Big Dipper

2024 models have been in circulation in the US for 441 days, about a year and a quarter, while the 2025 models have been available for less than 2 months. OLED models are similar with 2024 models available in the US for 404 days and the OLED models for only 40 days. That said, Samsung’s 2024 Mini-LED/QD TV set line saw the largest declines, with prices of some models declining more than 30% over the last two weeks, however we note that many of those sets seeing steep declines over the last two weeks are not even at their lowest point for this year, having seen a large price increase between the middle of April and early May. We make the assumption, although unconfirmed, that Samsung had assumed that some tariffs might be assigned to these sets and raised prices to compensate (in advance), but then found that there would be no additional tariffs and lowered prices back to a more normal level. Either that ot Samsung’s inventory levels for these models was excessive and now needs a bit of stimulus to move volume.

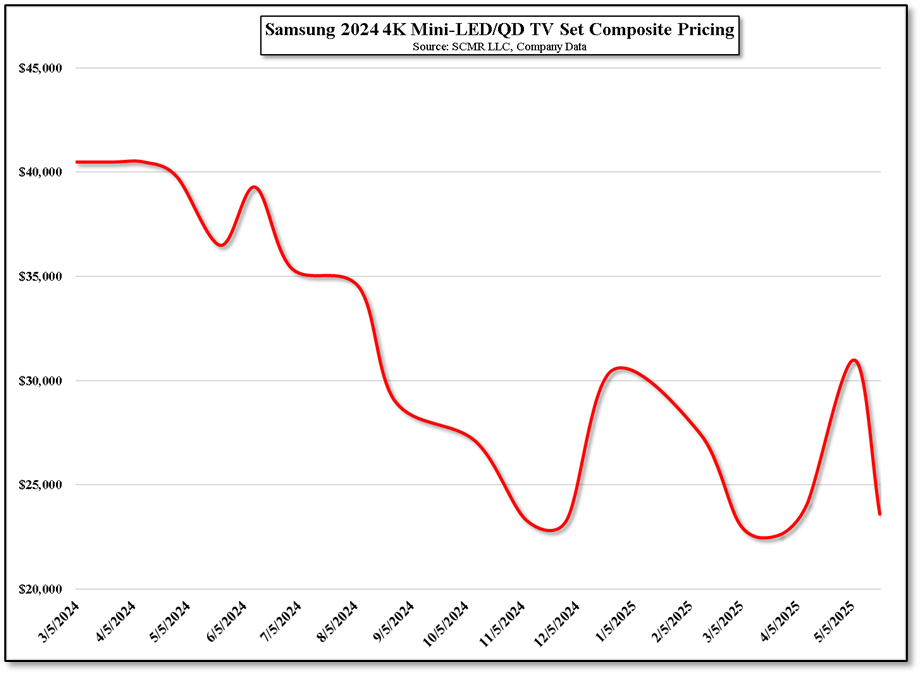

Whatever the reason, the chart below shows how aggressive, both to the upside and to the downside, Samsung has been with it’s 4K Mini-LED/QD line pricing during this year. The two peaks and dips represent changes of ~30% from top to bottom. We note also that the last two weeks are the first time Samsung has begun to lower prices on 2025 models. We expect that after the holidays those models that have seen discounts recently will find their way back up to those initial price points until either the tariff rules change again, or inventories are high enough that Saamsung feels compelled to move levels lower a bit.

Wee don’t envy those that must set TV set pricing given the tariff volatility and the current fear of a self-generated recession, especially given the inventory pull-ins that have been a part of the CE space this year. While we expect there will be more sabre rattling from the WH, we expect the show of power that was exhibited has now transitioned to actually trying to get some sort of agreements signed that will show that Trump’s tariffs were a success. As we have noted previously, the agreements are tenuous at best and are mostly for show because when it gets down to consumers, they don’t care if China says they will buy 10% more soybeans, unless it means that the price of soybeans will be less at the supermarket. CE products are no different.

RSS Feed

RSS Feed