(More) Fun With Data – China Smartphone Shipments - September – Better…

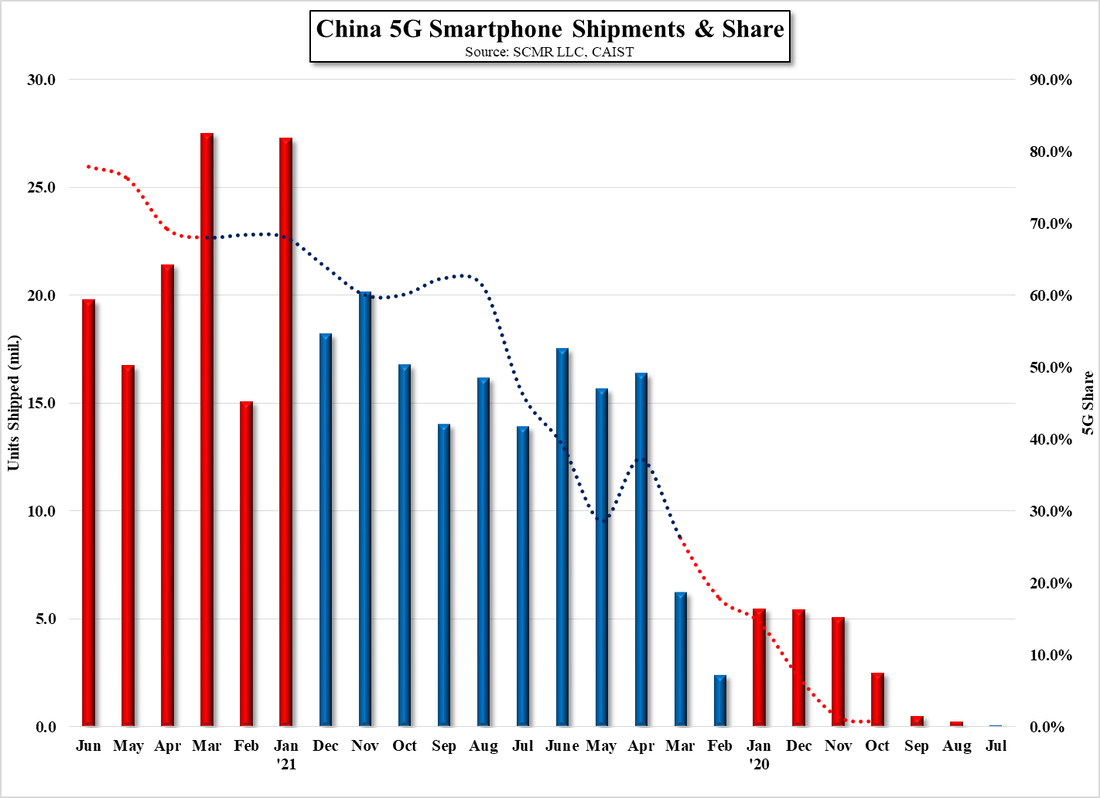

5G shipments were 15.104m units, up 5.9% m/m and essentially flat y/y, while representing 72.2% of all phones shipped on the Mainland in September, a bit lower than in past months this year. It is difficult to attribute the lower 5G share to a singular factor, but we would expect the overall macro situation might attract consumers to lower tier phones, where 5G is less penetrated. We would become concerned if the 5G share fell below 70% for more than a month or so, but our expectation is for a range between 70% and 80% for 2023, and our overall expectations for full year smartphone shipments in China remains at 252m units.

RSS Feed

RSS Feed