Big is Not Always Better – OLED gets small

As noted, bigger OLED sets are certainly available, but unless you were looking for some sort of specialty product, 55” and up was your venue, so why would LG come out with a smaller OLED TV set and why would anyone want one? Last year LG Electronics (066570.KS) announced a 48” OLED TV and has been rumored to be releasing a 42” OLED TV panel in the near future, and as it turns out, the 48” OLED TV has proved far more popular than most thought. So what prompted LG to go in this opposite direction? There were two reasons.

First was gaming. Gaming is visual and as the space picked up legitimacy over the last few years, gamers were willing to pay up for a better visual experience. In the past gamers were limited to monitors, while TVs with lower resolution and slower response times were less of an option even though they came in larger sizes. But as TV specs improved gamers saw the larger sizes as a way to enhance their ability to see both detail and a more realistic view, and began adopting TVs as a gaming platform. Since such could also be used for watching regular TV or streaming, the cost was justifiable spread across a wider base.

OLED TVs are known for their high contrast, making dark areas where opponents might be hiding a bit more defined, and high response time reduces the blur or trails that might follow a fast moving object, so the gaming elite began to choose OLED TVs as the perfect monitor replacement. However the fact is that OLED TVs are more expensive than regular LCD TVs and 55” LCD TVs are just a bit too large for a gamer to sit close to, without sustaining neck injury from constantly twisting from left to right. The 48” OLED TV released by LG was the ‘Goldilocks’ solution, not too large and not too small, and in theory a bit less expensive than a larger set, making it an ideal choice for those gamers who wanted the best possible experience, without a specialized (and very expensive) custom solution.

But there was another reason for 48” OLED TVs, and one that had less to do with demand and more to do with supply. Production efficiency is a key to display panel profitability and substrate efficiency, or the ability to utilize the greatest amount of the display substrate, is a large part of that. As LG Display produces its large panel OLED displays on Gen 8.5 platforms employing a 59.2 ft2 sheet, utilizing as much of that substrate is a key to fab efficiency. Unfortunately not every size panel can be efficiently cut from a Gen 8.5 substrate as shown in the table below, and as consumers migrated toward 65” OLED TVs and LGD shifted production toward larger sizes, efficiency declined.

This was not just a problem for LG Display but for all panel producers who found themselves in the same situation with LCD substrate efficiency, but panel producers are a wily lot and came up with a solution called ‘multi-mode’. Instead of producing only one size panel on a sheet of substrate, fab production engineers figured out a way to mix panel sizes on the same sheet of substrate, and while this meant a slower TACT time, it was much more efficient for panels 65” and larger. By using Multi-mode to produce 77” TV panels, panel producers are able to bring the substrate efficiency up from 59% to almost 83% by producing both two 77” panels and two 48” panels on a Gen 8.5 substrate. This gave them the 77” panels that were in increasing demand, but also gave them 48” panels which were a novelty at the time.

While this trend is antithetical to the norm, the desire for larger TVs, it seems LGD has created a price point that is attractive to consumers who want an OLED TV but are somewhat constrained as to budget. As the efficiency of producing a 48” panel on a Gen 8.5 fab is the highest among all sizes 32” and above (actually 49” is slightly higher), it seems that LGD has latched onto a hot product and we expect that 48” OLED TVs, now a difficult size to garner, will become more commonplace over the remainder of this year. This will not only open the base of potential OLED TV buyers but will help LGD to increase the overall number of panels its produces, which while only a ‘numbers’ game, will help to increase OLED TV share, making it a more visible part of the TV set business.

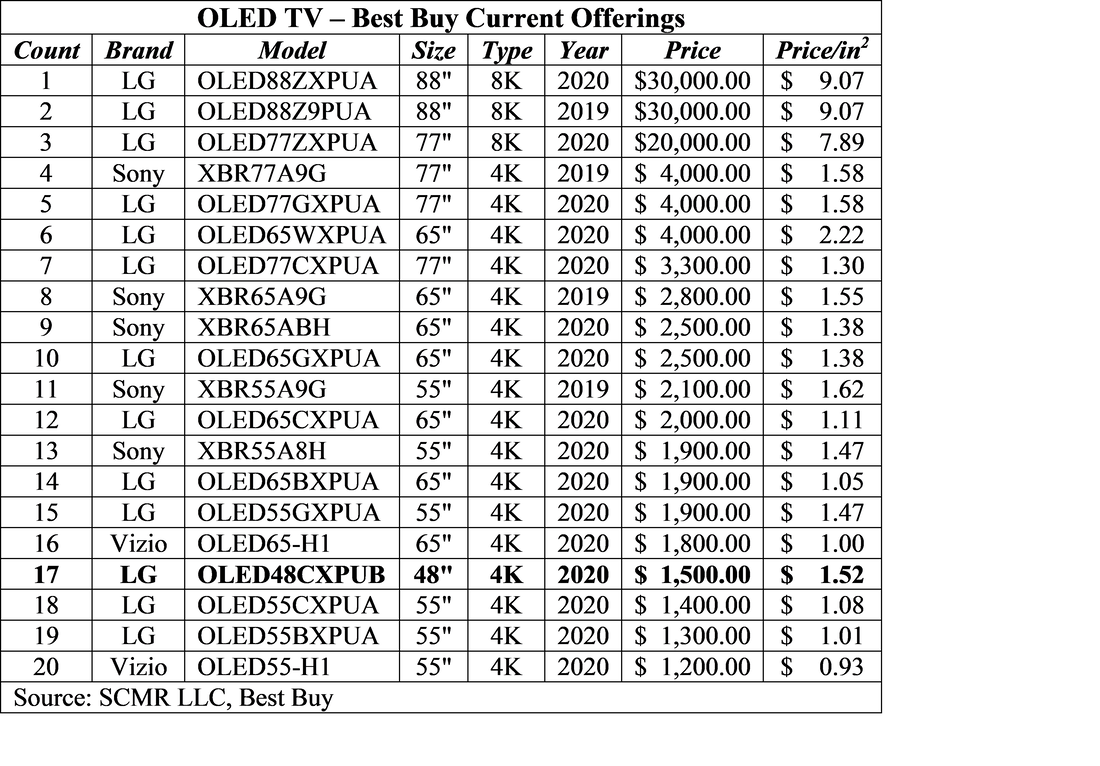

Here’s what is available on Best Buy (BBY) as far as OLED TVs. We note that other sellers will have different brands and prices. We have excluded all models that are either unavailable within 300 miles (1) or are open-box only (2).

RSS Feed

RSS Feed