Bronze

Of course, the necessity for increasing OLED IT panel production volumes is based on demand, so both Samsung Display and BOE are making the bet that OLED IT volumes will continue to increase, although both are starting production at levels below the stated capacity of the fabs, and both stating that the expansion to full capacity will take place as the market continues to grow. Some of this open-endedness comes from Apple, who has been thought to be adjusting its OLED transition plans due to weak market conditions, but when making long-term plans (fab equipment has a 5–7-year depreciation term in South Korea and a 7 year term in China) shorter -term factors carry less weight.

So how much does it cost BOE and Samsung Display to build out these new fabs? SDC has the advantage of being able to reuse fab space that was previously used for large panel LCD production, so no greenfield cost, but lots of modifications for new equipment. Samsung Display is using Canon (7751.JP) as a source for the deposition tools it is building its fab around, which are estimated to cost ~$400 million each (2 are needed for a 15k line) with another ~$100 million for vacuum chambers and logistical equipment that is tied to these tools, so the key equipment cost alone is over $600 million.

BOE has selected Sunic Systems (171090.KS) to supply their deposition tools for an expected ~$500 million price tag (inclusive of associated equipment) so BOE will have a cost advantage. This seems to have lit a fire under Samsung Display to beat BOE in being the first to mass produce IT OLED products on a Gen 8.6 platform, gaining the advantage of experience, a key to improving yield. In that vein, SDC took delivery of its 1st (of two) Gen 8.6 OLED deposition tools about a year ago and has been refining the process and tool characteristics since the installation was completed. The 2nd tool is expected to be delivered within the next 2 – 3 months. SDC has stated that they expect to begin mass production in 2026, however more recently there have been indications that SDC is planning to begin mass production this year, likely putting at least the first (of two) lines about a year to 18 months ahead of BOE.

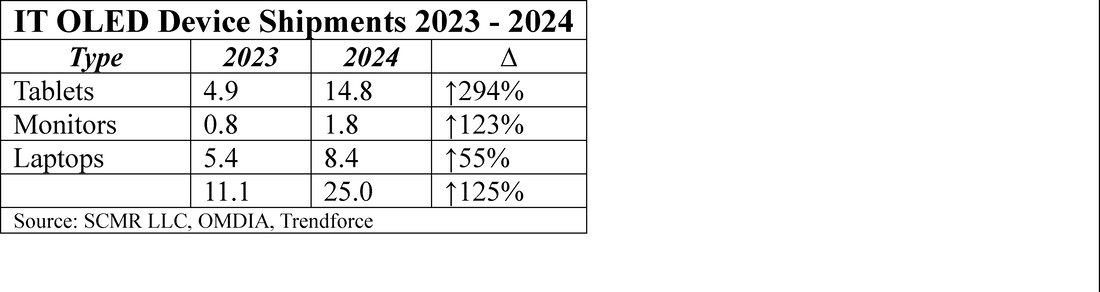

Again, the risk to both producers is how rapidly the market for OLED IT products develops and how much of that capacity can be produced on existing Gen 6 capacity. In the table below we look at rough (very) shipments for OLED IT products in 2023 and 2024 and we note that it is estimated that Apple (iPad Pro) was responsible for at least half of the growth in OLED tablet shipments. Given that there is a considerable amount of global Gen 6 capacity, even another year of strong unit growth could be covered by existing Gen 6 capacity, albeit a bit less efficiently, so the necessity for either SDC or BOE to begin production at these new facilities is less critical.

All in, SDC and BOE will duke it out for leadership in this new Gen 8.6 OLED IT category and will likely not get much out of the results for the first few years, while LG Display has the option of remaining a Gen 6 OLED IT player or stepping up to Gen 8.6 and incurring the risk of taking on a considerable financial burden and hoping that the market can support all three players quickly. It is good that the industry is progressing in terms of its ability to efficiently produce OLED IT products, but the necessity for immediacy seems a bit harder to understand. Samsung Display has always been the leader in RGB OLED production and as BOE is the masthead producer for the highly competitive Chinese display industry, neither seems to have much choice that to compete at this point, while LG Display will likely be the only profitable supplier of IT OLED for the next few years without the cost and depreciation of a new fab. If it’s between 1st or 2nd place and losing money for the next few years and 3rd place and making money now, we go for the bronze.

RSS Feed

RSS Feed