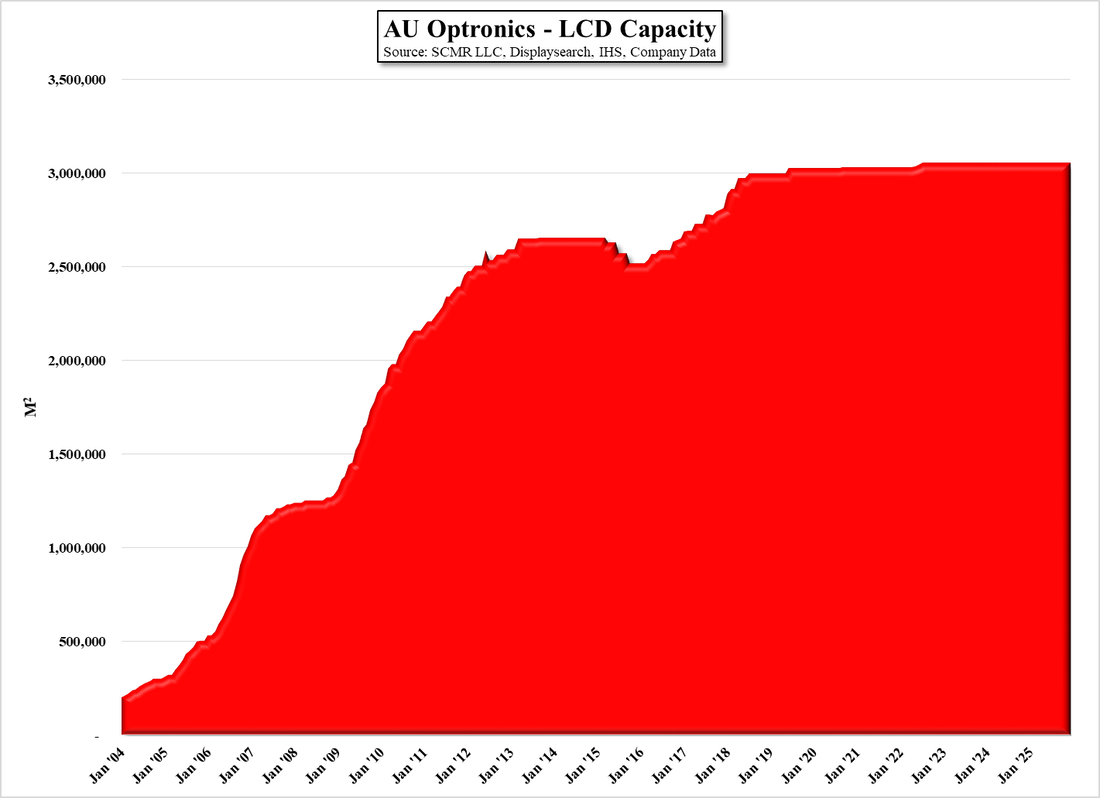

AU Optronics to Add LCD Capacity

While these numbers are assuming panel prices stay at current levels, any further increase in IT panel prices would enhance the improvement, so the risk to AUO, as with all other panel capacity expansions, is when utilization starts to fall, which is usually accompanied by falling panel prices. Such a double whammy is the bane of panel producers, which is why AUO has almost always taken a more conservative stance toward panel capacity increases, focusing more on improving mix by adding more premium products. While cyclicality in the industry don’t always allow even this conservative philosophy to produce profits, it is the inverse of China’s panel producers’ philosophy, which is more focused on building share by rapidly increasing capacity.

Right now, given the high utilization rates and panel price increases seen over the last year, the Chinese philosophy wins out, but there is certainly something to be said for a more conservative approach to expansion and a greater focus on profitability. Last month the AUO board approved capex of NT$455m (~$16m US) for “factory and capacity optimization and adjustments.” Company management did note that they expected the shortage of key components to worsen in 2Q, as compared to 4Q ’20 and 1Q ’21, citing glass substrates, PCBs, and polarizers more specifically, along with ‘persistent’ IC supply issues, with component and material lead times extending to roughly eight weeks from a pre-pandemic four weeks.

RSS Feed

RSS Feed