Glass Half Empty?

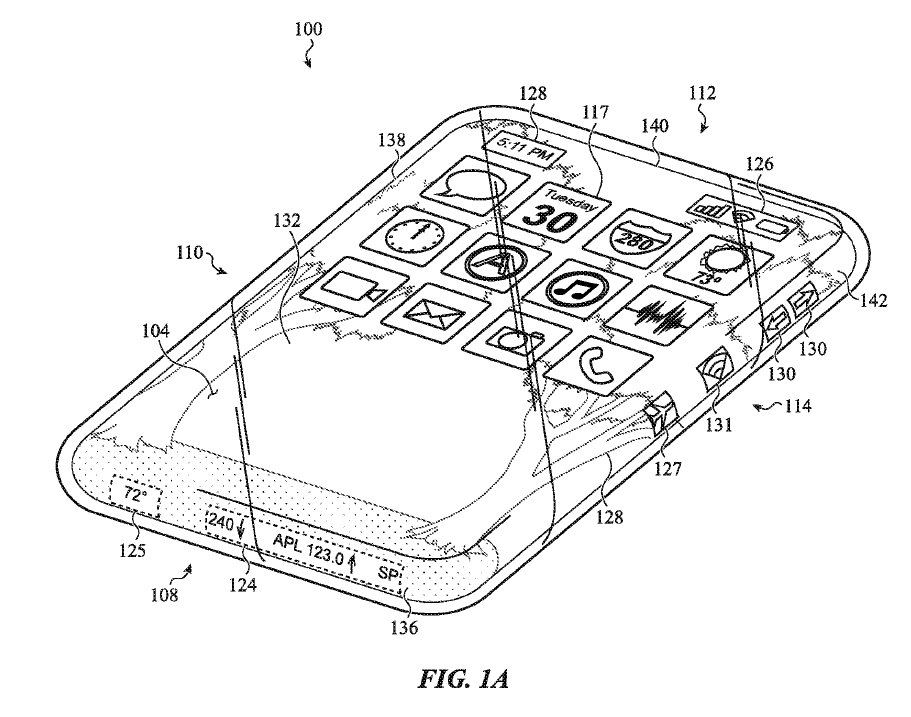

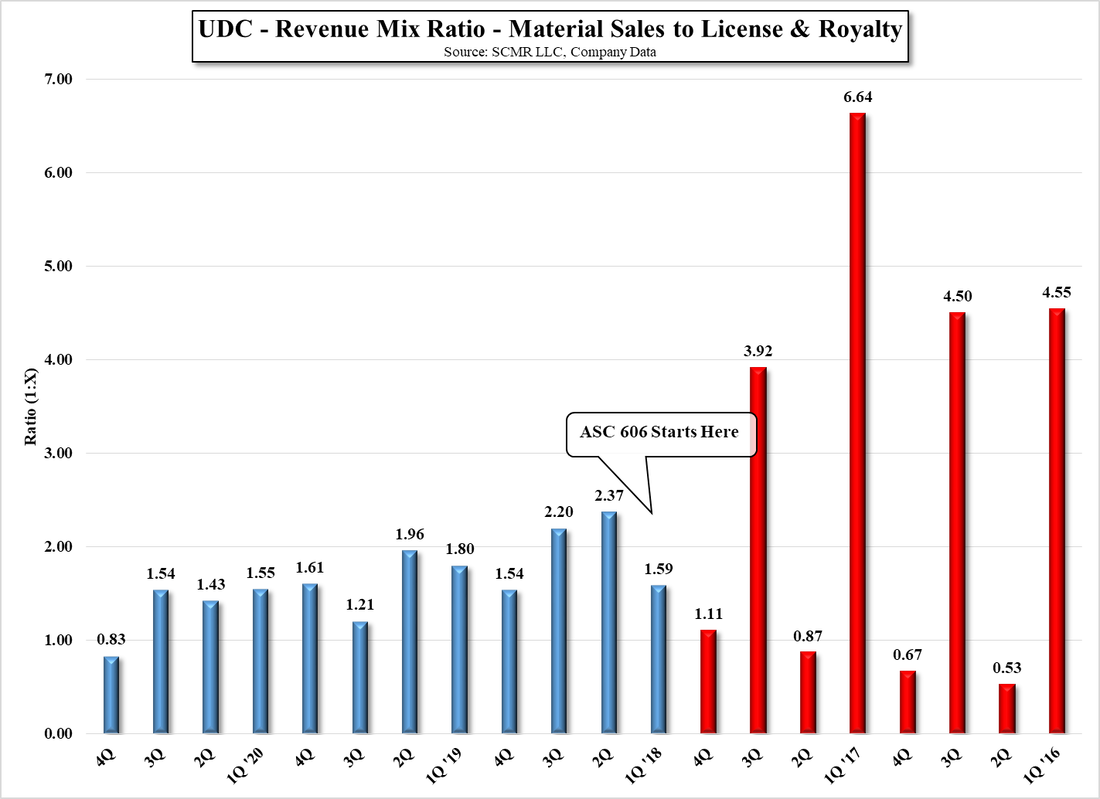

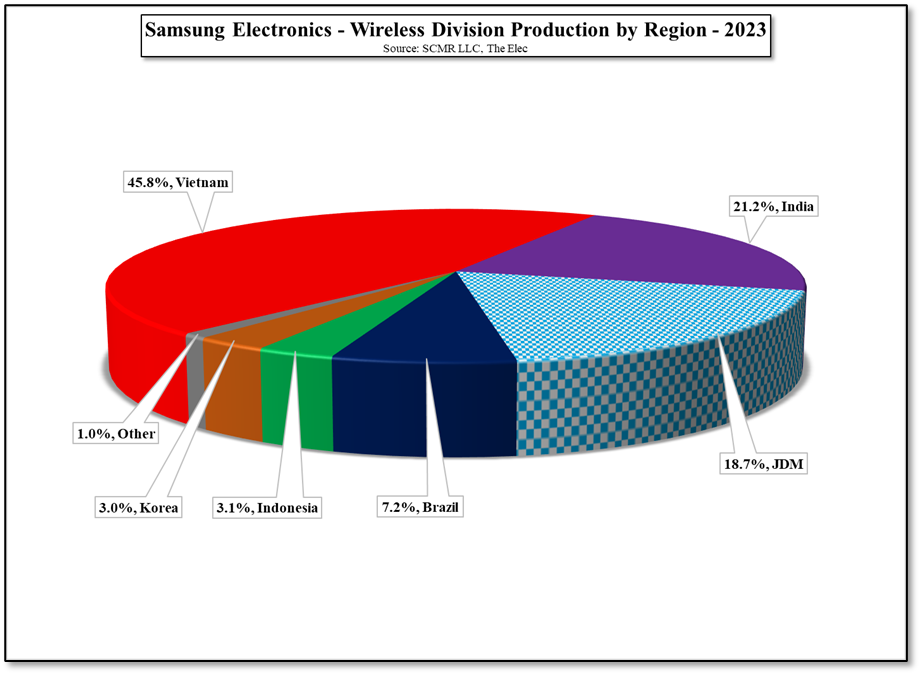

Both LG Display and Samsung Display are in the midst of that major decision making process, with both finding the current macro environment making those decisions harder and less likely to be made as originally expected. SDC has been working toward the expansion of its OLED production capacity to facilitate a push to bring OLED technology further into the IT space, meaning monitors, notebooks, and tablets. SDC is already producing relatively small numbers of such IT displays which have made it into mainstream products, but this production has been done on existing Gen 6 SDC infrastructure, which is more oriented toward small panel (smartphone) production. While the glass substrate upon which mobile devices (smartphones) are produced are almost 30 ft2 and can contain almost 300 devices on a single sheet, the chambers used for the deposition of OLED materials are unable to process such sheets, forcing the substrate to be cut in half or quarters to be processed. This slows production and makes it less efficient, so SDC and other OLED producers have been working toward moving their RGB OLED display production to Gen 8 lines, which use substrates that are over 2x larger, there are problems associated with such large substrates, along with the deposition chamber size issue mentioned earlier. As we have noted previously, Samsung is working with partners to develop a deposition system that can process an entire Gen 8 substrate without cutting, which would have a significant impact on efficiency and therefore cost, but the decision as to whether to build out capacity based on a tool that has not been used for mass production is a serious one, along with the cost of such a tool, which we would expect to be $200m to $300m, and the other equipment and fitting needed.

