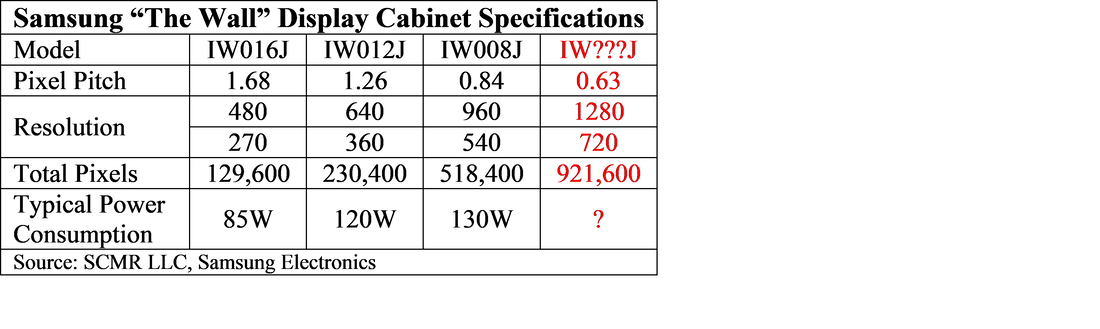

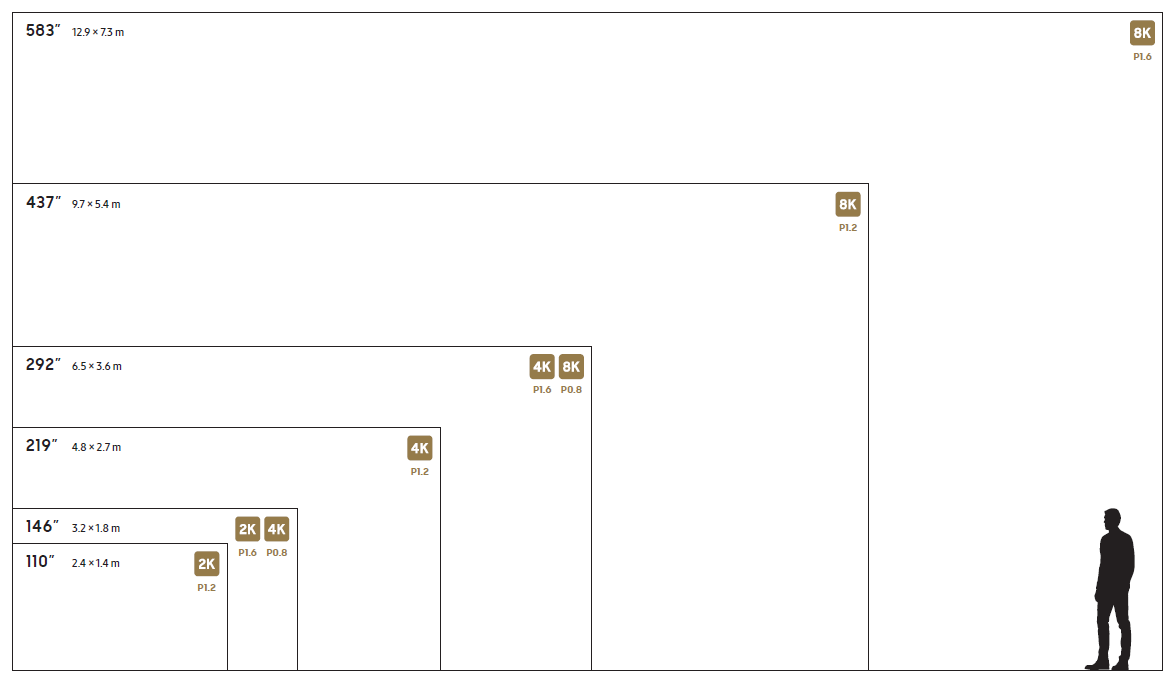

Sold One!As we have noted previously, Samsung Electronics (005930.KS) has recently begun offering its 110” Micro-LED TV in China, and while we noted that the pre-order excitement was high enough to have sold out what ever number of units were being offered (you now have to contact on-line customer service to place an order), we were not sure if any had actually been delivered. In fact word has come down that the first 110” Micro-LED TV set offered has been delivered to a customer in Jining City, Shandong Province (free delivery we assume) for the price of 1.05m yuan, or $156,997 US. The system is a 4K device with a 120Hz refresh rate and a maximum brightness of 2,000 nits. It is equipped to handle HDR10+ and covers 100% of both Adobe (ADBE) RGB and DCI-P3 color standards and is able to display 4 separate video feeds on the massive screen. To get some understanding of what this unit looks like, image a single TV set the size of four 55” TVs. Currently you can get a house brand 55” LCD TV at Best Buy (BBY) for just a bit over $300; perhaps not as high quality as a Micro-LED TV with all the bells and whistles, but for the price of the 110” model, you could get 506 55” TVs. You could give one to everyone in the neighborhood and still have lots left over…

0 Comments

Another Micro-LED Project Started in China |

AuthorWe publish daily proprietary market research focusing om consumer electronics and the global supply chain. The archieved notes represent a selection of our proprietary analysis and forecasts. please contact us at: [email protected] for detail or subscription information. Archives

January 2026

|

RSS Feed

RSS Feed