November Taiwan Panel Data – “Hangover Year”

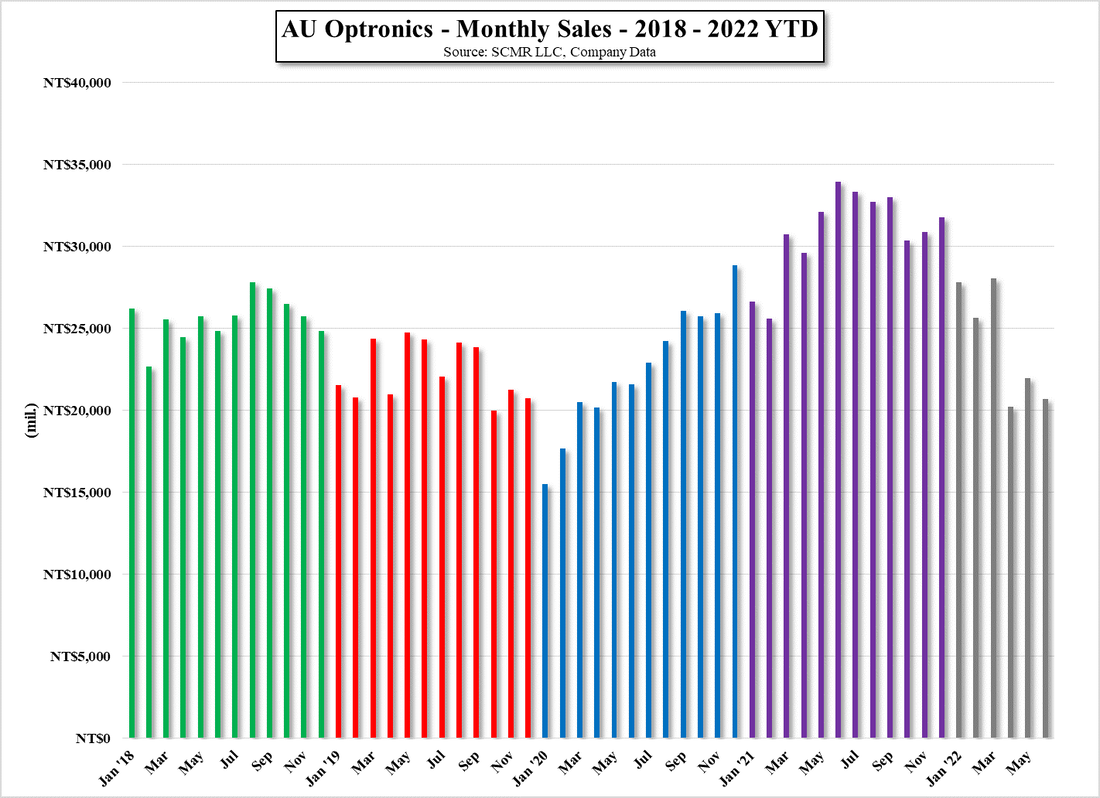

AU Optronics reported November sales of NT$17.48b ($571.04m US), up 1/7% m/m and down 43.4% y/y, as a typical (5 yr. avg.) November has been up 1.2%, November m/m results are slightly better than average. AU Optronics reported area shipments of 1.5m m2, up 17.3% m/m but down 30.2% y/y, which implies an ASP/m2 of NT$11,650, which is down 13.1% m/m and down 18.9% y/y. Based on the November report, AUO saw improved utilization but lower panel prices, netting out to a slight improvement in overall sales. December for AUO is typically up 0.4% m/m.

Innolux reported November panel sales of NT$16.182b ($528.63m US), up 3.7% m/m and down 39.1% y/y. With a typical (5 yr. avg.) November being down 3.8%, Innolux saw a stronger than expected improvement in sales during the month. Innolux also reported large panel shipments of 9.17m units, up 4.6% m/m but down 22.8% y/y, and 19.75m small panel units, down 9.9% m/m and down 29.3% y/y. December is typically up 1.5% m/m for Innolux.

November panel sales for both AUO and Innolux were better than we expected given the relatively poor results we have seen from CE retailers, albeit mostly anecdotal, bringing the 4th quarter YTD (2 months) results up 3.6% q/q for AUO and up 2.4% q/q for Innolux, but if we assume a flat December for AUO, 2022 will show the worst yearly performance since 2005 which puts the year in better perspective. Results from other panel producers will likely be less onerous using the same long-term perspective, particularly Chinese LCD panel producers, as they have ben adding capacity over the last few years while Taiwan producers have not, but we expect that on a static capacity basis most panel producers’ full year results would look the same. We look at 2022 in the LCD panel business as the ‘hangover year’, after the parties in 2020 and 2021, and expect 2023 to be a bit less frenetic but still needing Tylenol™ and electrolytes to make it through the year.

RSS Feed

RSS Feed