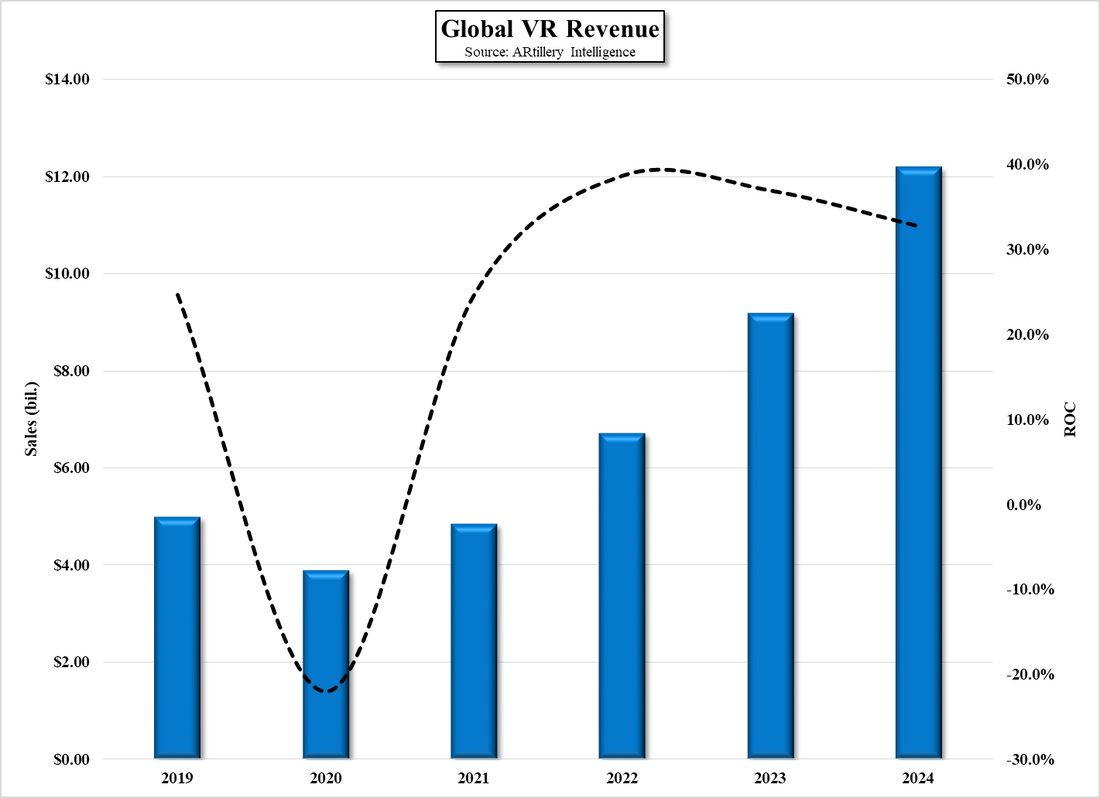

Samsung Display is also evaluating the timeline for the expansion of its QD/OLED production capabilities, which are currently limited to a 30,000 sheet/month line. The expansion of that capacity would likely cost less than $1b, given it would be done in an existing SDC site that is currently not in operation, but again, it would include substantial depreciation, capital expense, and likely weigh on profitability for some time after it begins operation. At the same time, LG Display is evaluating when it might order equipment for a potential OLEDos (OLED on Silicon) production line that would be used to produce AR/VR high resolution displays, with a timeline that must coincide with Apple’s plans for a 2nd generation AR/VR device (Sony (SNE) is expected to produce the displays for the 1st generation device). Such a decision, particularly the equipment ordering, was expected last quarter but was postponed and could be pushed forward again.

These decisions are all being hampered by the state of the global economy, particularly the fear of a global recession in 2023, and the prospects for continuing Chinese COVID-19 lockdowns adding to the negativity. As these are major capital and strategic decisions, it is understandable that managements want as much time as possible to see how the macro economy develops, and with the holiday season on the horizon, how consumers participate this year. Other factors, like the war in Ukraine and the semiconductor trade issues with China add to a witch’s brew that seems to have put the display space and much of the CE space on hold until next year, with little excitement over delving into new technologies or capacity risk taking.

All of this is understandable, especially to those that cannot count on governmental subsidies to fund new projects or support extended payback periods, but at the same time the rapid change in demand that occurred when COVID became a global issue made it apparent that the JIT global supply chain was far less flexible than most had thought and without the capacity expansion and technology risk taking that seems to have gone by the wayside currently, the CE space will face another cycle of rapid price increases or shortages whenever the demand gap is suddenly filled by some global event. In the past companies like Samsung and LG took big risks in the display space and in most cases reaped significant rewards, but we fear that the recent CE down cycle might have tempered some of the bravado that is necessary to lead an industry. Hopefully the fear will pass quickly.

RSS Feed

RSS Feed