Biting the Bullet

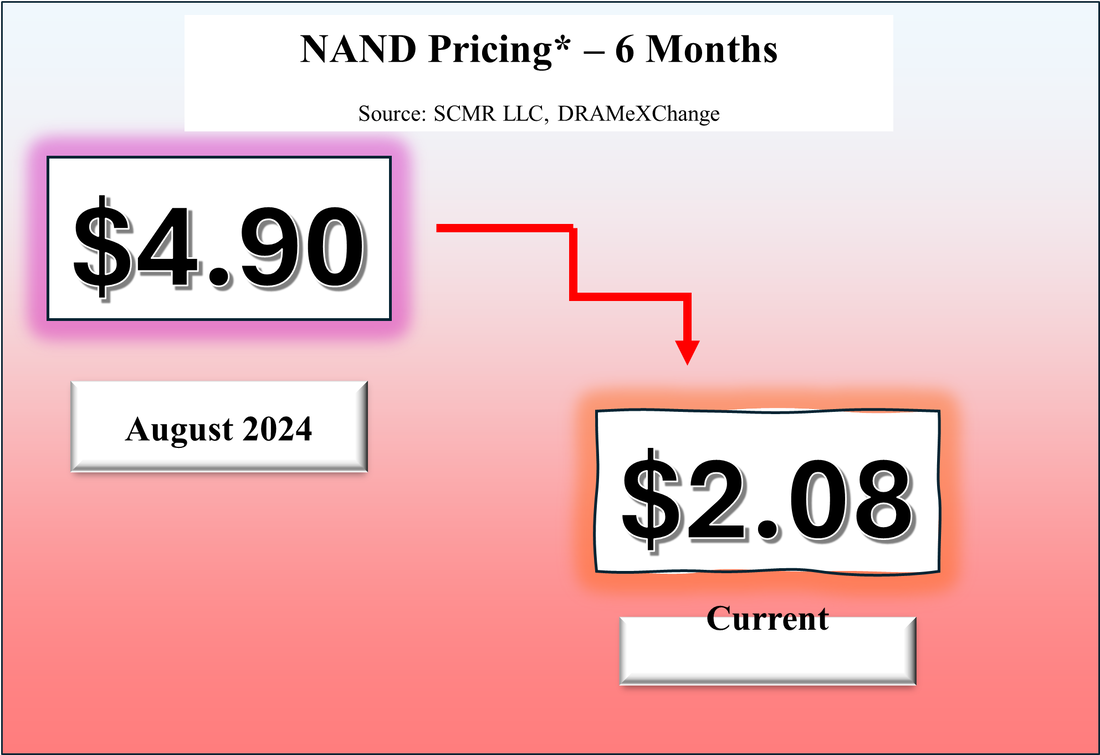

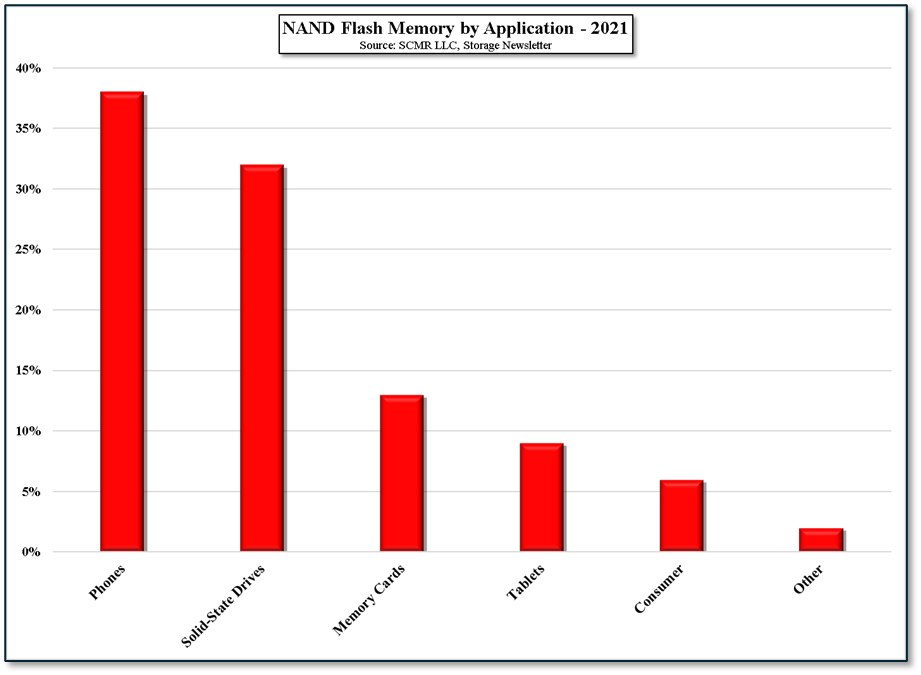

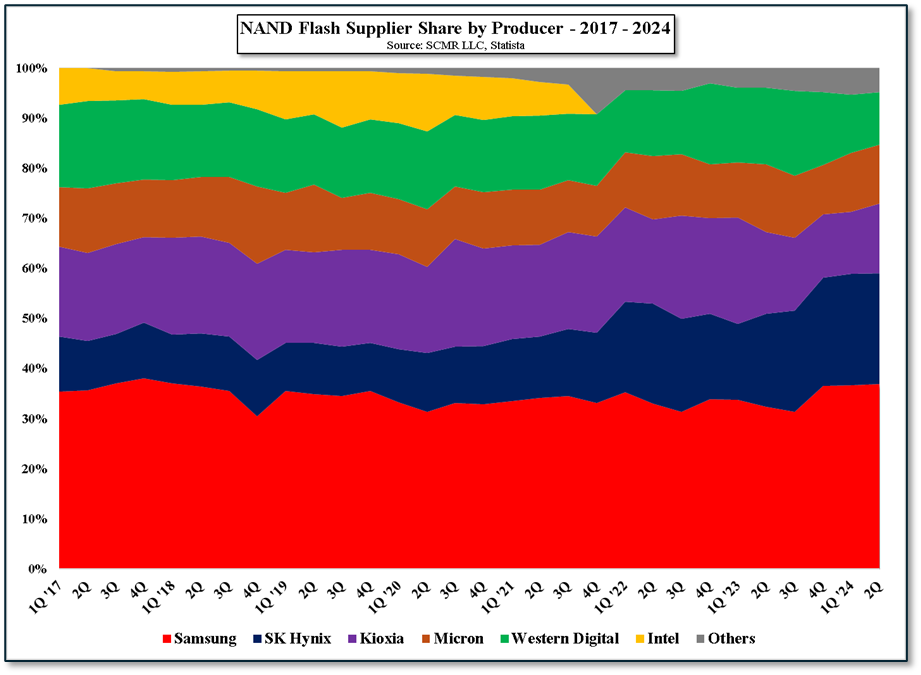

As the leader, Samsung tends to set the tone for the industry, and in March of 2024, a few months after a peak was reached in NAND pricing and inventory had built up to the point where an oversupply situation was obvious, Samsung cut NAND production by almost 50%. Relatively quickly other producers followed and within a short time NAND prices stabilized and began to rise again. Unfortunately, the slowdown in smartphone demand and a somewhat surprising weakening in enterprise SSD demand (given the AI hype) made NAND prices unable to hold early 2024 gains and a second decline began in 2H.

