Is Samsung Display Getting Its QD/OLED Act Together?

This decision also put Samsung Display in the position of having less of an impact on parent Samsung Electronics, who was forced to source from other panel producers. At the time of the announcement this change had a positive spin for Samsung Electronics in that it was a buyer’s market for large panels and Samsung would not be burdened by SDC’s losses in the large panel business if panel prices declined further. Samsung Display however realized that it needed a large panel product to maintain its relationships with both its parent and other large panel customers and began a track toward the commercialization of a new technology that combined OLED and quantum dots.

The technology was based on a layer of blue OLED emitter material essentially covered with a color filter made of red and green quantum dots. This was not the same as the color filter used by the WOLED process championed by LG Display, which combines green/yellow and blue OLED emitters, forming a white light and then uses a color filter to remove 2 of the three colors from each sub-pixel with phosphors. In the original SDC QD/OLED model the two OLED emitters were replaced by a single blue OLED emitter and the color filter phosphors were replaced by quantum dots that shifted the blue light to red and green rather than filter out much of the light which should lead to a brighter display.

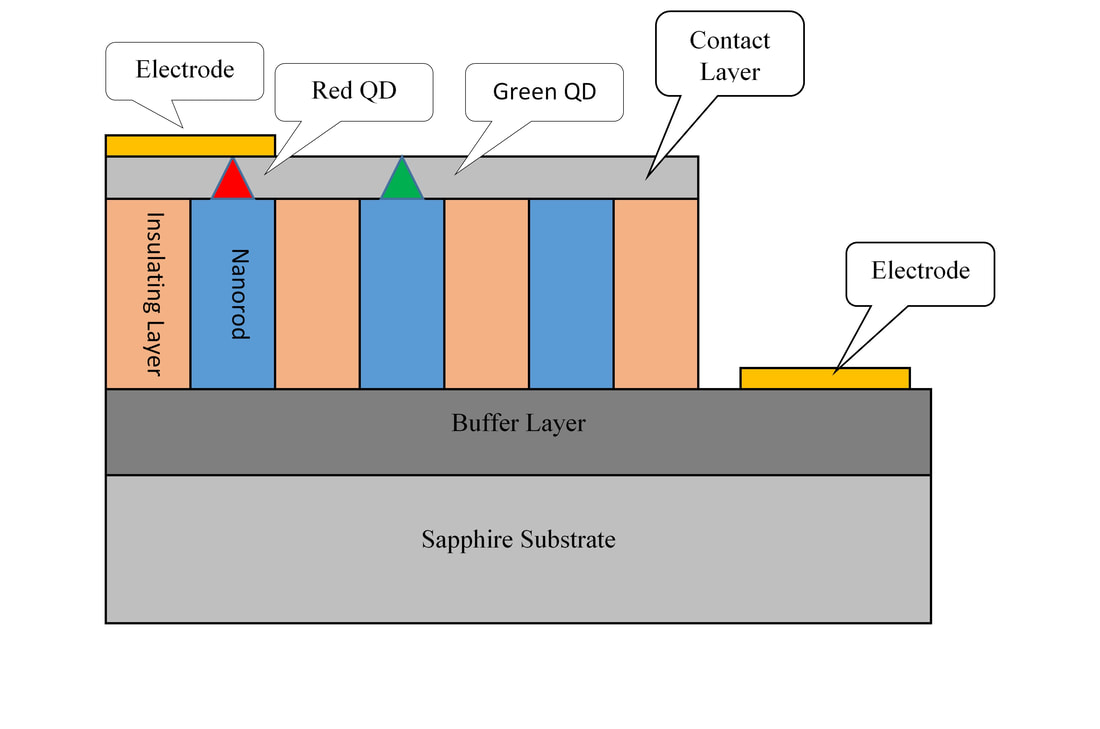

Unfortunately the only blue OLED emitter commercially available is a fluorescent material, rather than a phosphorescent one, with fluorescent materials producing far less light than phosphorescents. As the goal of the SDC project was to develop a brighter display, using a fluorescent blue emitter did not produce the desired results and SDC has been evaluating an alternative known as nanorods. Nanorods are small structures that are ‘grown’ using the same materials used for LEDs, and as the direction of the growth can be controlled, these structures are grown as rods, which are bunched together to form a light source, in this case a blue one. Using the same quantum dot color converters, an RGB pixel can be created by converting the blue light to red and green and allowing some of the blue to show through in each pixel. While that sounds relatively simple, getting the nanorods, which are less than 1um wide to stand up next to each other is a bit like herding cats, they tend to go in every direction, so Samsung is using a process called dielectrophoresis, similar to the process used to separate platelets from whole blood, which aligns the rods by using an electric field. The process lines up the rods vertically, which represents a major step toward the commercialization of the process.

Does this mean Samsung Display is ready to produce QD/NANO displays? Almost, according to UBI Research, who has analyzed 160 Samsung Display patents relating to QNED. They have come to the conclusion that SDC just needs to refine those processes and make sure such devices can be considered for mass production at a profitable price point. As we have noted previously, SDC has been delivering samples of the technology to its parent and potential customers, so it seems they have progressed considerably from where they were toward the end of last year, but their goal of delivering a display product using QD/OLED or QD/Nano by the end of the year is still iffy. That said, it seems they are getting close.

RSS Feed

RSS Feed