Buyer Basics

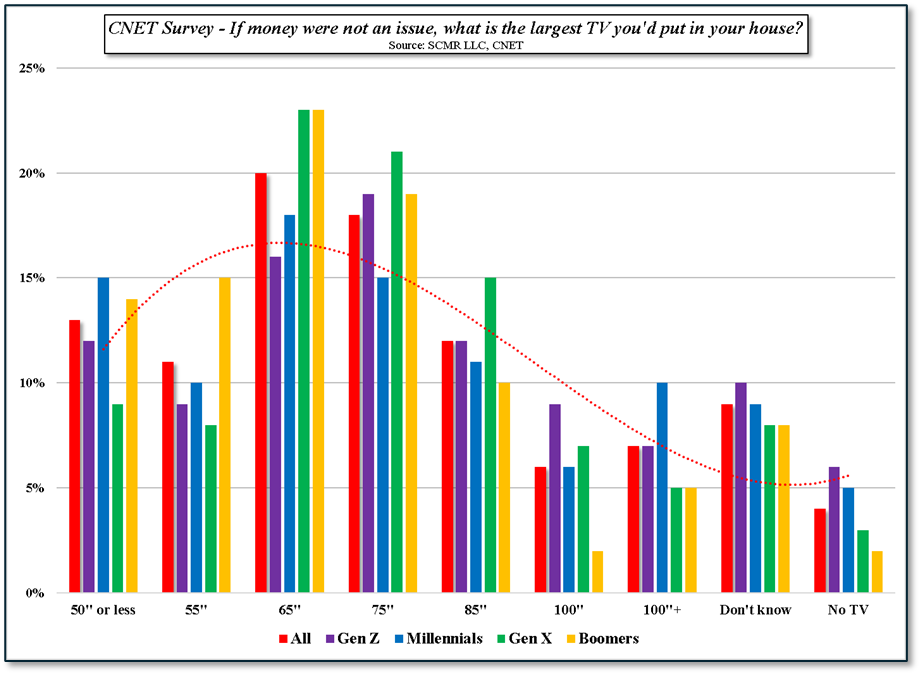

- If money were not an issue, what is the largest TV you’d put in your house?

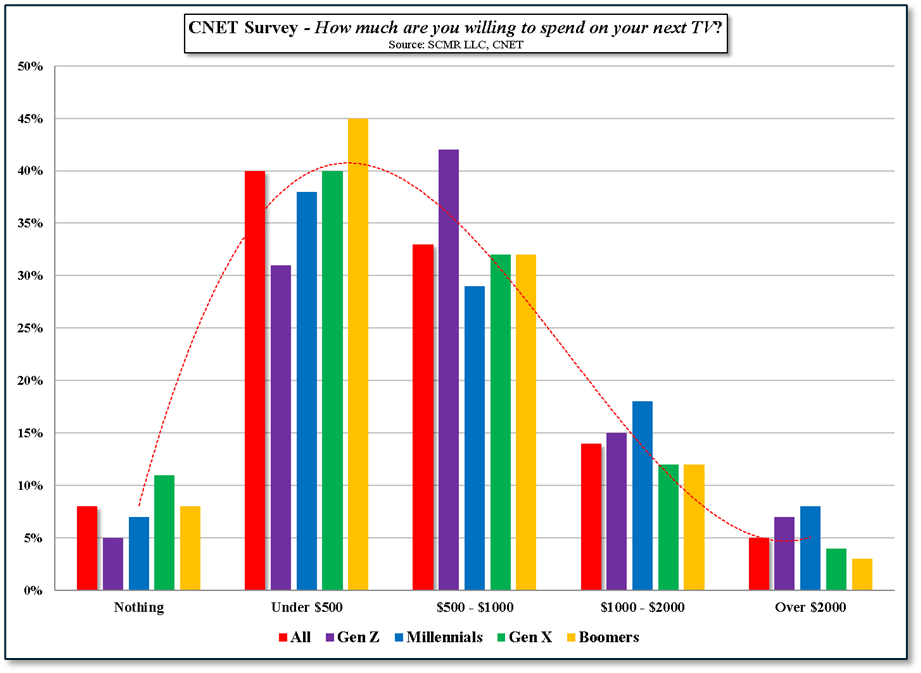

- How much are you willing to spend on your next TV?

The second question, the more valuable of the two in our view, reflected the current spending ‘potential’ of US consumers. 40% of the consumers surveyed indicated that they were only willing to spend under $500 for a new TV, which, in most cases, rules out the ‘premium’ TV category that includes most OLED and Mini-LED/QD TVs, but does include a number of 75” LCD TVs. While the overall share of those who will be willing to spend between $500 and $1,000 drops from 40% to 33%, the combined share of those who will be willing to spend up to $1,000 is 73%, leaving only 19% willing to spend above $1,000 and 8% not will to spend anything on a new TV. Millennials stood out as those most willing to spend over $1,000 (26%), although that was not significantly above the average.

RSS Feed

RSS Feed