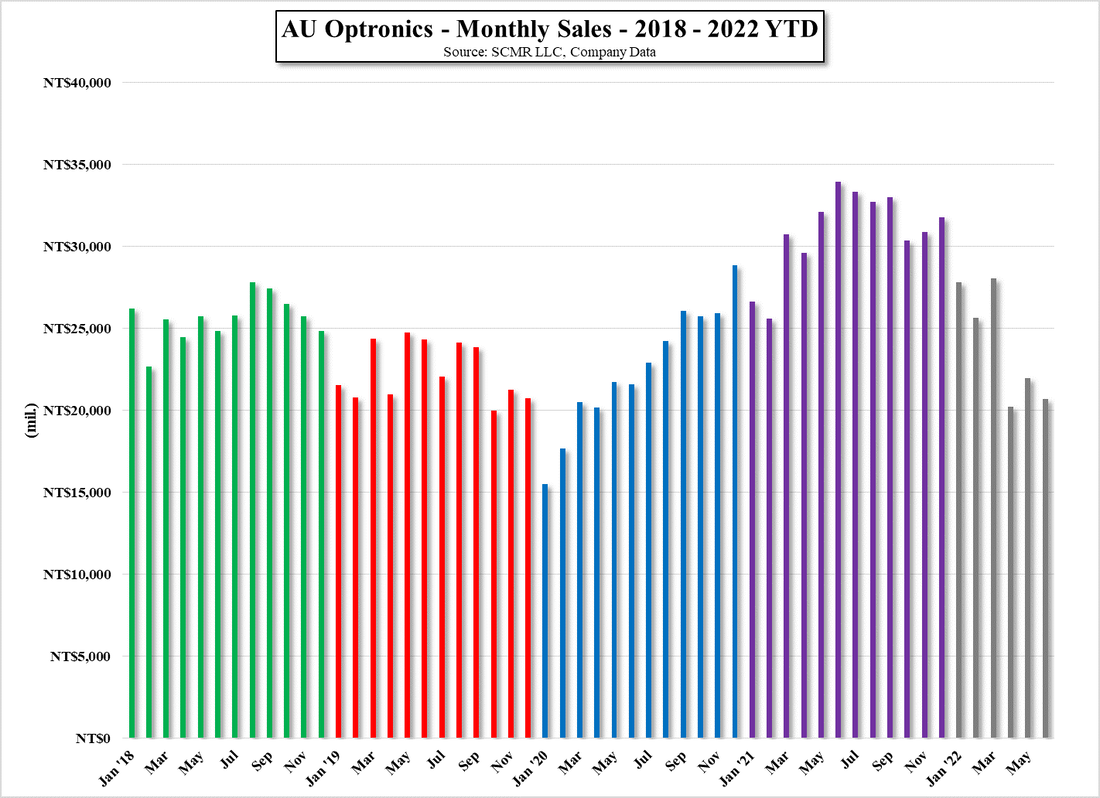

AUO in June – Hints of What’s to Come

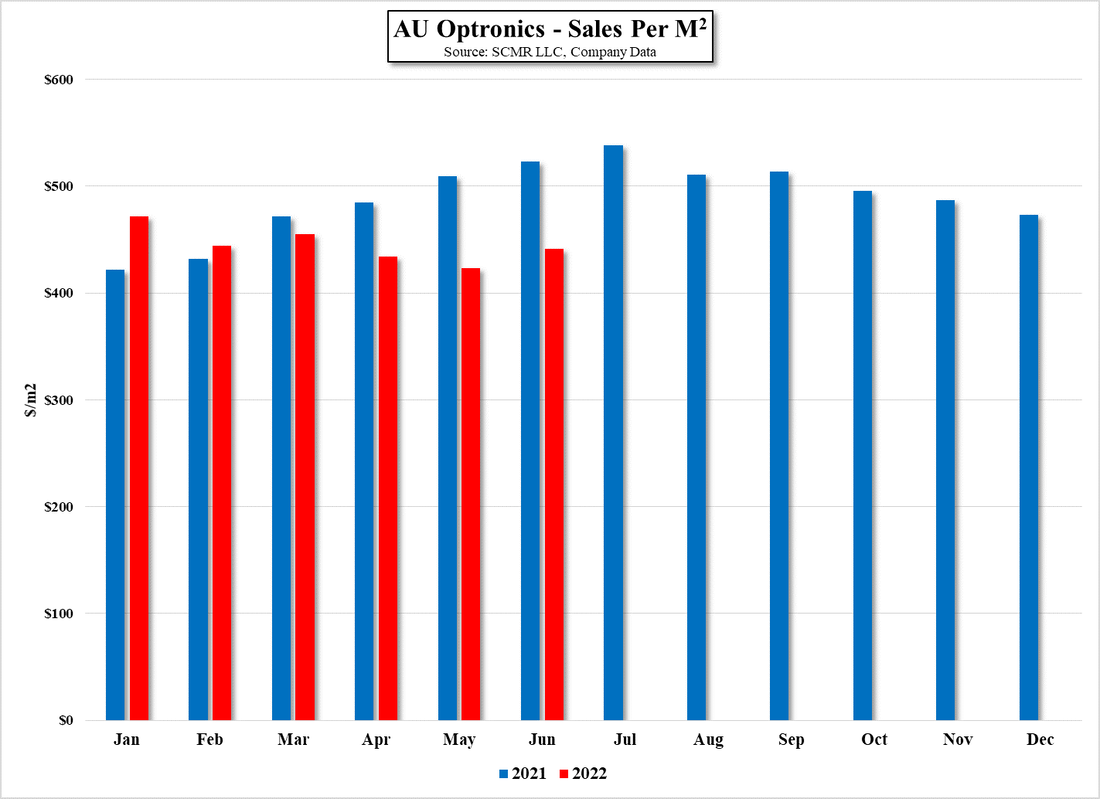

While we wait for Innolux (3481.TT) and Hannstar (6116.TT) to report June sales and shipments to complete the Taiwan panel producer data, we expect July results for most panel producers will see further declines, more weighted toward order reductions than price declines, giving a messy start to 3Q. With Samsung Electronics (005930.KS) reducing or eliminating TV panel orders from suppliers to reduce inventory, as we have previously noted, it will be difficult for panel producers to maintain production at earlier levels, unless they are willing to offer larger discounts than in previous months, which will amplify panel price declines. Our hope is that the order cuts will be enough to reduce inventory to more normal levels by mid-August, and that the panel price declines that have been evident for part of last year and the 1st half of 2022 will slow to more ‘normal’ levels as we enter September. Brand targets have been reduced but consumers have yet to jump at discounts thus far, and the macro environment leaves a bit to be desired, so again we look at such prospects as possible but less probable than an extension of the current CE malaise into 4Q. As of yet there are few signs pointing toward a better than expected outcome, but we keep looking.

RSS Feed

RSS Feed