Fun with Data – 5G in 1Q – Digging Deeper

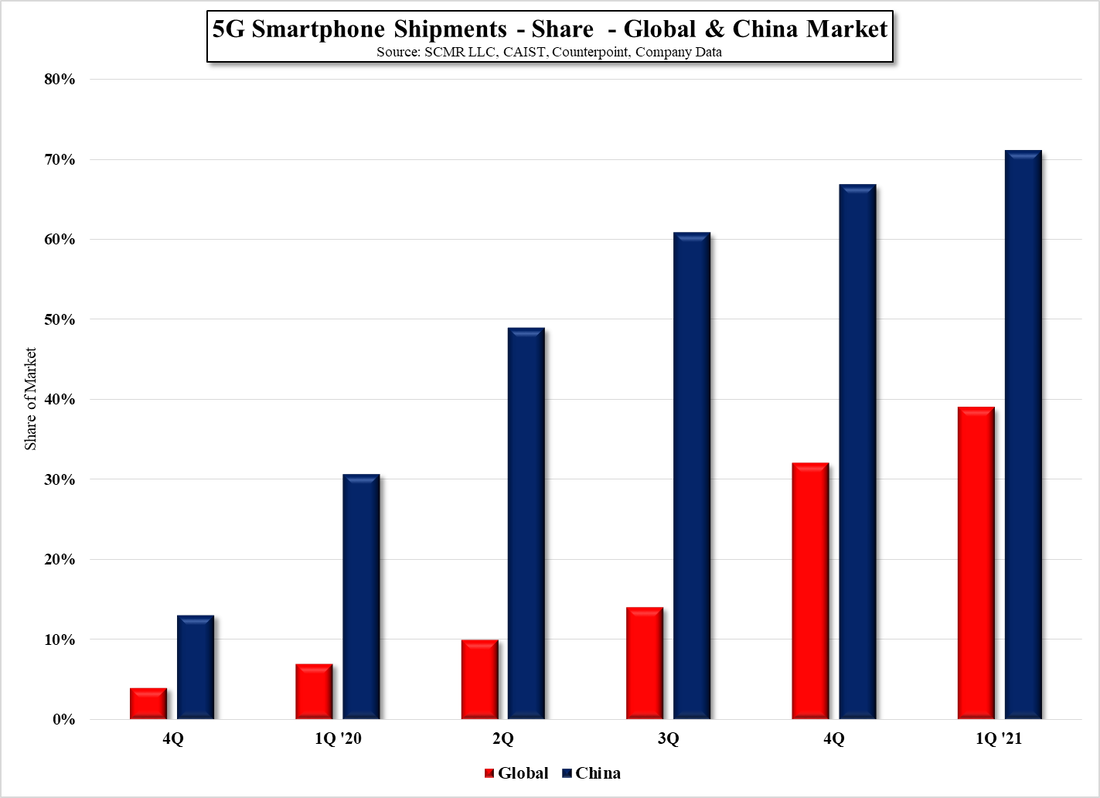

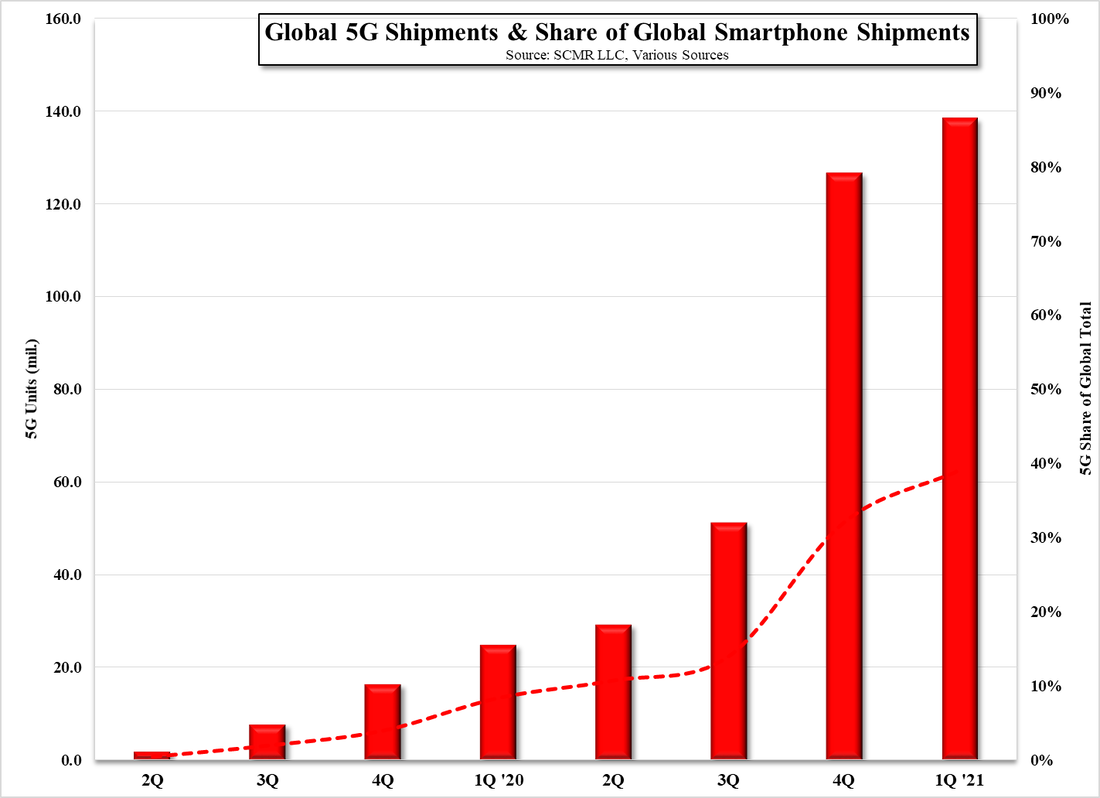

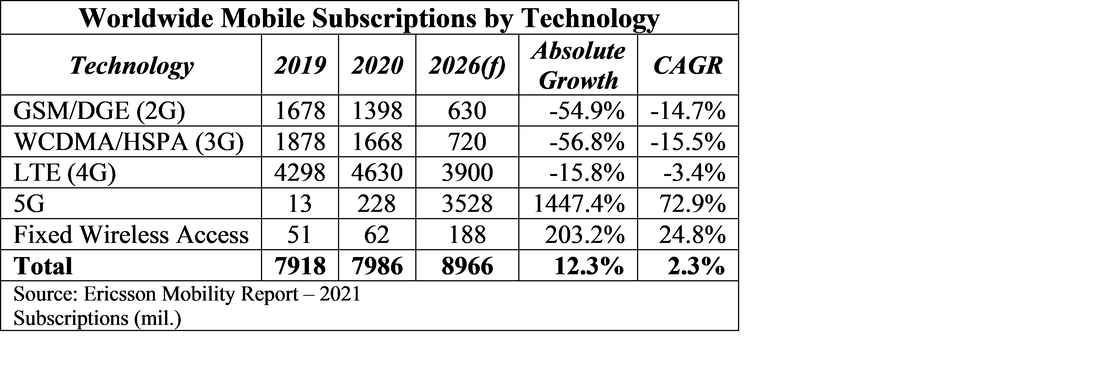

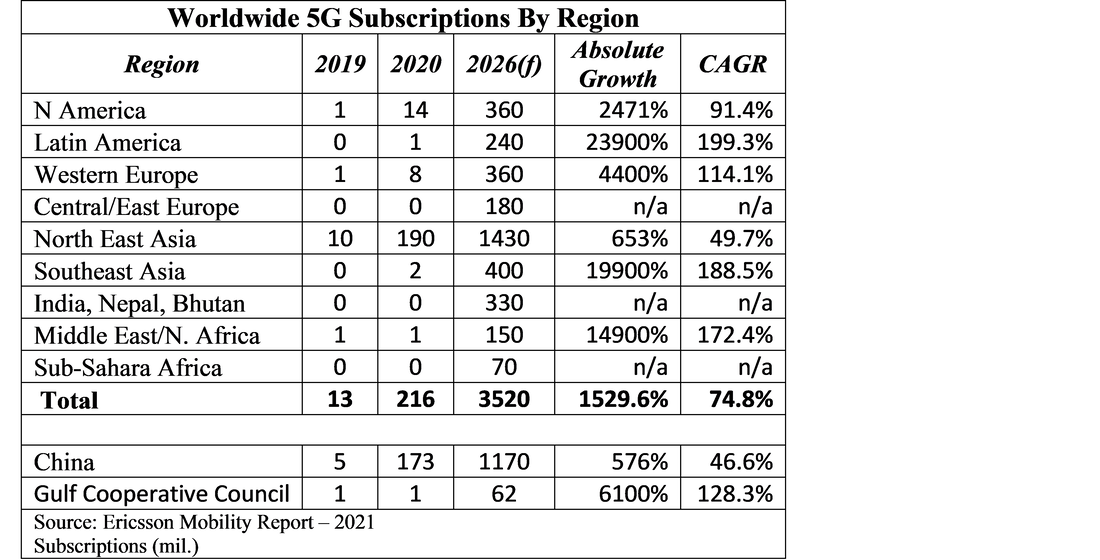

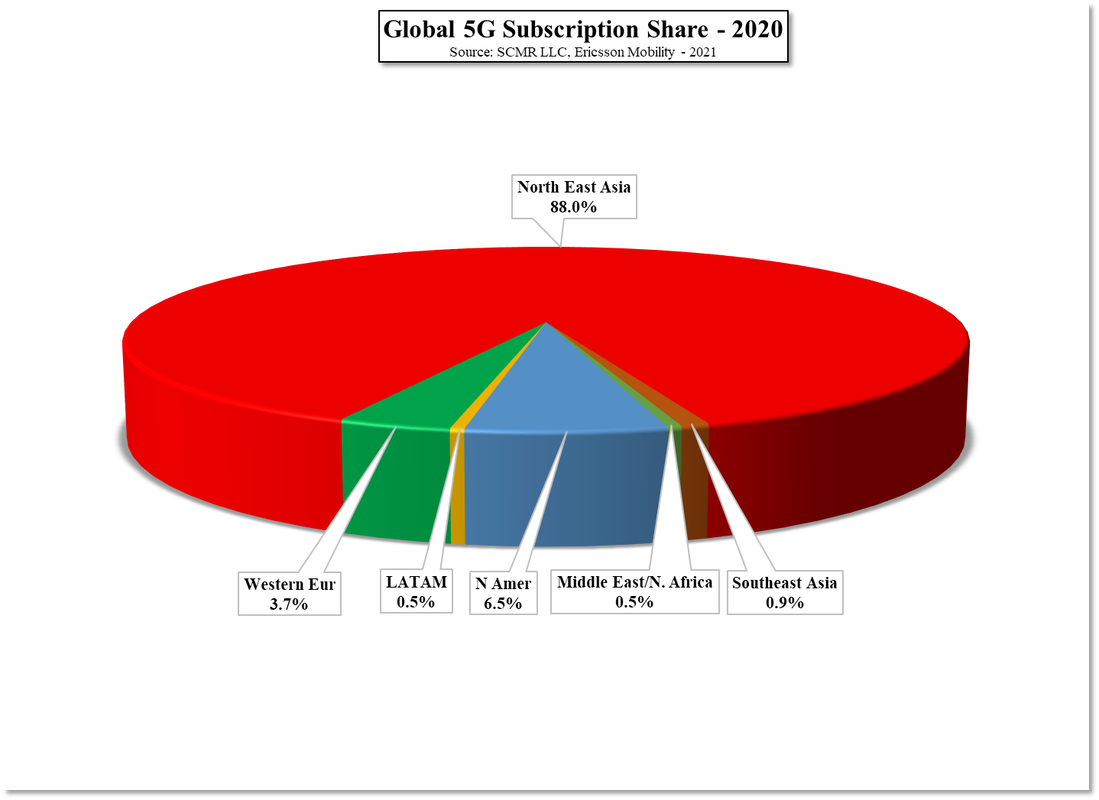

Early data for 2021 suggests that global 5G smartphone shipments represented 39% of total smartphone shipments in 1Q of this year, or ~138m units, and before we go further we note that based on our China shipment data, that 39% is far below the 71% share that 5G represents of China’s total smartphone shipments. That has been the case since the data became meaningful in 4Q 2019. Chinese consumers have embraced 5G far more aggressively that global consumers, likely because China has made a concerted effort to deploy large numbers of 5G base stations across the country, or at least in populated areas, and continues to deploy at a rapid rate. According to the Vice Minister of the Ministry of Industry & Information Technology, China has installed over 910,000 base stations across the country, accounting for ~70% of the global total.

