Fun with Data - Who’s buying NFTs?

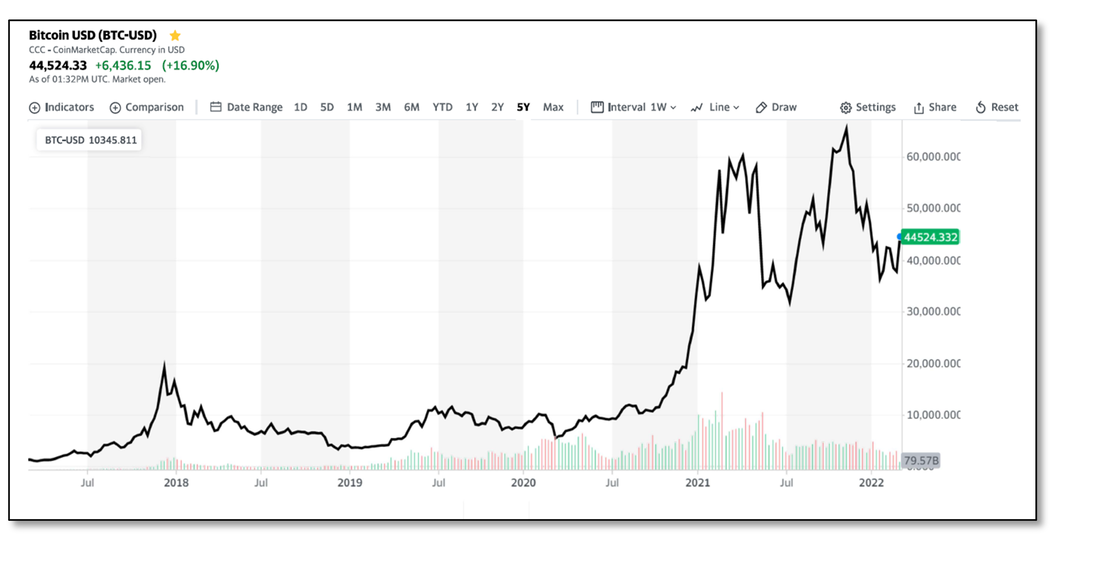

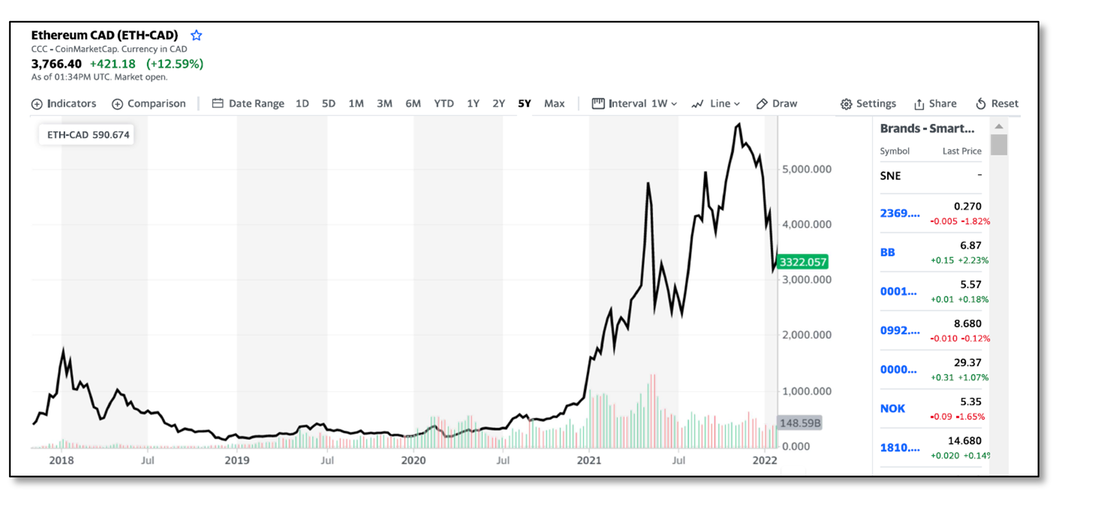

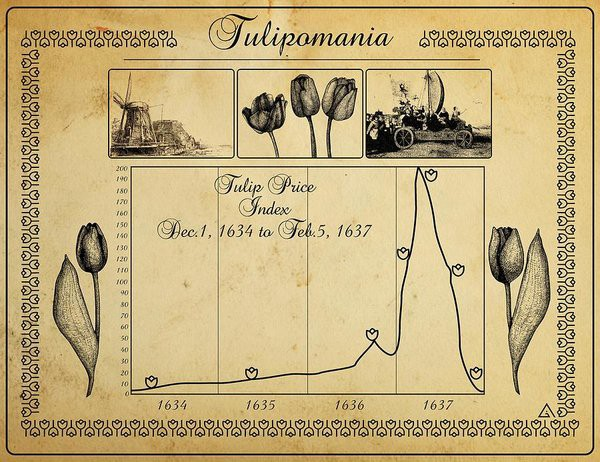

Much of the interest in NFTs in Southeast Asia has come from Axie Infinity, a game developed in Vietnam that allows players to earn Smooth Love Potions (SLPs) the more they play the game, which can be converted into Etherium and sold, which became a way for serious gamers to put food on the table during COVID lockdowns, and the concept of digital tokens appreciating in value was a quick step toward NFTs, particularly when the value of early art-based NFTs soared, with collectibles and art generating almost 80% of NFT market value at the end of last year. We are not saying NFTs look like a get-rich-quick proposition to those in less wealthy countries as the inclusion of the US, Canada, and Germany in the top 10 debunks that concept, but one wonders why some would be willing to risk government wrath and potential financial loss unless there was the promise of a pot of gold at the end of the rainbow, although when you look at Figure 3, which shows the average ‘gas’ price (the fee paid to the platform for any transaction) on Ethereum, there are those who profit with relatively little risk in the NFT/crypto space..

RSS Feed

RSS Feed