QD/OLED – CES & More

That said, we are in unparalleled times in the display industry, with a number of new display technologies surfacing that are all vying for a dominant place in the display world. Mini-LED based displays, essentially a typical LCD display with an LED backlight on steroids, is the ‘other’ of the two technologies that has extended the life of LCD technology by improving this older technology’s contrast (The difference between pure black and pure white), a weakness that makes LCD technology less comparable to newer self-emitting technologies such as OLED.

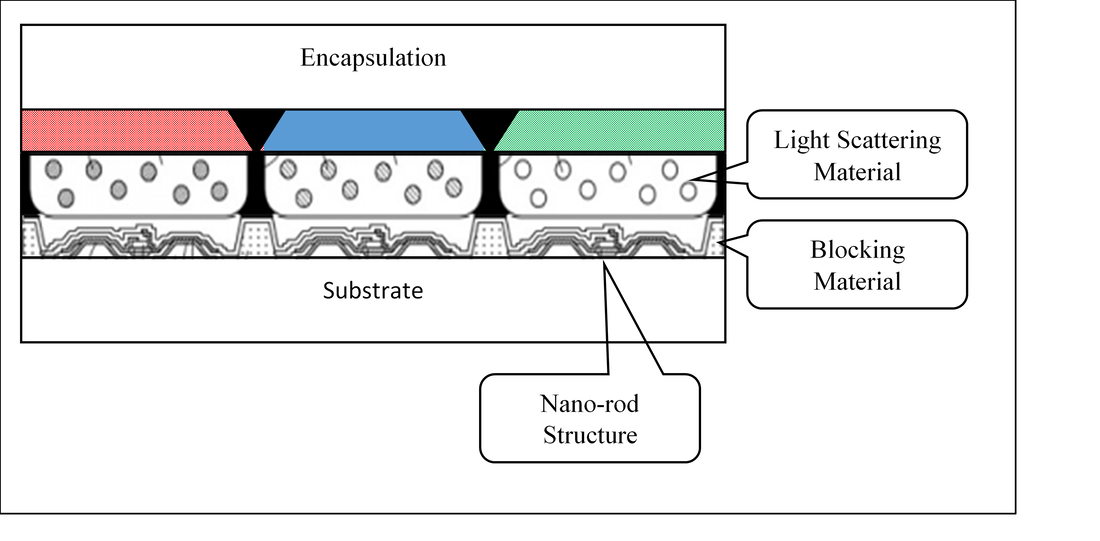

OLED has gone from a novelty in 2013 to the mainstay of small panel displays and while still a niche product in the TV space (<5% of total TV unit volume), it is a key technology in the lucrative premium display market. As a self-emissive display mode, RGB OLED allows for ultimate control over each sub-pixel, generating almost infinite contrast, but large panel OLED displays are subject to two basic limitations, the first being an inability to manufacture TV size RGB OLED displays, and second, limitations on the brightness of the display. OLED TVs use a combination of yellow/green and blue OLED emitters to create a white light that is made up of red, green, and blue light components, but in order to create the three colors necessary for an RGB display that white light must pass through a color filter, essentially a sheet of red, green, and blue dots. Each dot will filter out two colors (for example a ‘blue’ dot will filter out red and green, while a red dot will filter out blue and green) which reduces the amount of light that is generated by the device.

OLED materials continue to improve and improvements in light extraction materials can also help to increase WOLED light output, but Samsung Display (pvt), the leader in small panel OLED, has been developing another approach that combines the properties of self-emitting OLED materials and those of quantum dots. Yesterday Sony (SNE) announced that it would be releasing a 4K TV (Bravia XR A95K) later this year that is based on a QD/OLED panel produced by SDC, however while this is a major step for SDC, missing from the show was an announcement from parent Samsung Electronics (005930.KS) that it would also be releasing a QD/OLED TV. While we expect that this omission was more of a tactical issue than a technology related one, Samsung’s approval and purchase of such panels are an absolute necessity for SDC, who must make the decision as to whether to expand QD/OLED production, which is currently capped at a maximum of 30,000 sheets/month.

