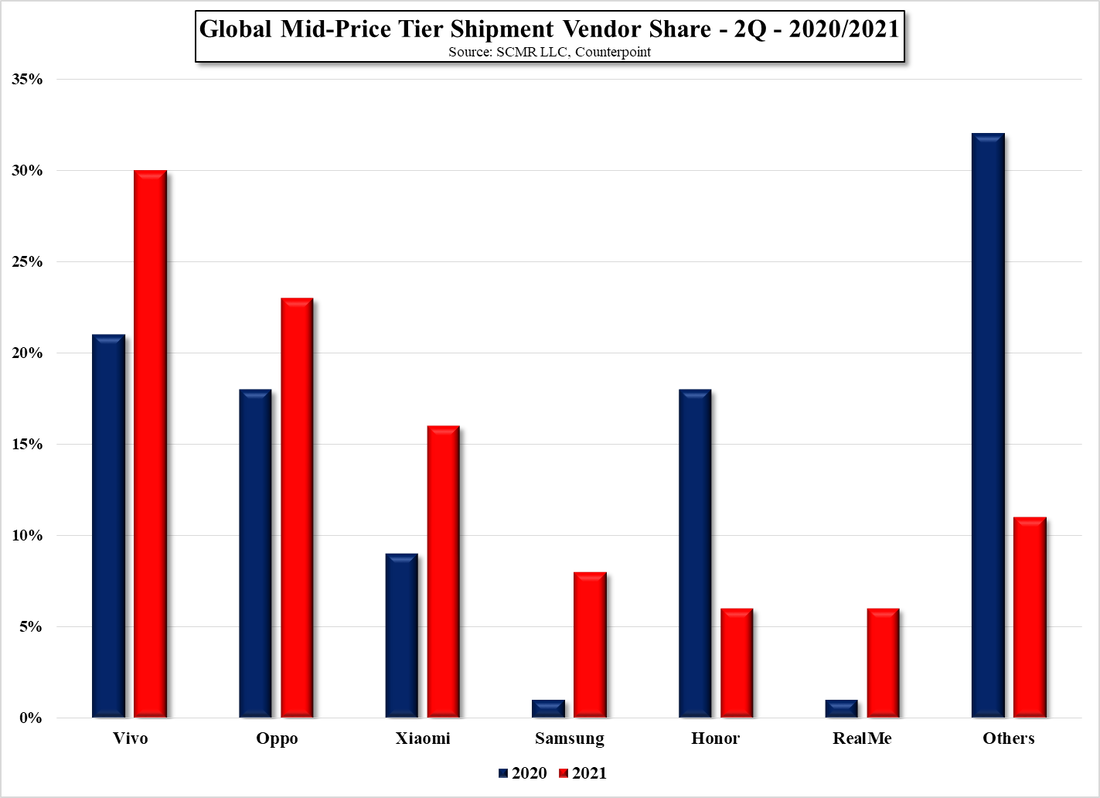

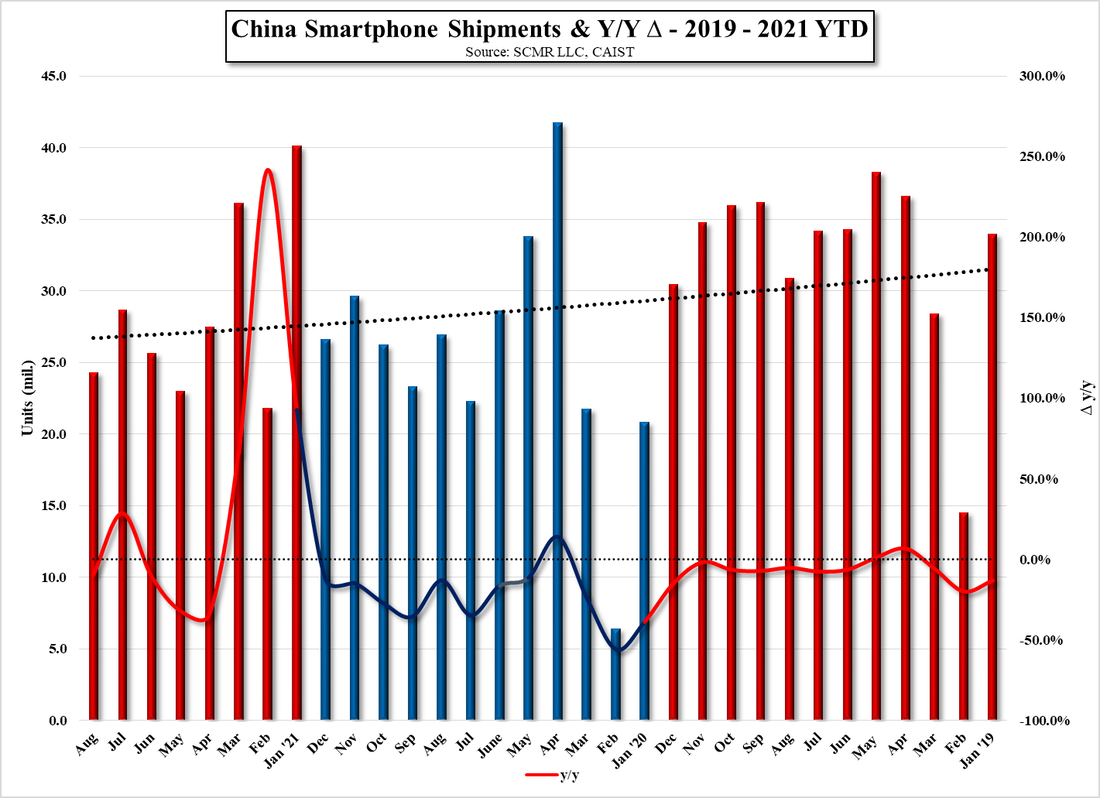

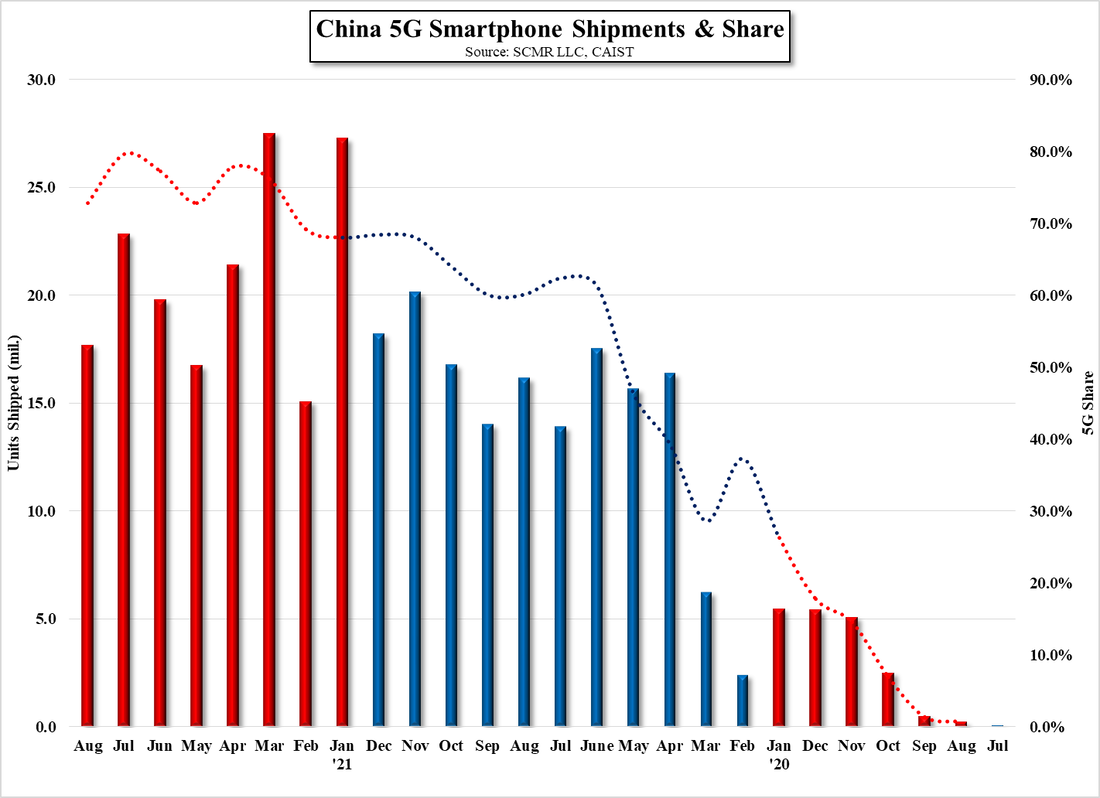

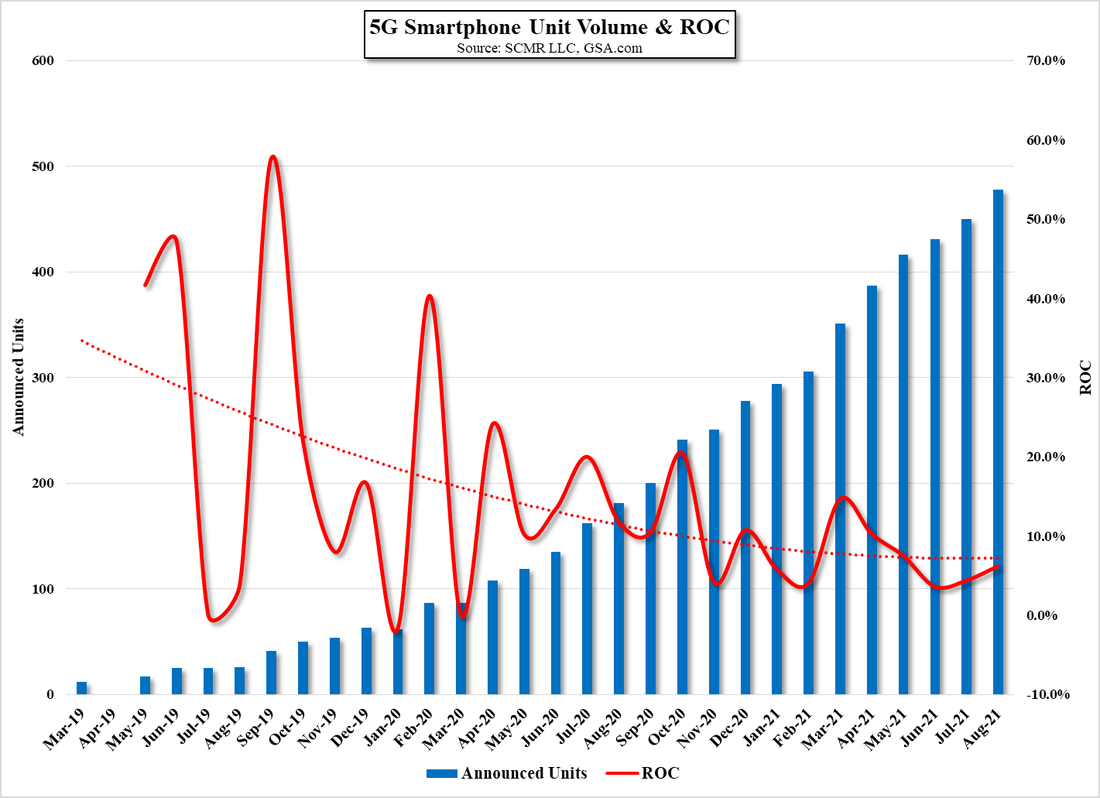

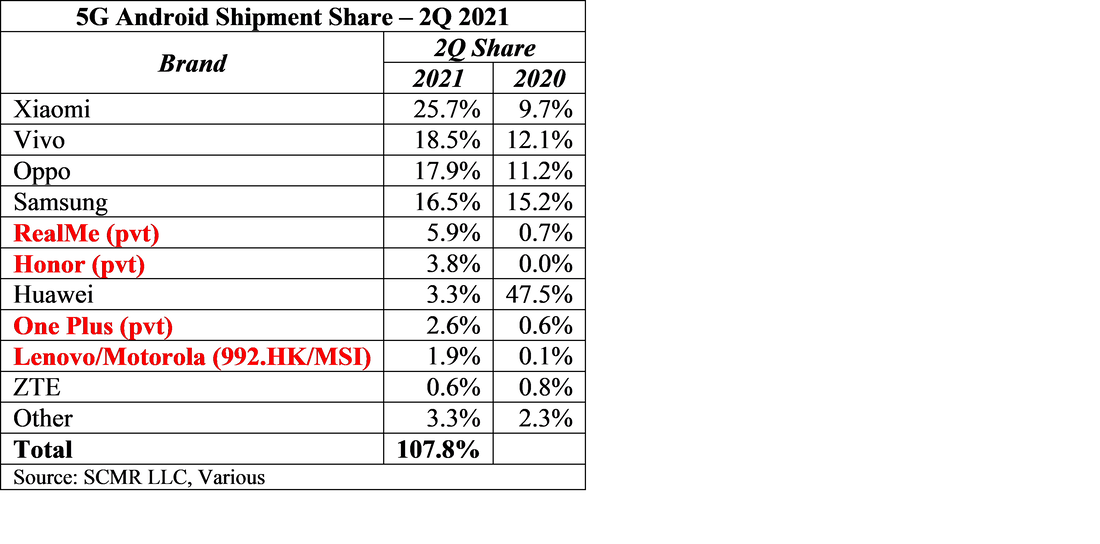

Fun With Data - 5G GranularityYesterday we noted the growth of 5G smartphones in China during August and today we dig a bit further into the global 5G market for clues as to share and direction. Based on data that breaks down 5G shipment share in 1Q and 2Q, it seems that global 5G smartphone shipments are moving from upper-tier priced models to lower-tier models as less expensive 5G chipsets find their way into lower priced phones, particularly the $200 - $400 tier (Figs. ½) and summarized in the table below. Taking it one step further, again looking at the $200 - $400 price tier, we can see what brands have made share gains over the last year by comparing current 2Q share against last year. While a number of vendors saw share increases y/y in 2Q, the most interesting change was from the ‘other’ category, which decreased from 32% to 11%. This was likely a function of the inclusion of Huawei (pvt) in the category as the company faced very significant share loss due to US trade sanctions. Only the Honor (pvt) brand lost share y/y, but this was likely a result of its spin-off from Huawei into an independent organization, so we believe the share loss that can be attributed to Huawei was captured almost completely by Chinese 5G smartphone brands, particularly Vivo (pvt), where 5G shipments increased from 28% of sales in 2Q last year to 80% this year.

0 Comments

China Smartphones & 5G |

AuthorWe publish daily proprietary market research focusing om consumer electronics and the global supply chain. The archieved notes represent a selection of our proprietary analysis and forecasts. please contact us at: [email protected] for detail or subscription information. Archives

January 2026

|

RSS Feed

RSS Feed