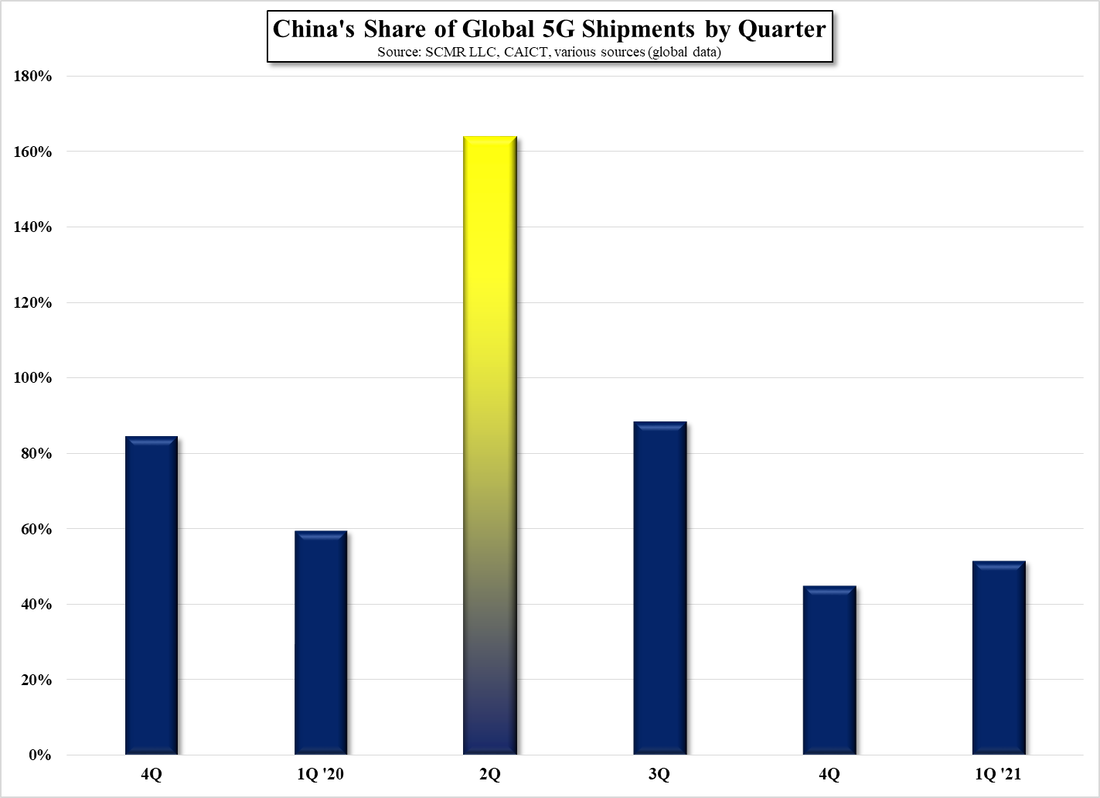

Unfortunately, as we parse the historic data there are some glaring inconsistencies. If we look at 5G shipment data for 2Q 2020, the global general consensus seems to be ~29m units, or roughly 11% of the total smartphones shipped that quarter. However data from China says that in the 2nd quarter of 2020 China shipped 49.5m 5G smartphones, or ~164% of the global total, which implies that either the global totals are incorrect, or the Chinese data is inflated. Almost all of the data on the Chinese smartphone industry comes from CAICT, the China Academy of Information & Communication Technology, which, in its own words, is a scientific research institute directly under the Ministry of Industry and Information Technology, which is an agency of the State Council, also known as the Central People’s Government, which presides over all of the countries provincial governments., alongside the Chinese Communist Party, and the People’s Liberation Army.

This makes CAICT a direct organ of the state government and likely has its releases and data carefully scrutinized by various state and party officials. While the data is at least consistent month to month in most cases, we would expect if there were any discrepancies, they would have been during the 1st half of last year when COVID-19 was at its peak in China, yet it seems that Chinese citizens, at least according to the data, were flocking to stores or on-line to purchase 5G smartphones. As specifics as to how the Chinese data is collected and what it contains, we might assume that the Chinese data includes every 5G smartphone ‘produced’ in China, whether it was sold on the Mainland or not, but data from other periods is more consistent with global numbers, so we can only accept the data as it stands but take it with a large grain of salt.

