AR Apps that Make Sense

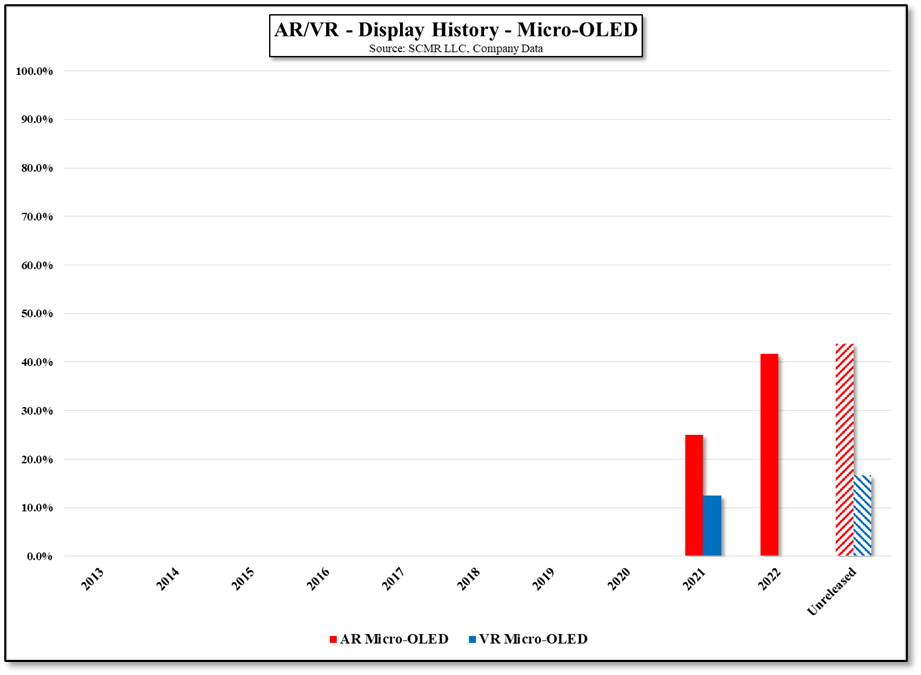

XRAI Glass (pvt) is a small London-based software company that has developed AR software using AR glasses from Nreal (pvt), a well-known Beijing-based producer of consumer-oriented AR glasses, with the most recent releases being the NReal Air, a $379 device (see below) that is based on a micro-OLED display and a birdbath[1] optical system that pairs with a smartphone (select phones only – currently waiting for IoS approval). While the AR glasses themselves are interesting in themselves, being one of the few AR glasses designed for consumers rather than business/commercial applications, our focus here is on the software provided by XRAI.

The software, which is available on Google Play that converts audio in visual ‘closed caption’ information for those who are deaf or have other hearing disabilities. The software is able to identify each speaker, and can translate from nine languages, including English, Mandarin, French, German, Italian, Japanese, Korean, Portuguese, and Spanish, with more languages coming, all in real time. Aside from these features, the software also supplies a personal AI assistant that can be questioned, with answers appearing on the glasses, and can be queried about conversations, such as “What groceries was I asked to pick up yesterday?”.

The software is available under three tiered plans, with the first being free (Essential Plan) that offers unlimited transcription in all nine languages, a one-day conversation recall and a simple display duplicate mode. The premium plan costs £19.99/month (~$24.08) and includes AR mode with 3D support and a 30 day history, along with regular translation, and the Ultimate plan (£49.99 or ~$60.20/month) adds unlimited conversation history, speaker ID, and the AI assistant. For those that have impaired vision, the company has partnered with another UK firm, Lensology (pvt) that will substitute a wide variety of prescription lenses into the NReal Arg lases, including tinted, polarized, and transition lenses for between 1/3 and ½ of typical optician prices (~$25.00 US for standard uncoated lenses).

[1] A birdbath optical system refers to a series of lenses that take an image from a display, typically a near-eye display, and using a spherical lens that looks like a birdbath, and a beam splitter and mirror, changes the direction of the display to focus on the users’ eye.

One concern we have, and hopefully others share, is the collection of data during the use of the application (or any application). As the information is encrypted and travels over a secure link, there is little need for concern over it being intercepted by nefarious parties, but the translations themselves and the meta-data that is part of that data becomes recognizable at certain points in the process and given the issues over privacy that are currently a major part of social media, we checked to see what the company collects, particularly as the UK’s secession from the EU could put GDPR[1] rules in jeopardy. It seems that the UK, despite its EU withdrawal, is still art of GDPR, so such rules remain in place and the company specifies its data collection policy below.

- No data is shared with 3rd parties

- Collects personal information, such as name. E-mail address, and user ID.

- Collects contact information and data on interaction with other applications, along with crash logs and diagnostic information.

- Data is encrypted over a secure connection and can be deleted upon request.

Note: We get no compensation from any company, mentioned or implied, and offer our notes only as informational to investors who have an interest in the consumer electronics sector. While there are links to our website and other websites, including those where items might be purchased, we receive no compensation for those links or products sold through those links.

[1] General Data Protection Regulations – passed in 2016 and enforceable in 2018, that sets parameters for data privacy and transfer

RSS Feed

RSS Feed