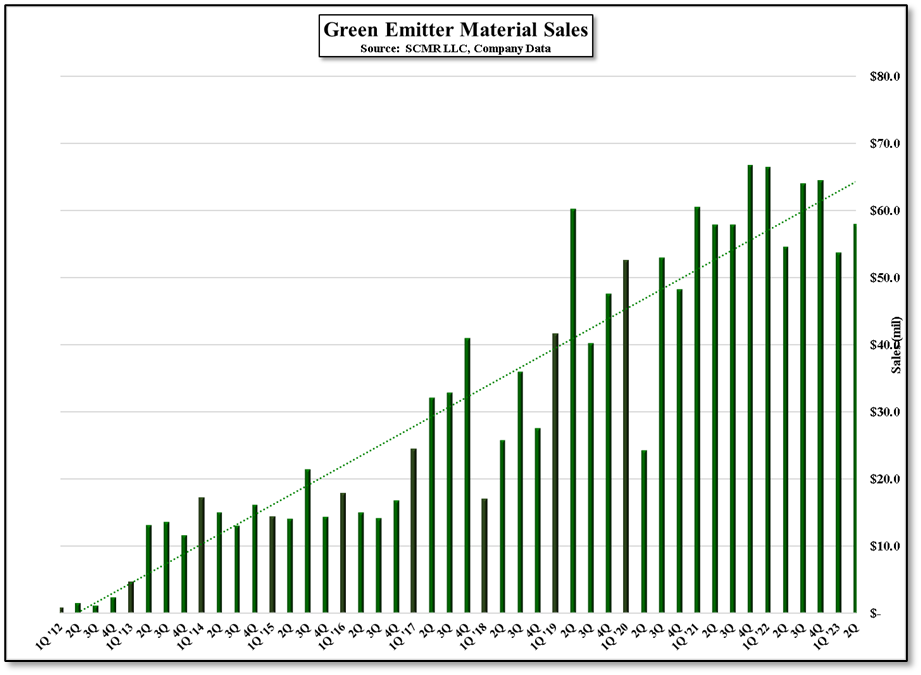

That said, while the cost of a blue phosphorescent emitter material will be higher than that of a fluorescent blue emitter, less will be needed (in theory) unless the efficiency is low, which will make the changeover less onerous from a total OLED stack cost. However it is important to understand that the adoption of a blue phosphorescent emitter material will not happen overnight, just as the adoption of a green phosphorescent material took time, as shown below. While we expect the idea of being able to reduce power consumption by 25% or have an OLED display that is brighter than is currently possible, will be an attraction to OLED panel producers, but implementing new OLED materials into existing manufacturing processes takes time and considerable effort, and could affect yield for an extended period of time. Typically such a change would be implemented on a single line, so once the new materials are proven, they would be expanded across other lines over time.

All in, while it will be exciting to see a commercial blue phosphorescent emitter material to complete the OLED stack, we hesitate to build in the high early expectations that are typical in the OLED space and take a more conservative view of how such a new material will be adopted. With Universal Display (OLED) expected to have an all-phosphorescent stack commercially available next year, expectations will be high, but we expect adoption to the levels seen for current red and green phosphorescent emitter materials will take some time and investors should be wary of building in high expectations at the onset.

RSS Feed

RSS Feed