August Panel Pricing – A Bit Better…

We expect that the utilization reductions have tightened the panel market to a degree, and panel producers are a bit more picky about the profitability of projects that they take on for customers as they have less capacity to fill, which pushes us to look at least a bit more favorably at pricing in September, and while we still expect the aggregate large panel price to decline between 2.9% and 3.5%, the momentum to the downside has lessened. The question to us is whether there is a seasonal improvement to demand driving the ‘improvement’ or is this more of a drive by panel producers to avoid unprofitable jobs that they might have taken on in the past in order to maintain a good relationship with large customers. We expect the power issues in China might also have a bit of psychological impact on buyers who still need to meet quotas, albeit lower ones, and are willing to negotiate a bit more to ensure volumes are met, but we expect things will cool down in China by the end of the month and buyers will remain in the driver’s seat.

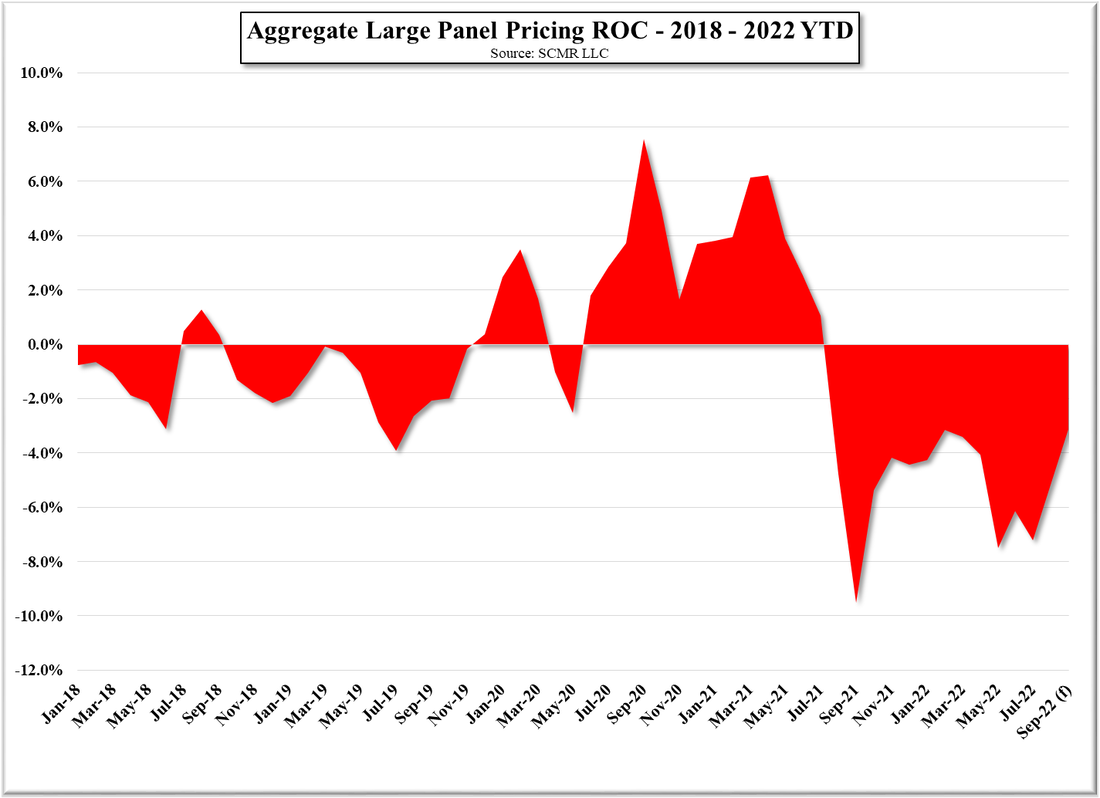

One metric we watch, which can be seen in Figure 7, is the m/m rate of change, and while still negative the ROC has begun to improve, a sign that at least some pricing pressure is being alleviated. That said, if we look at Figure 8, it can be seen that pre-COVID, the m/m rate of change was considerably smaller than what has been seen since late 2019, and while the direction has certainly improved, stability is what we look for to establish a basis for a sustained recovery. We expect such stability will not come during periods of low utilization and will take some time even after utilization rates return to more normalized levels as those changes will destabilize panel pricing for a short period until a more realistic balance between brands and panel producers is achieved. While we are not want to give timelines for the industry, we would expect the first point at which a stable balance between both sides of the equation could occur would be late 1Q or early 2Q 2023. Lots of things would still have to fall in place to achieve that timeline, but we see that as the first point at which it could occur.

RSS Feed

RSS Feed