BOE by The Numbers & More…

BOE has been diversifying in order to maintain profitability through the cycles that are part of the display space, and we have broken out the company’s revenue segments below (Sales are in billions). While product diversity is certainly a goal for BOE, with a 92.2% share of revenue, the display business was certainly the key to the company’s sales and the panel price increases seen in 2020 and 1H 2021 were instrumental in generating the 64.3% display segment growth and substantial increase in gross margins. That said, we were a bit surprised at the size of BOE’s Mini-LED business, which generated $71m last year, which was a bit larger than we had expected. BOE’s top 5 major customers represented 37.8% of sales last year, with the largest of the top 5 representing 9.05% of total sales, with 42.8% of total sales being made in China and 43.8% in other Asian regions, while the company’s top 5 suppliers represented only 17.9% of purchases in 2021.

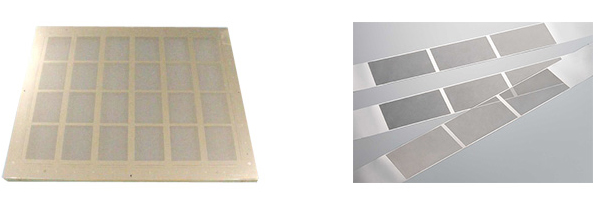

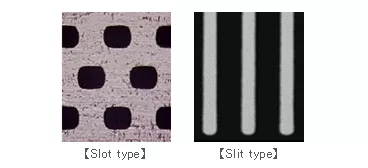

The problem with running Gen 8.5 lines for RGB OLED displays has been the fine metal masks used to pattern OLED materials on the substrate, and while these masks are made of a strong alloy that is resistant to heat, even the smallest sag in what looks like a thin screen will create a defective display. As the masks must be larger for Gen 8.5 lines, they run the risk of sagging and OLED panel producers have been wary of making the move from Gen 6 to Gen 8.5 fabs for RGB OLED displays. In the case of the three producers mentioned, SDC has taken a new approach, devising a vertical OLED deposition unit, taking out the potential for much of the sagging, while LGD and BOE are working with conventional horizontal deposition tools to try to conquer the problem.

RSS Feed

RSS Feed