Corning – Quick Take – Display & Specialty Materials

Our focus tends to be on the display side of Corning’s businesses, which includes traditional display glass and specialty materials (Gorilla Glass, etc.). The display glass segment posted sales of $959m, up 1.8% q/q and up 11.1% y/y, with net income of $236m, down 6.3% q/q but up 10.8% y/y.. Display segment net margins were 24.6%, a bit lower than we expected but not out of line with typical years. Glass prices rose slightly in the quarter, and as we have noted in the past, this is an unusual occurrence, as glass prices typically tend to decline. The display glass market is one with few suppliers and high barriers to entry, which has allowed Corning and other producers to maintain stable glass pricing over the last few years. With glass demand driven by average panel size increases and increased panel capacity, the environment for display glass has been ideal.

Corning has ‘share’ agreements with most of its customers, which gives them access to a percentage of Corning’s output for the quarter or year, but pricing is adjusted on a quarterly basis. It has been difficult for Corning to renegotiate pricing most recently, not because of customer resistance to higher glass prices, but more to be able to renegotiate fast enough to cover the increased costs of raw materials and transportation. We would expect to see at least another quarter or two of display glass price increases as Corning catches up to increased costs, especially in transport as Corning’s inventory levels have been low, pushing them to use more expensive air transport to meet demand deadlines. With expectations of low display fab utilization, Corning will continue to run glass production at levels that allow it to build inventory, which will help to maintain margins, especially in light of continued glass price stability or increases, but display glass sales need both increasing volumes and average panel size increases to maintain growth. We expect that weakening demand for TV and notebook demand will begin to make y/y cmparisons a bit more difficult in 2H, and while that does not change our broader view of the display glass segment, it does temper our enthusiasm a bit, even after a strong quarter.

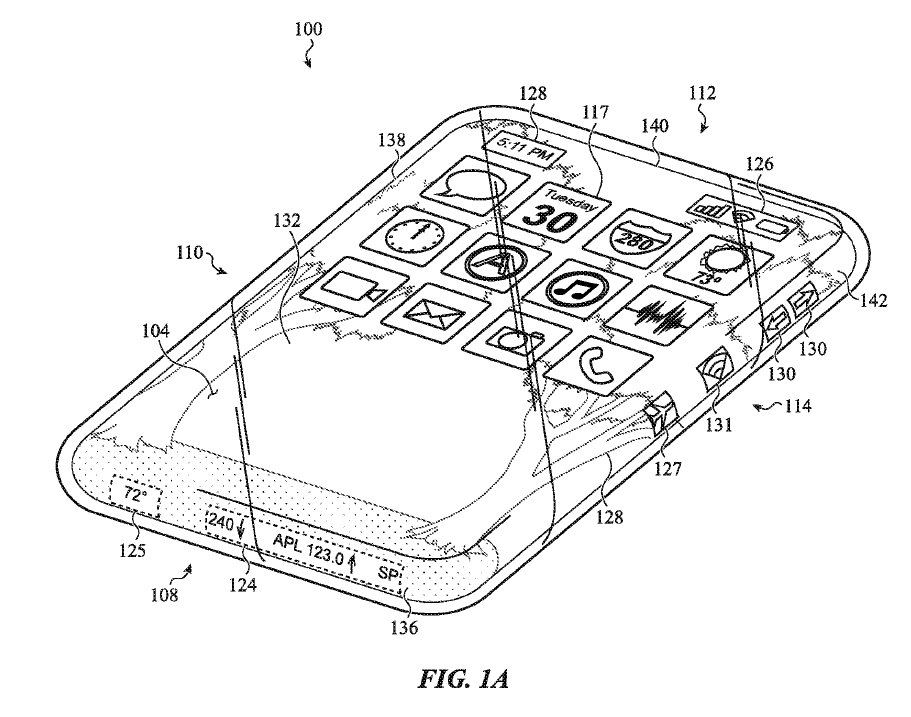

All in, Corning performed quite well in the quarter and will likely do so again in 2Q, and strength in the optical segment will likely offset even a small amount of weakness in the display space. Specialty materials, which saw sales increase 9.3% y/y saw net income decline by 17.6% as the segment invested in new product development, which has been the driver for the segment for the last few years. Smartphone demand remains somewhat stagnant, but Corning continues to develop products that lead to higher content/device, which is the ultimate driver for the segment and automotive Gorilla Glass and similar products are finally coming to fruition. While there are certainly product areas where there are risks for Corning, it seems to be the definitive defensive play when large cap hardware technology companies are under pressure.

RSS Feed

RSS Feed