August Display Company Recap

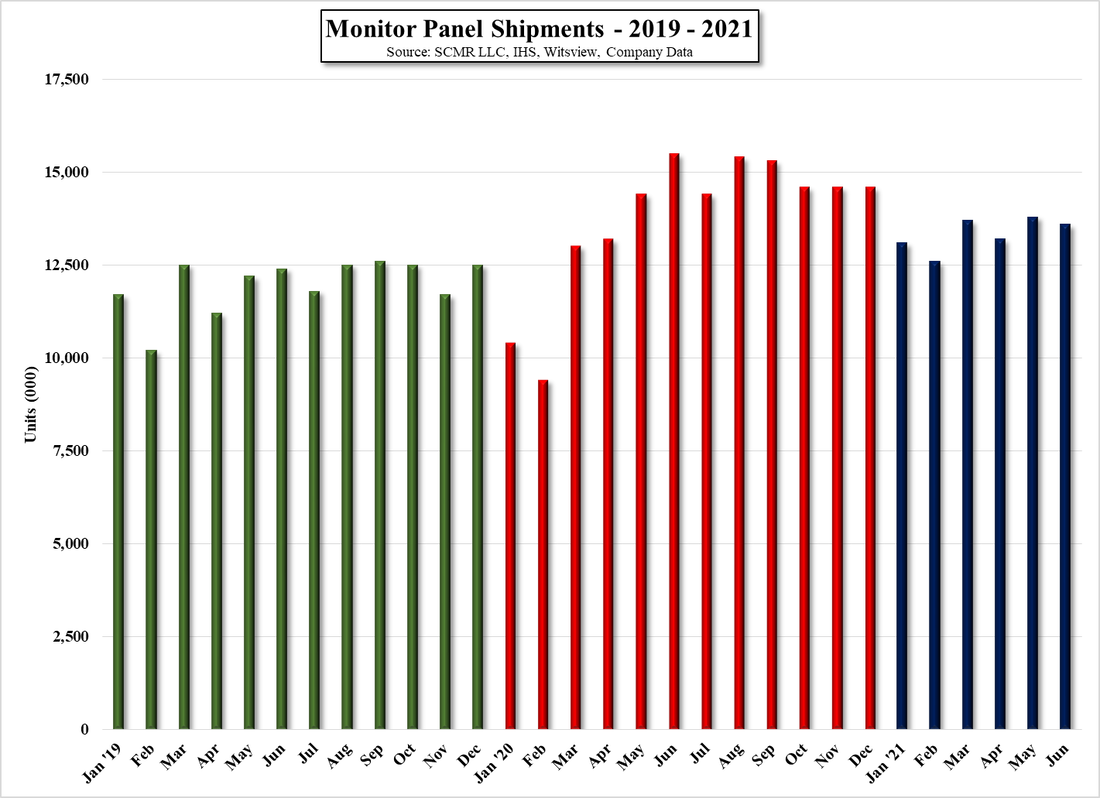

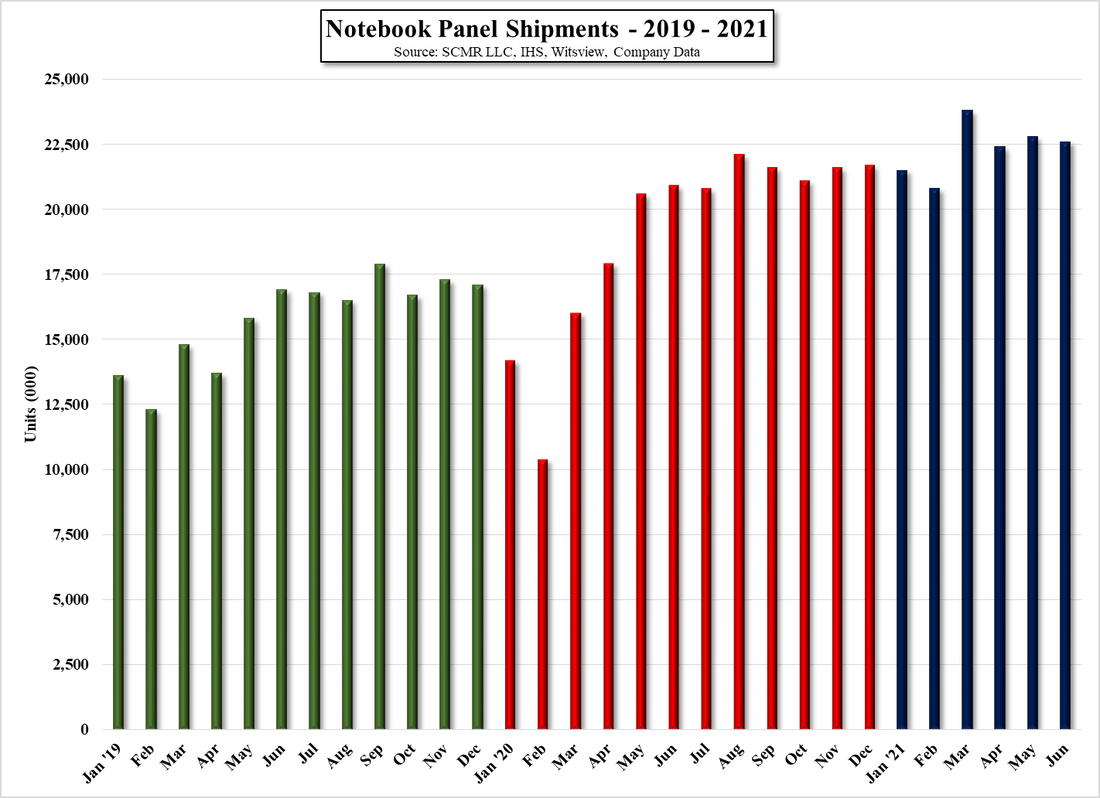

TV panel share is a monthly variable that does not get reported by many panel producers (some do quarterly) but based on our data, we believe the shipment level for LCD TV panels declined by 4.3% in August, following a 1.5% increase in July, offset by a 2.8% increase in monitor shipments, flat notebook shipments, and a 4.8% increase in tablet shipments. The shipment trends are noted in Fig. 7. Panel producers have been decreasing their share of TV panel production in lieu of IT panel products, less in anticipation of the price drop seen in August but more due to the continued demand for notebooks and monitors. While there is much talk over how this will lessen the effect on panel producer sales as TV panel prices decline, we have only seen one month of excessive TV panel price declines and therefore little cumulative negative momentum. Given that September saw an even larger decline in LCD TV panel prices and little price offset from IT panel pricing, we expect that September industry large panel sales will be down in excess of 5%.

All in, August looks to be the tip of the iceberg for large panel LCD producers in terms of the impact of decreasing TV panel prices. If September and October are any indication of the severity of such panel price drops, the effects will be felt by almost all large panel producers, especially if there is little positive offset from IT panel pricing or shipments. Given that it took only a short period for TV panel prices to trace back almost half of the gains made in the last year, it sets the stage for a weak 4th quarter for large panel producers. As noted above, we expect IT panel pricing to remain reasonably stable for the remainder of the year, and would find it difficult to assume that TV panel prices continue to fall at such a precipitous rate for the rest of the year, but we did not expect to see an almost 20% drop in TV panel prices in September. “Surprise, Surprise” – Gomer Pyle USMC (1964).

RSS Feed

RSS Feed