Buying Growth

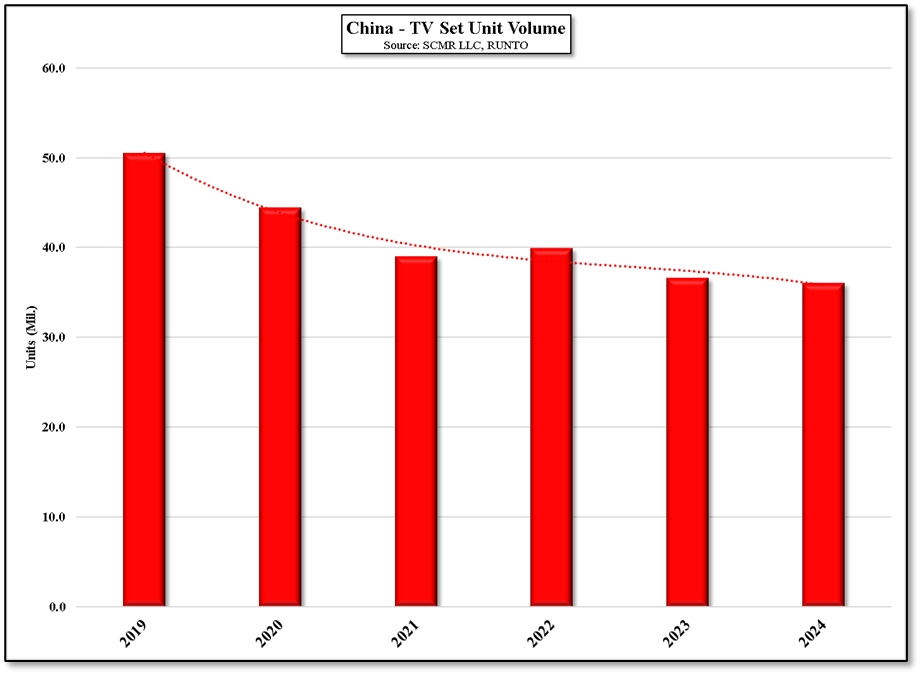

There is little empirical data as to why TV set volumes have been on the decline in China for the last few years but if the Chinese population is moving closer to the attitudes of westernized countries, they have less time to sit in front of a TV as their lives become more complex. However, even more of an influence is the availability of other display types, particularly inexpensive smartphones. US consumers spend 3 hrs. 33 mins. on their phones each day, just a bit below the global average of 3 hrs. 50 mins, and Chinese citizens are getting close at 3 hrs. 19 mins.[1] With less overall time available and a more convenient solution than TV, it is not surprising that TV set volumes have declined as China’s social development matures.

.

[1] https://explodingtopics.com/blog/smartphone-usage-stats

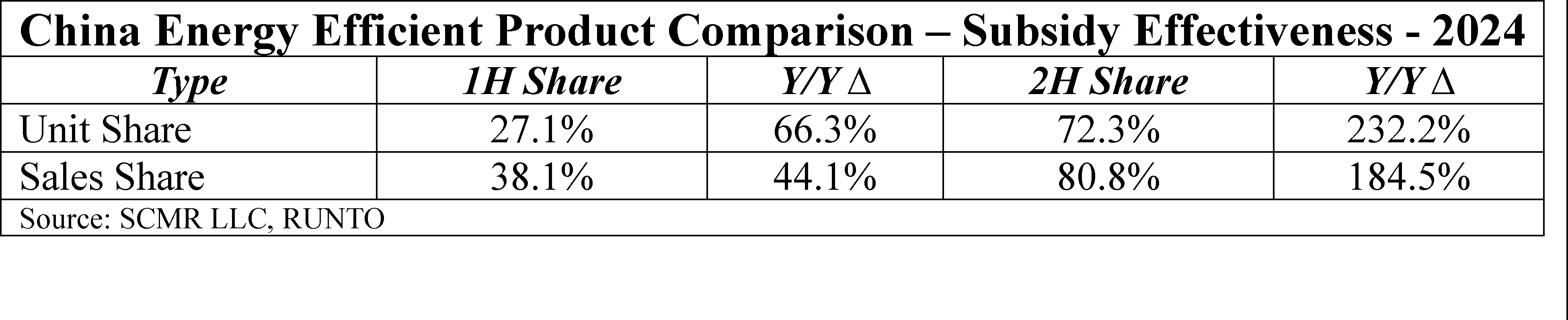

Since TV set energy efficiency was only a small factor in Chinese consumer’s minds before the subsidy became effective, comparing 1H energy efficient TV set volumes (Pre-Subsidy) against 2H energy efficient TV set volumes (Post-Subsidy) gives clues as to how influential the subsidies were. As shown below, energy-efficient TVs (level 1 & 2) represented 27.1% of unit volume and 38.1% of sales, however in 2H, after the subsidies had been put in place (August), energy efficient TVs represented 72.3% of unit volume and 80.8% of sales. To compensate for possible seasonality we show that the y/y increase in units in 1H was 66.3% but was 232.2% in 2H and similarly, sales were up 44.1% y/y in 1H but up 184.5% y/y in 2H.

RSS Feed

RSS Feed