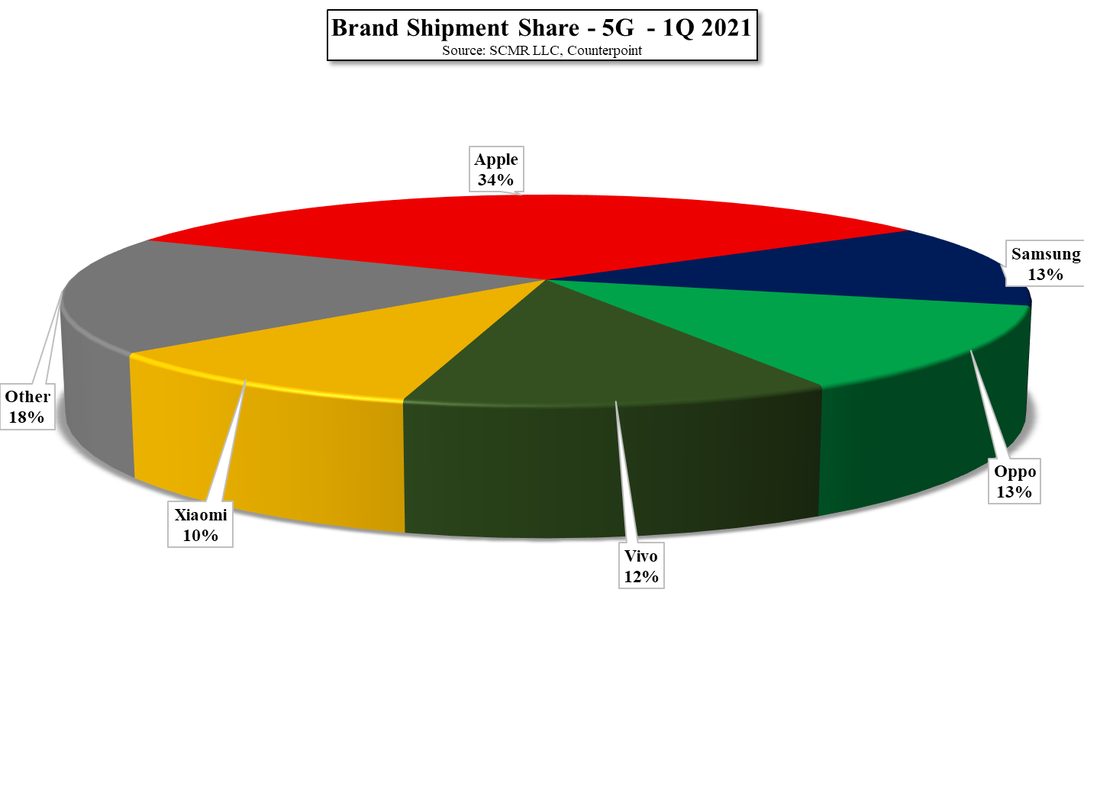

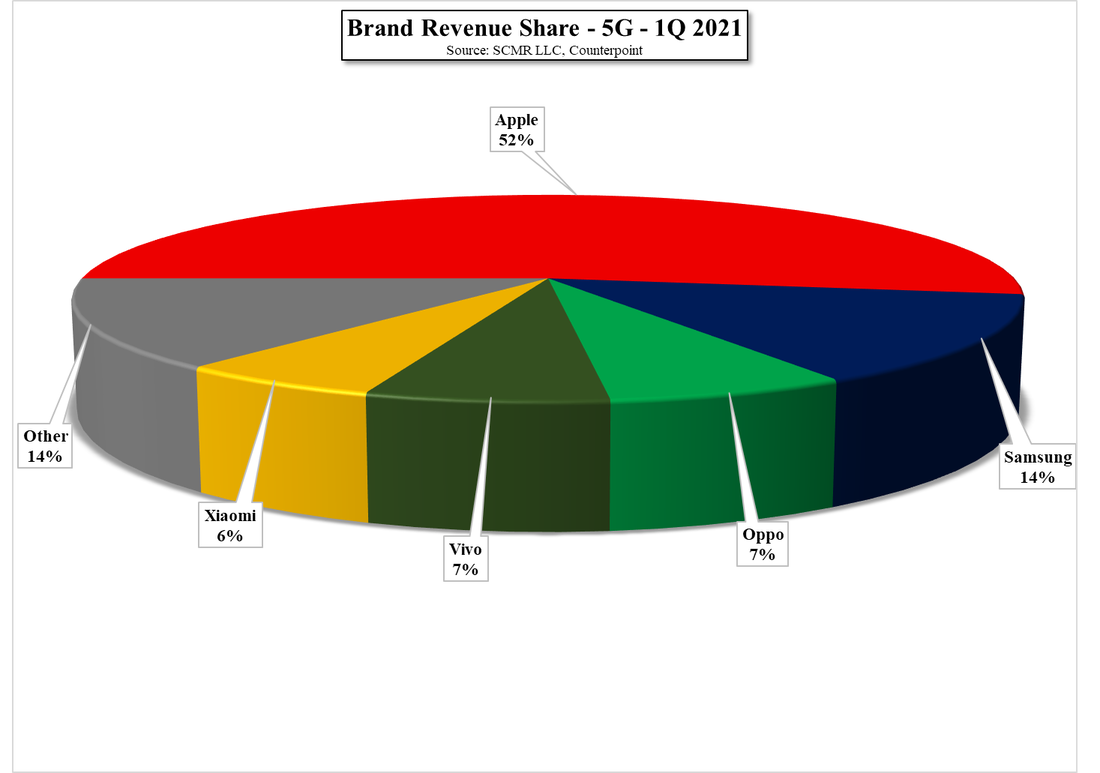

We would expect 2Q data to be similar, but while Apple could maintain a revenue share over 50% in 2Q, as new models from other brands are released, Apple’s shipment share will decrease until the iPhone 13 is released in October. We expect the revenue impact to be a bit more muted this year as some Apple users migrated to 5G last year, but we expect the release will still be impactful. If Apple pulls in the release date a bit to compete with Samsung’s potential updated foldable line, the 3Q boost could be closer to what was seen last year, with the understanding that last year was both an anomaly from the standpoint of the growth limitations that COVID-19 put on 5G growth, and as the first full year of meaningful 5G smartphone shipments and sales. While this year will still see the impact of COVID-19 on the smartphone market, perhaps more through component shortages than physical limitations, and 5G smartphone offerings have proliferated considerably from last year, 5G smartphone shipments and sales will see more subdued q/q growth and less of an impact from individual brands.

RSS Feed

RSS Feed