Without this additional potential demand SDC has little or no large panel TV display product, leaving Samsung Electronics to buy all of its TV panels from competitors and leaving SDC only able to compete in the small panel market, but Samsung Electronics must also consider where a QD/OLED TV might fit into their TV line , which already consists of pure LCD TVs at the low end, quantum dot enhanced LCD TVs at the mid-tier, quantum dot LCD+Mini-LED TVs at the top tier, and Micro-LED TVs at the ultra-high premium level.

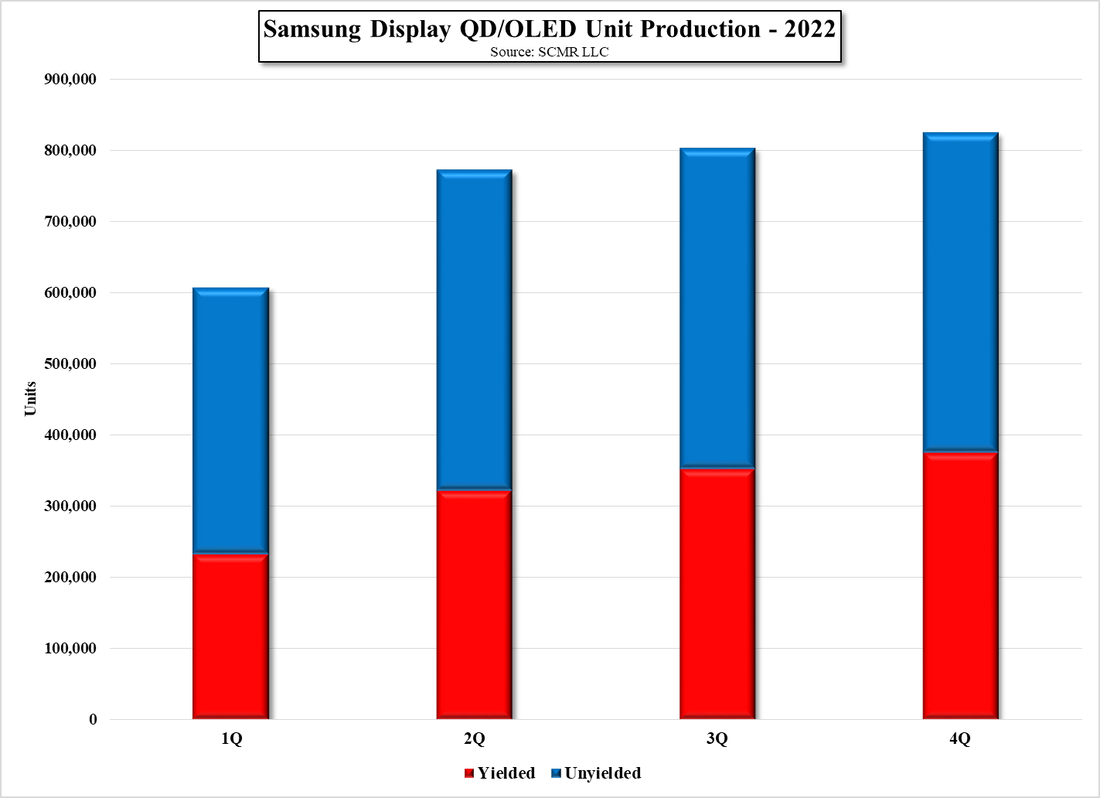

Rumors that Samsung is considering buying WOLED panels from LG Display (LPL) add another potential TV price class, so QD/OLED must find a place in what is a rather complex TV line-up at Samsung, and the marketing of each category is carefully considered by Samsung, who is the leader in the TV set space. We expect Samsung Electronics to offer one or both OLED types, potentially using WOLED as a low-end OLED offering and QD/OLED as a high end OLED offering, but much will depend on SDC’s ability to keep the cost of QD/OLED panels in a range that allows Samsung these options, and with true mass production just beginning, it is likely that the focus at SDC is resolving potential yield issues rather than refining production costs. Given the number of moving parts in such product decisions, while we were a bit surprised that Samsung did not make a specific announcement, we expect it will happen this year.

RSS Feed

RSS Feed