BOE Notes

- (Suggestion) – BOE should consider buying Visionox. According to the ‘investor’, Visionox’s (002387.CH) major shareholder is looking for an exit strategy and the value of the stock is ~10b yuan ($1.566b US), which would buy Visionox’s three OLED fabs at a price far cheaper than they could be built for today. BOE’s response, “Thank you for the suggestion”. Visionox has been struggling to achieve profitability for years and while they continue to build out the 3rd OLED fab in Hefei, they have been relying on government subsidies to provide operating capital, with net income negative despite increasing sales from fab ramps. While BOE would be paying cents on the dollar and has the production experience to improve overall yield, such an increase in capacity would likely outstrip BOE’s customer demand.

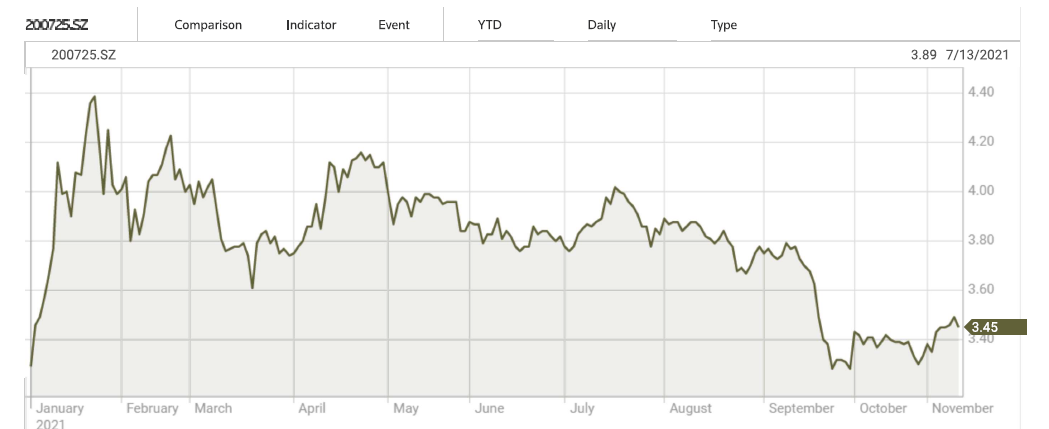

- Status of Repurchase Plan? BOE has been operating a stock repurchase plan under which it has bought 248.6m shares. While this seems like a very substantial amount, it represents 0.645% of the company’s outstanding shares and a purchase value of ~$213m US and seems to have done little for the stock, although the program continues.

- Who is Your Glass supplier for the Vehicle Display Base Project? Last month BOE announced it will spend $390m to build a ‘Vehicle Display Base’ in Chengdu. It seems some investors are confused about what this actually entails as the project is an assembly facility that takes open cell panels (those without backlights) and customizes them according to customer specifications. That would include adding a backlight, frame, and a number of other possible components, so the only glass that might be used in such a situation would be a cover glass.

- What are your capabilities for LTPO? BOE responded that LTPO is in development and would be ‘introduced in a timely manner’ and that all of the company’s flexible OLED lines ‘have conditions to upgrade part of the production capacity to LTPO’. We expect 2023 at the earliest. This question was most likely asked in reference to BOE’s tacit final approval from Apple to be supplying OLED displays for the iPhone 13 and future iPhone series. Some iPhone models are expected to be using TFT systems using LTPO rather than the more typical LTPS backplanes in the future, with the LTPO process being more complex and more costly. We believe only Samsung Display (pvt) is currently able to supply high volume LTPO OLED displays to Apple and will probably be the primary supplier of those models in 2022, with LG Display (LPL) developing MP capabilities for LTPO to a small degree next year and expanding that in 2023.

- It seems the company is behind plan as to flexible OLED shipments. In July and August 11m and 14m units were shipped. How many in September? Surprisingly the company indicated that they had shipped 40m flexible OLED panels by the end of 3Q, which would imply ~15m in September, although they did not confirm the correctness of the July and August figures. We believe they are correct.

RSS Feed

RSS Feed