Putting Oliver Through College

Apple’s transition from LCD to OLED starting with the iPhone X, released om November 3, 2017, is expected to continue for the next few years as they migrate much of their product line to OLED. Samsung Display and LG Display have been the primary small panel OLED suppliers to Apple but are continuingly being challenged by China’s largest panel producer BOE (200725.CH), who has made some inroad with Apple, supplying replacement displays for earlier iPhones and as a 3rd supplier for some later models. While BOE has had its own issues with Apple, they continue to challenge SDC and LGD, along with a number of smaller Chinese OLED producers, and SDC has gone to the US ITC alleging patent infringement, with BOE, and other Chinese OLED producers (Chinastar (pvt), Tianma (000050.CH), and Visionox (002387.CH)) responding by challenging the validity of those patents in US Patent Court.

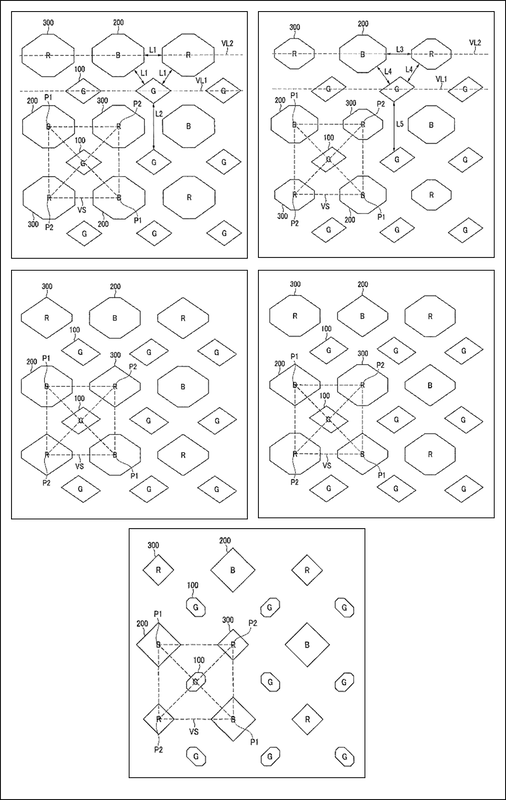

As the ITC investigation continues (target date 3/17/25) the patent challenges also continue, and the US Patent Review Board has ruled on one of the 4 patents that Samsung claims were infringed upon. The ‘683’ patent, filed by Samsung Display on 11/13/17 in the US and 3/6/12 in Korea makes 15 claims concerning OLED pixel structure, particularly Samsung’s ‘diamond’ pixel structure shown on the left side of Figure 1. The PTAB has decided that 10 of the 15 claims made in the original patent are not valid, while leaving 5 intact. Samsung will have the opportunity to appeal that decision.

Limiting the broad scope of a patent is not an unusual outcome in patent review cases, but narrowing the patent will also narrow the ITC’s investigation scope, making SDC’s case a bit harder, and could open one of the other patents included in the investigation to further scrutiny as it is essentially a continuation of the ‘683’ patent mentioned above.

All in, the validity of the ‘shape’ characteristics of the pixels (polygon, Octagon, or non-quadrilateral) as specified in the ‘683’ patent, remain in effect, which is a key point in terms of the infringement, but spacing between pixels, size, and arrangement, the other ‘683’ claims, are invalidated, reducing the points that SDC can cite in the ITC investigation. We expect SDC will appeal the PTAB decision, but this ruling and any potential appeal will likely push out the final ITC decision and the battle for OLED supremacy will continue in both the consumer space and the courts for another year. That’s how lawyers put their kids through college.

RSS Feed

RSS Feed