Google Buys Micro-LED Start-up

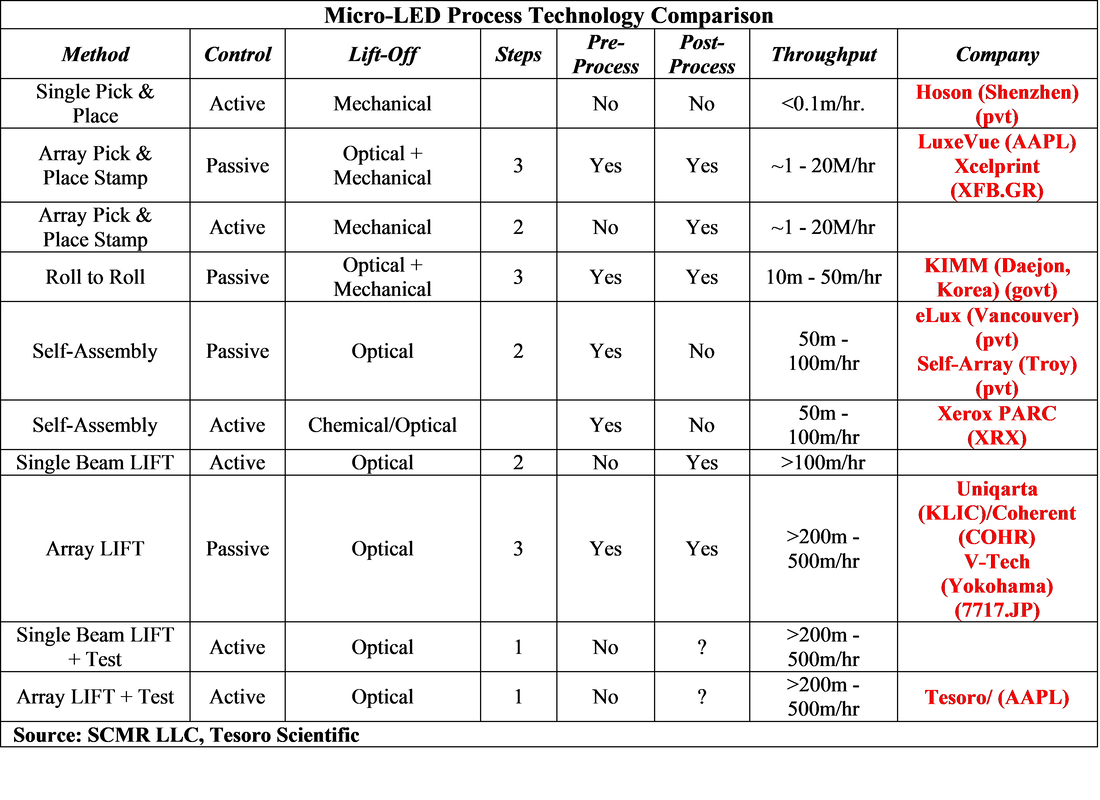

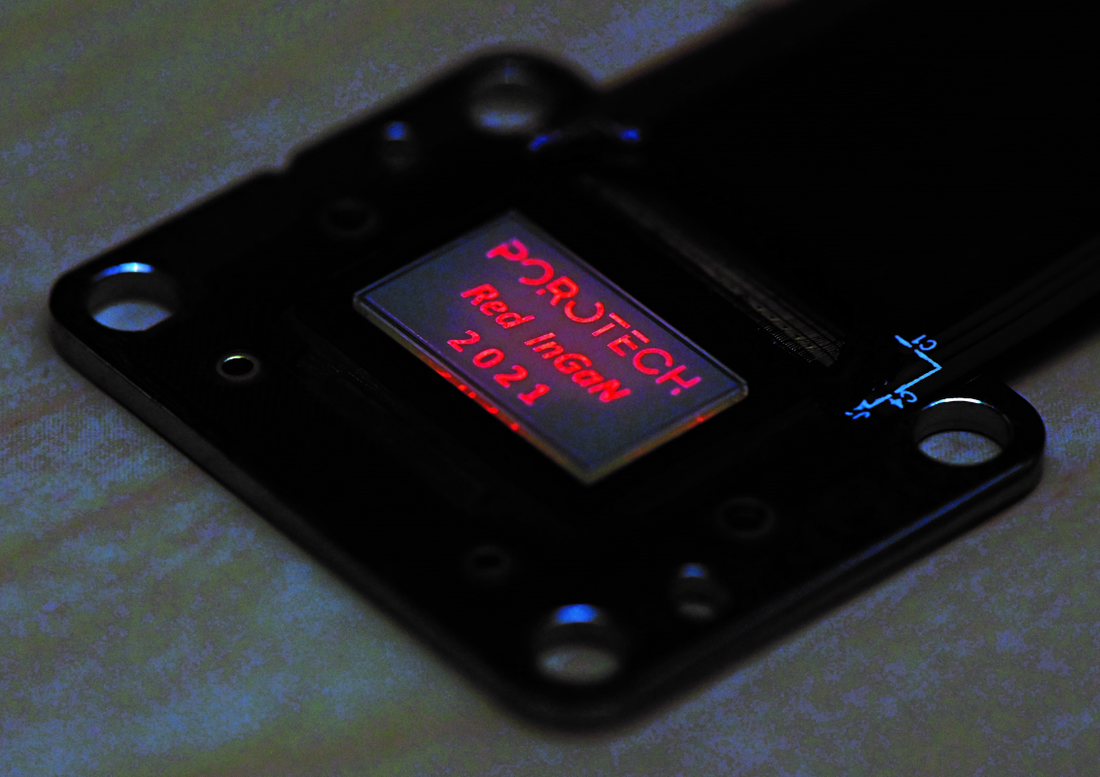

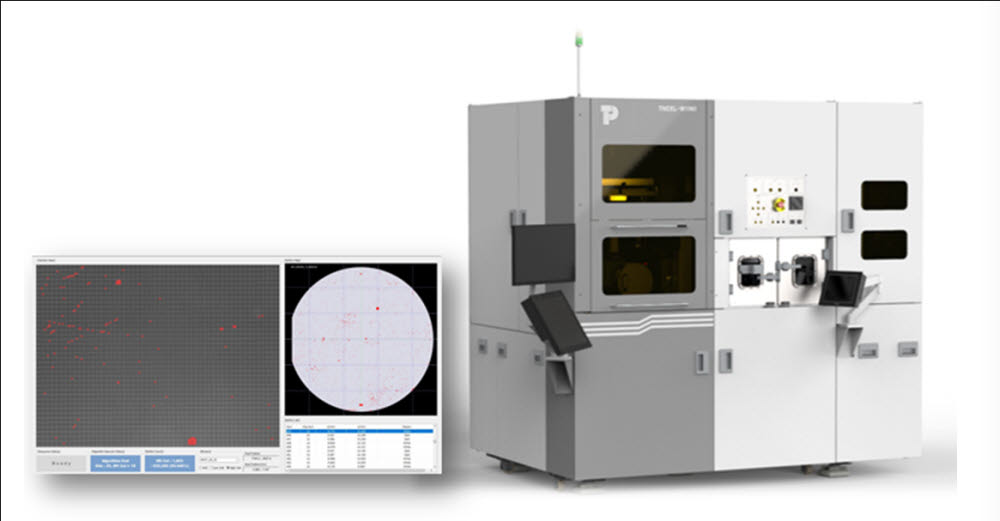

One issue concerning light field imaging is that they require a large number of ‘elements’ in order to capture the ‘cake slices’, some 2 to 3 times what might normally be used in volumetric imaging, and that is where Micro-LEDs come into the picture, as they are considerably smaller than typical pixels and sub-pixels, allowing designers the ability to place a greater number of imaging elements in the same space as more typical self-emitting display systems. That said, producing micro-LEDs and placing them on control circuitry is a difficult task and makes such a process an expensive one, which is reflected in the high cost of Micro-LED displays, and those are using much larger Micro-LEDs than would be needed here. Raxium is also developing a process for producing ‘monolithic’ Micro-LEDs (see Figure 5), essentially LEDs that are produced directly on a silicon substrate, as opposed to sapphire substrates from which they have to be transferred.

The application that we expect has interested Google here is the use of light field imaging in an AR device, which would allow someone using such a device to see a far more realistic image overlaid on the real world, and in theory, the user should be able to see more than just a ‘flat’ image overlay, being able to look ‘around’ the object to get a better perspective on how it fits with the actual image he sees through the glasses. The example might be an engineer wearing such glasses, who was replacing a part on a mechanical device, could bring in the image of a replacement part to see what other parts might need to be removed to install it, but would also be able to see around the part just by shifting his view, rather than having to load static images of the sides or back of the part.

This is only one application of such an AR device and there are so many more that large company’s like Google, Apple (AAPL), Microsoft (MSFT), Meta (FB), and a slew of smaller companies have been trying to develop micro-display technology that will enable AR since ~2013, when Google announced the abortive ‘Google Glass’ device. We expect that Google sees Raxium as another step toward such a device and we expect the valuation for Raxium might be high, but if it advances Googles efforts toward a ‘revolutionary’ AR device, the cost is worth it. In the long run.

RSS Feed

RSS Feed