Business ModelsAlibaba (BABA) Cloud announced that it was lowering the price of its LLM model for the 3rd time to remain competitive in the Chinese AI market. The model, known as Qwen-VL has a number of primary features, such as multi-modality (Can accept both text and image input), High-resolution processing (>1m pixels), enhanced image extraction, and multilingual support (Eng, Chinese, Japanese, Korean, Arabic, Vietnamese) and is closest to Google’s (GOOG) Gemini, which has similar features. The model is part of Alibaba’s cloud-based AI chatbot family, which focuses on enterprise customers rather than the consumer market as a way to differentiate itself from Chinese and other AI competitors.

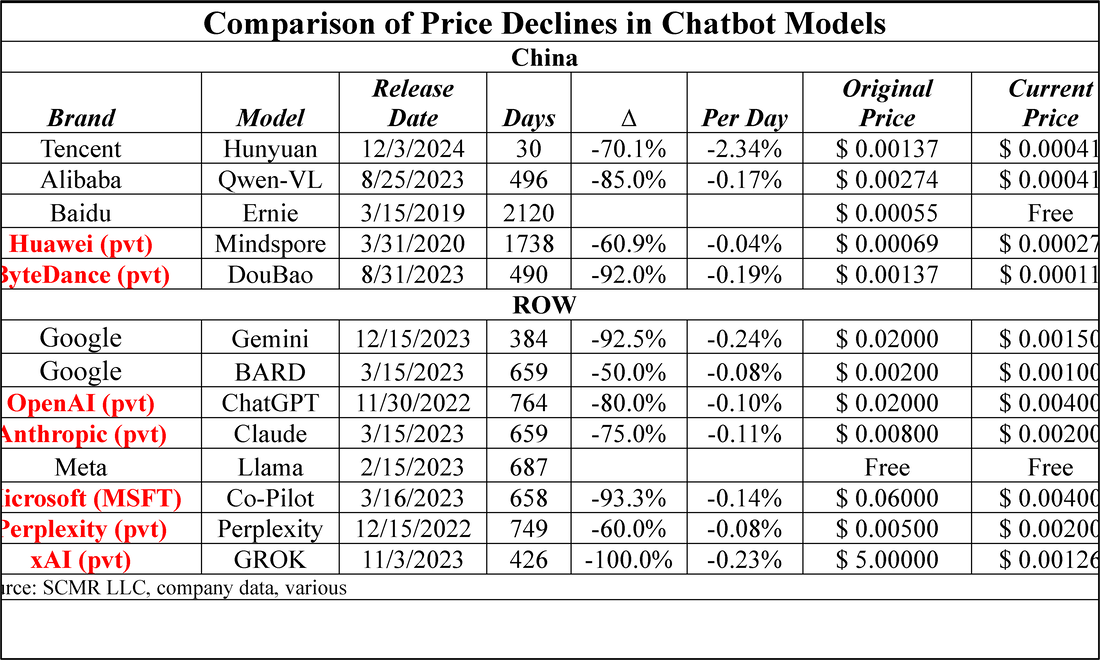

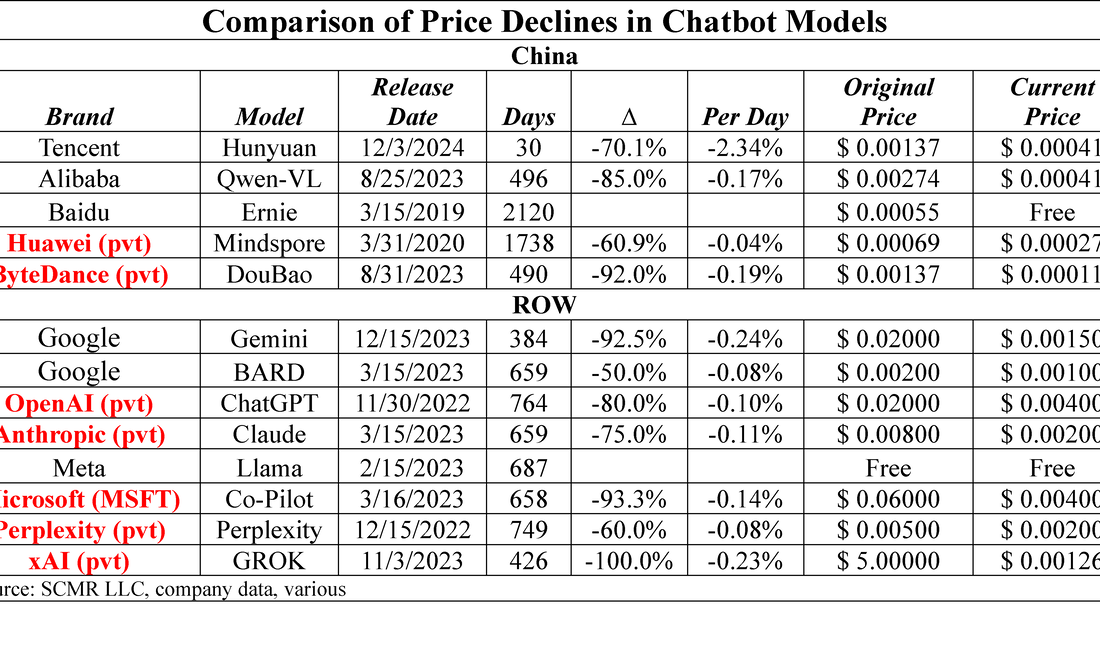

While much has been said about the competitive nature of Chinese companies, that rhetoric has been typically focused on manufacturing, however it seems that the AI market in China has spurred an even more intense competition to gain share in its own market. In June of 2024 there were over 230 million AI product and services users in China, according to state-sponsored data, which grew to over 600 million by the end of October, with almost 200 LLM commercially available models to choose from. While we believe the share of the potential user base that is using an AI on at least a weekly basis is higher currently in the US than in China, and generated more sales in 2023, expectations for industry growth over the next seven years are higher for China (25.6% CAGR for China v. 23.3% for the US[1] ), which is the impetus for the even more aggressive nature of Chinese AI Chatbot brands. With this intense level of competition among AI Chatbot model providers, we were curious to not only to see if we could quantify the rate of price reductions but also compare those to model price reductions outside of China. We note that this is an unscientific comparison, as each of the models has its own set of features and characteristics, and the availability of this data is, at best, poor, but we gathered as much data as possible, and converted the Chinese price data to US dollars for comparison. Most notable is that the price of the most recent Tencent (700.HK) model, which has been available for roughly one month, is now the same as the Alibaba Qwen-VL model, which has been available for well over a year, and while the non-Chinese model prices have come down at a similar rate to the Chinese models, the current prices of the non-Chinese models are appreciably higher. Overall, one might question the viability of the current business models behind commercial chatbots based on the data. We note also that Baidu’s (BIDU) ERNIE model is now free, and Google’s BARD has morphed into Gemini. We can find no specific data on how the MetaAI (FB) models are broken out pricewise and we note also that there are newer models for some (GPT-4 for example) that have much higher performance and cost, but this is as close to a comparison as we could make given the time involved. The prices are for 1,000 tokens of input data in all cases. [1] GrandView Research Business Models? |

AuthorWe publish daily notes to clients. We archive selected notes here, please contact us at: [email protected] for detail or subscription information. Archives

May 2025

|

RSS Feed

RSS Feed