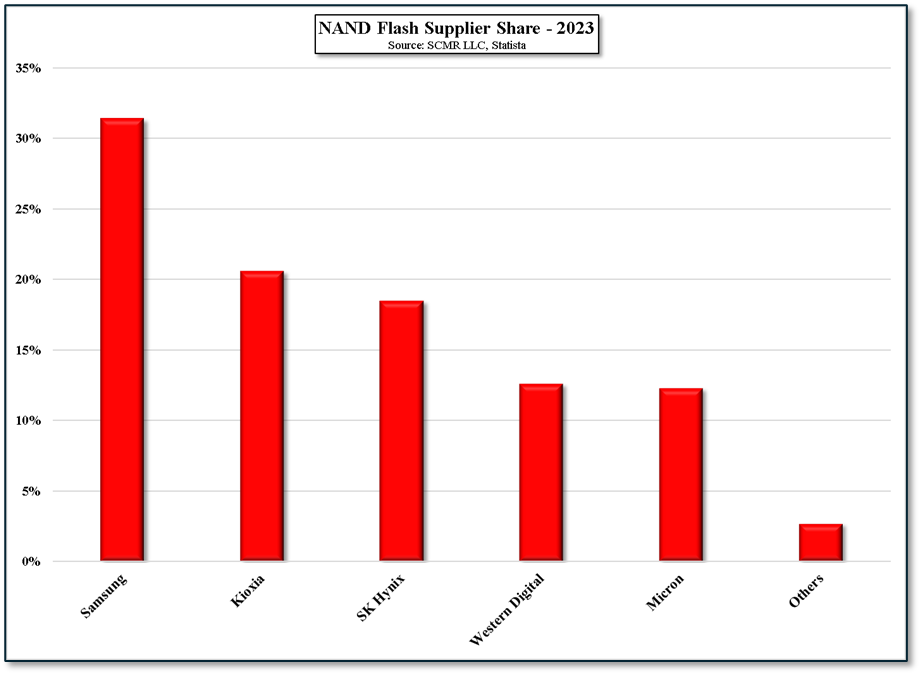

Samsung’s poor results in 4Q were the result of that weakness, and the company has decided to cut production at its fab in Xian, China, its largest NAND production fab, by more than 10%, from 200k wafers/month to 170k, and will also cut NAND production at two lines at its fabs in Hwaseong, South Korea. Typically, one would expect the other NAND flash producers to follow relatively quickly but it seems that Samsung is the first to set the tone of trying to break the downward NAND pricing cycle this year, at least thus far. While it has been a short time since Samsung signaled the NAND production cuts, we expect others to follow, however, given the continuing hype around AI and its positive influence on data center capacity and the need for SSD’s, it might prove more difficult to convince others to participate, particularly Samsung’s biggest rival in the NAND space, SK Hynix ((000660.KS), who has been and continues to add capacity for high-end NAND products.

As the leader, Samsung tends to set the tone for the industry, and in March of 2024, a few months after a peak was reached in NAND pricing and inventory had built up to the point where an oversupply situation was obvious, Samsung cut NAND production by almost 50%. Relatively quickly other producers followed and within a short time NAND prices stabilized and began to rise again. Unfortunately, the slowdown in smartphone demand and a somewhat surprising weakening in enterprise SSD demand (given the AI hype) made NAND prices unable to hold early 2024 gains and a second decline began in 2H.

Samsung’s poor results in 4Q were the result of that weakness, and the company has decided to cut production at its fab in Xian, China, its largest NAND production fab, by more than 10%, from 200k wafers/month to 170k, and will also cut NAND production at two lines at its fabs in Hwaseong, South Korea. Typically, one would expect the other NAND flash producers to follow relatively quickly but it seems that Samsung is the first to set the tone of trying to break the downward NAND pricing cycle this year, at least thus far. While it has been a short time since Samsung signaled the NAND production cuts, we expect others to follow, however, given the continuing hype around AI and its positive influence on data center capacity and the need for SSD’s, it might prove more difficult to convince others to participate, particularly Samsung’s biggest rival in the NAND space, SK Hynix ((000660.KS), who has been and continues to add capacity for high-end NAND products.

RSS Feed

RSS Feed