BOE Ships iPhone Pro Displays

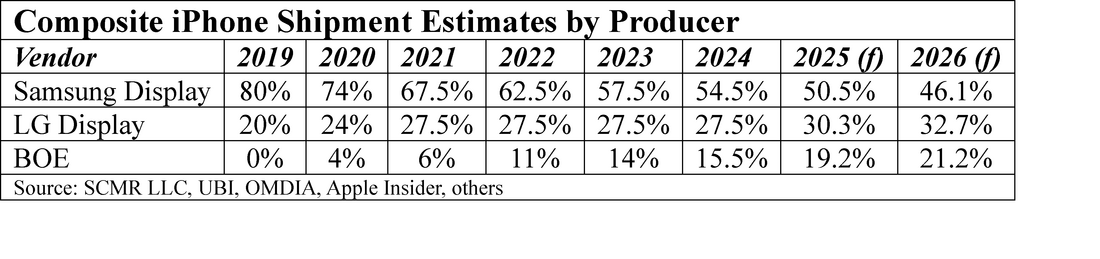

BOE’s original plans were to produce ~10m phones as part of the 100m units that Apple is expected to ship for the iPhone 17 series, however it is now expected that the number will be between 2m and 3m because of the location limitation, leaving the remainder to be split between Samsung Display (52-54m) and LG Display (LPL) (42 – 44m). Apple is between a rock and a hard place this year as it is thought that BOE is offering a steep discount in price on their production, helping to boost Apple’s margins or give it some room for discounting, however at the same time Apple is also very wary of BOE’s patent infringement loss, and cannot take the chance that there will be any limitations put on sales of BOE’s displays in the US. They can still use BOE’s pricing to extract some blood from SDC and LGD but without the threat of making BOE a full volume competitor this year, the effect is limited, especially as BOE is a first time supplier for the iPhone Pro model using LTPO and is therefore expected to have low yields relative to SDC and LGD, who have been producing these models in years past.

RSS Feed

RSS Feed