Fun with Data – Where are Those Smartphones Made?

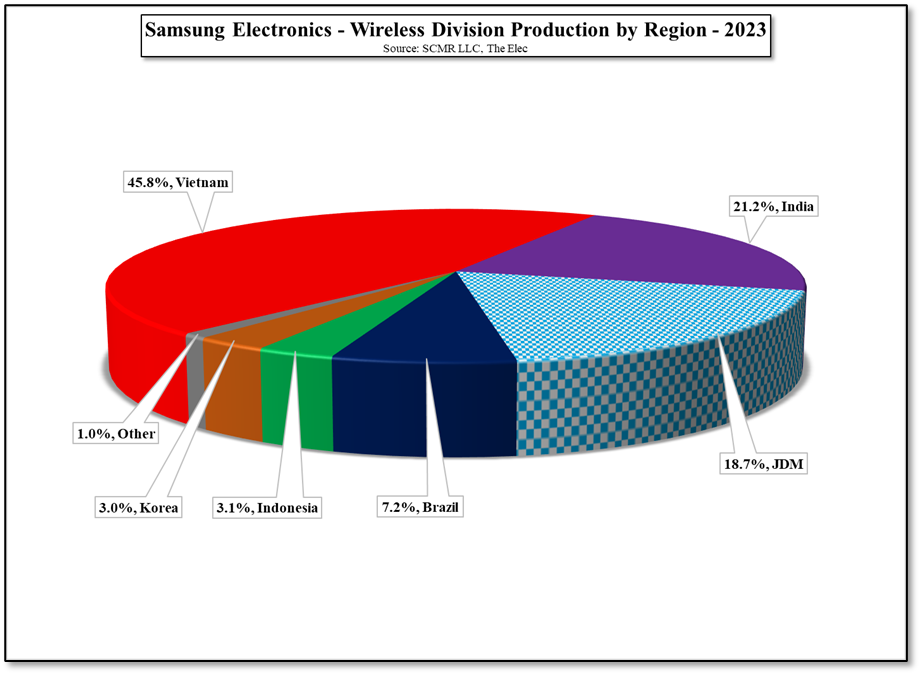

At the same time Samsung still produces the majority of its phones through its own facilities around the globe, utilizing lower-cost labor for the manually intensive assembly process. Given the high cost of labor in South Korea, Samsung does little assembly work in its home country, with the majority of phone assembly going to factories it owns in Vietnam, but this year Vietnam has been plagued with COVID lockdowns and rapidly rising labor costs, up 6% this year after a one year freeze in 2021, so Samsung is reducing Vietnam’s share of total production from 50% to 60% this year to 45.8% next year, with much of the shift going to India and Indonesia, two regions where Samsung has aggressive long-term production plans.

Of course, in terms of actual production, much will depend on whether Samsung is able to reach its mobile phone production target for next year, which is 320m units, as it will likely fall short of its original 310m target for this year by ~10%, but the rise in JDM share will remain on the increase to contain costs. There is however some downside to the JDM program, the loss of leverage for Samsung itself with suppliers. As the JDM is responsible for choosing suppliers and purchases parts directly, Samsung will lose a bit more of the buying power it has with suppliers, and that could result in higher costs, so there is a difficult evaluation that has to be made if the JDM program is to continue to grow, and the difficult task of determining whether the cost of components is going up because of macro trends or due to a loss of leverage, will have to be made by the company, a complex task at best. It seems the world learned much about the global supply chain over the last year, but it is infinitely more complex than most people think, with billions of dollars at stake with each new factory or supplier relationship

RSS Feed

RSS Feed